Australian environmental markets

Insights

- Australian carbon credit units (ACCUs) were successfully migrated from Australian National Registry of Emissions Units (ANREU) accounts into the new Unit and Certificate Registry. This means account holders have greater visibility of and access to information about each ACCU, including method, location, and issuance date

- ACCU migration marks an important milestone for the delivery of the Unit and Certificate Registry. The blockchain Unit and Certificate Registry is a foundational part of our infrastructure. It supports the ongoing growth of deep, liquid, transparent and accessible carbon markets.

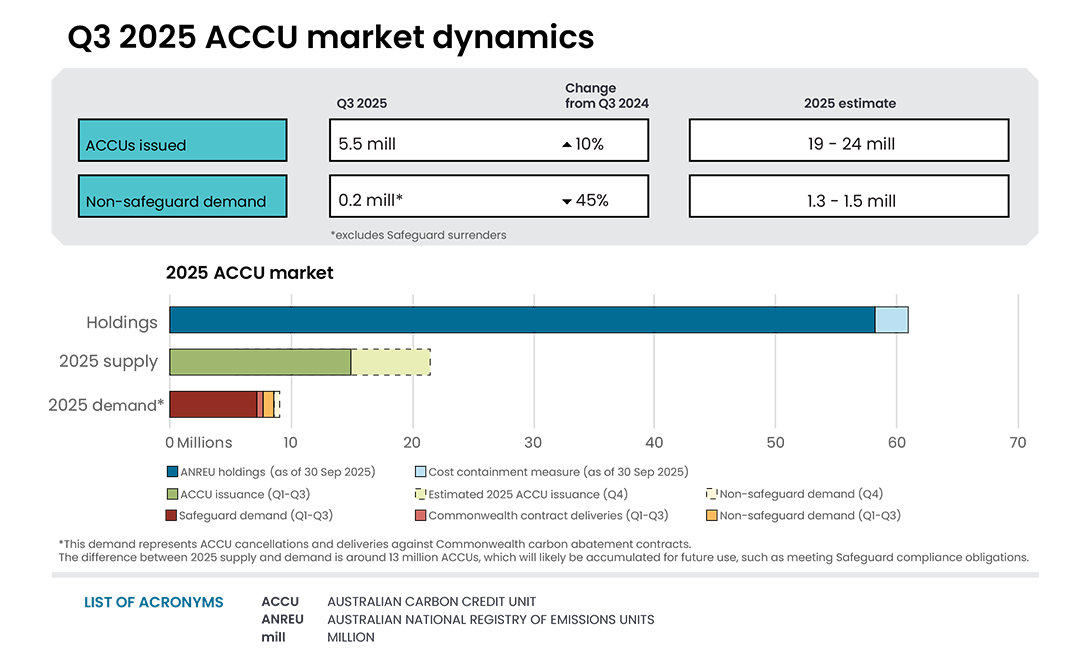

- Total ACCU supply for 2025 may be towards the higher end of our 19 to 24 million estimated range. A total of 5.5 million ACCUs were issued in Q3 2025, bringing the year-to-date total to 15 million. An additional 7.3 million ACCUs were under application with the Clean Energy Regulator (CER) at the end of Q3 2025.

- The ACCU supply pipeline appears strong. It is supported by the development of new ACCU methods and new and existing project registrations. In Q3 2025, 150 projects were registered, primarily in the soil carbon and vegetation methods.

- As expected, ACCU holdings experienced another quarter of growth primarily in accounts of safeguard and safeguard-related entities. Total holdings increased from a total of 52 million at the end of Q2 to 57 million at the end of Q3 2025. Healthy ACCU inventories enable safeguard entities to plan their compliance over forward years as baselines continue to decline.

- Preliminary CER data for the second year of the reformed Safeguard Mechanism suggests the Safeguard Mechanism is continuing to work as intended. The preliminary data is subject to change and does not fully consider the approval of any ongoing flexibility measure applications, such as trade-exposed baseline adjustments. The preliminary data indicates for the 2024-25 safeguard compliance period:

- Covered emissions reduced by 2.4% from 135.9 million tonnes of carbon dioxide equivalent (MtCO2-e) in 2023-24 to 132.7 MtCO2-e in 2024-25.

- Covered emissions for 143 facilities exceeded their baselines, totalling 13.7 MtCO2-e in potential excess.

- Responsible emitters of 59 facilities reported covered emissions below their baseline and may be eligible for an approximate total of 7 million Safeguard Mechanism credit units (SMCs). This would be a decrease in SMC eligibility of 15.7% from the 8.3 million issued in 2023-24.

- Non-safeguard ACCU cancellations dipped to 0.2 million for Q3 2025. This followed a high Q2 of 0.5 million, which was the highest level of non-safeguard cancellations in the last 5 years.

- On 3 November 2025, the Guarantee of Origin (GO) Scheme was launched. It includes the Product Guarantee of Origin (PGO), a voluntary certification framework that tracks the emissions intensity of products and the Renewable Electricity Guarantee of Origin (REGO) Scheme discussed in the large-scale renewable electricity chapter.

On this page

- ACCU and SMC market dynamics summary

- ACCUs migrated to the Unit and Certificate Registry

- ACCU supply continues to grow as expected

- ACCU method development updates

- Project registrations in Q3 2025

- ACCU holdings build in anticipation of future compliance obligations

- Preliminary data for the second year of the reformed Safeguard Mechanism

- Non-safeguard related ACCU cancellations lower after a strong Q2

- ACCU and SMC spot prices rise as safeguard entities consolidate holdings

- Nature Repair Market update

- Integrity and transparency updates

- Supplementary figures

ACCU and SMC market dynamics summary

| Supply | Demand | |

|---|---|---|

| Balance carried forward from Q2 2025 | 51.7m | - |

| Change during the quarter | ||

| ACCU supply | +5.5m | - |

| ACCU Scheme contract deliveries* | - | <0.1m |

| Non-safeguard cancellations | - | -0.2m |

| Safeguard surrenders | - | -0.2m** |

| Net balance at the end of Q2 2025 | 56.8m | |

| Cost containment measure | 4.4m | |

Notes:

- Totals may not sum due to rounding.

- * This refers to ACCUs delivered under Commonwealth carbon abatement contracts in the quarter. These ACCUs are held in the cost containment measure and are available to eligible Safeguard entities to purchase at a fixed price of $82.68 for 2025-26, rising at the Consumer Price Index plus 2% each year.

- ** 175,000 ACCUs were surrendered to meet 2023-24 safeguard compliance during the quarter. This occurred after the surrender deadline as part of an enforceable undertaking. The remainder have been surrendered for the 2024-25 compliance period.

| Supply | Demand | |

|---|---|---|

| Balance carried forward from Q2 2025 | 6.9m | - |

| Change during the quarter | ||

| SMC supply | <0.1m | - |

| Safeguard surrenders | - | - |

| Net balance at the end of Q3 2025 | 6.9m | |

ACCUs migrated to the Unit and Certificate Registry

On 11 November 2025, we announced the successful migration of ACCUs to the Unit and Certificate Registry. This marks an important milestone, establishing a single, modern platform for managing ACCUs and SMCs. The registry forms a foundational part of the market transaction infrastructure, supporting the growth of deep, liquid, transparent and accessible carbon markets.

During the migration process we successfully moved more than 177.7 million ACCUs. This included over 60 million active ACCUs and the transaction history of over 2,000 private and Commonwealth ANREU accounts. The registry reflects the Australian Government’s commitment to strengthening the integrity, transparency, and accessibility of Australia’s carbon markets.

The Unit and Certificate Registry provides richer data sets and multi-factor authentication for enhanced security when transferring units. For example, more information is provided for all ACCUs including method, location, and issuance date. Making this information available to users aligns with market feedback and reflects the CER’s commitment to providing information to support market participants.

For the time being, the original ANREU system will only be used for Certified Emission Reduction Units under the Kyoto protocol, as discussed in the Q2 2025 Quarterly Carbon Market Report (QCMR). You can read more about the ACCU migration and ACCU functionality on the Unit and Certificate Registry webpage.

ACCU supply continues to grow as expected

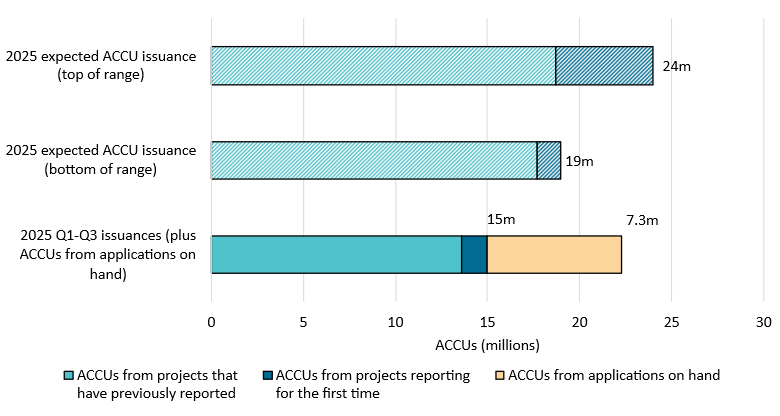

ACCU supply for 2025 remains on track to meet the CER’s estimated range of 19 to 24 million. At the end of Q3 2025, 213 crediting applications were on hand with the CER for an estimated total of 7.3 million ACCUs. Nearly three-quarters of these were submitted within the quarter. Strong crediting applications on hand is a positive indicator that ACCU issuance is tracking towards the estimated top half of the 19 to 24 million range.

Estimated Australian carbon credit unit (ACCU) issuances (in millions) in 2025

Note: This figure is not interactive.

Description

This figure shows ACCUs issued in Q1-Q3 2025 and the remainder of the 2025 estimate by category and in total. This figure also shows ACCUs on hand from claims being assessed by the Clean Energy Regulator as at 30 September 2025.

Small print

Totals may not sum due to rounding. Category details:

A) ACCUs from projects that have previously reported

This is an estimate based on factors such as the typical timing and volume of ACCUs per claim. This category factors in ACCUs from applications on hand at the start of the year.

B) ACCUs from projects reporting for the first time

This is an estimate based on factors such as the typical timing and volume of first issuances. This category is the main driver of uncertainty for the 2025 estimate.

C) ACCUs from applications on hand (30 September 2025)

Some of these ACCUs may not be issued this calendar year depending on assessment outcomes.

In Q3 2025, 5.5 million ACCUs were issued. In the first 3 quarters of 2025, 15.0 million ACCUs were issued, an 18.6% increase compared to the 12.6 million issued in the same period in 2024. This was mainly driven by higher issuances to vegetation projects, in particular human-induced regeneration projects.

Description

This figure shows ACCUs issued by method type by quarter and the annual total over time.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Hover over/tap on the line to see the annual total ACCU issuance per year. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitives and savanna fire management.

Other includes energy efficiency, industrial fugitives, agriculture, transport and facilities method types.

In October 2025, the CER issued 0.6 million ACCUs to the Moomba carbon capture and storage (CCS) project. This is the largest single ACCU issuance to date and a significant development for CCS. The Moomba facility is expected to capture up to 1.7 MtCO2-e every year over its 25-year crediting period. As the Moomba CCS project reduces covered emissions at a safeguard facility, the number of ACCUs issued in relation to the project will be added to the net emissions number of the facility for the year they were issued. This ensures the carbon abatement is not counted twice.

Overall, ACCU supply from existing projects remains strong. The CER will publish its outlook for 2026 ACCU issuance in the Q4 2025 QCMR.

ACCU method development updates

The method development process continues as reported in the Q2 2025 QCMR:

- The integrated farm and land management method remains under development.

- The reducing methane emissions from landfill gas method has progressed to the final stages of development. It has been assessed by the Emissions Reduction Assurance Committee and found to meet the legislated offset integrity standards under the Carbon Credits (Carbon Farming Initiative) Act 2011 (the CFI Act).

On 19 September 2025, the Department of Climate Change, Energy, the Environment and Water (DCCEEW) released the savanna fire management (emissions avoidance) determination 2025 exposure draft for public consultation. This followed the release of the initial consultation material in August 2025. The consultation period began on 7 October 2025 and closed on 3 November 2025. In line with the standard methodology development processes, submissions will progress to the Emissions Reduction Assurance Committee for consideration. Advice is then given to the Minister as to whether the new methods meet the offsets integrity standards.

Project registrations in Q3 2025

In Q3 2025, 150 ACCU Scheme projects were registered, including 86 soil carbon projects. This larger volume was due to application processing efficiencies for soil carbon projects. The remaining 64 projects were comprised of 60 vegetation and 4 non-soil carbon agriculture projects.

Description

This figure shows registered projects under the ACCU Scheme by method type by quarter and the annual total over time.

This figure is interactive. Hover over/tap each data point to see the number of projects registered. Hover over/tap on the line to see the annual total of registrations per year. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture - other' to highlight growth in the soil carbon sector. The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Other includes energy efficiency, agriculture - other, savanna fire management, transport, industrial fugitives, facilities and carbon capture method types.

Revoked projects are excluded.

For more detail on registered projects, refer to the project register.

ACCU holdings build in anticipation of future compliance obligations

ACCU holdings, excluding the cost containment measure, rose by 5.1 million to reach 56.8 million at the end of Q3 2025. Safeguard and safeguard-related accounts were the main driver, increasing by 4.1 million. Holdings are categorised based on available information for accounts, so values should be treated as estimates.

In Q3 2025, around 40,000 ACCUs were delivered under Commonwealth carbon abatement contracts. At the end of Q3 2025, the cost containment measure held a total of 4.4 million ACCUs. Since the fourth pilot exit window closed on 31 December 2024, ACCUs delivered to the cost containment measure have been increasing by 0.1 million each quarter.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts as of 30 September by market participation and the cost containment measure quarterly over time.

This figure is interactive. Hover over/tap each section to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. ACCU holdings data excludes ACCUs held in accounts controlled by the Australian Government for scheme administration purposes. Historical values may change retrospectively due to changes in the classification of ANREU accounts as new information becomes available.

Category definitions

Project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Safeguard

Account holders are safeguard entities that control a single account, or in cases where safeguard entities control multiple accounts, only those that have surrendered ACCUs for Safeguard compliance purposes or have specified a facility are included. Some safeguard accounts also engage in trading activity, which may result in holding fluctuations in this category.

Safeguard related

Account holders are companies, such as subsidiaries, that are related to registered safeguard entities. These accounts do not specify a facility or have not surrendered ACCUs for safeguard compliance purposes. These ACCU holdings may be used for future safeguard compliance purposes.

Intermediary

An account holder’s primary operation is to facilitate the trading of ACCUs between the supply and demand sides of the market. This also includes accounts that have accumulated ACCUs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Government

Account holders are government entities that are accumulating for voluntary or compliance purposes.

Business

Account holders do not have a direct link to ACCU Scheme projects. Account holders include participants that are accumulating for voluntary purposes.

Cost containment measure

ACCUs that have been delivered under Commonwealth carbon abatement contract milestones after 12 January 2023. These ACCUs will be available to eligible safeguard entities under the cost containment mechanism.

At the end of Q3 2025, 6.9 million SMCs were held in the Unit and Certificate Registry. Of these, 6.7 million were held by a safeguard or safeguard-related entity, 0.2 million by intermediaries and a small amount by ACCU Scheme project proponents. While ACCU project proponents may act as an intermediary at times, their accounts are still classified as ‘project proponents’, as this is their primary activity. For more detail on account classification, see the QCMR data workbook.

A strong, liquid ACCU market is expected over the next few years. This will support safeguard entities to build reserves and continue planning for their future compliance obligations as baselines decline over time. Market intelligence predicts the compounding baseline reductions will result in net ACCU holdings beginning to decline in the latter part of this decade. Over time the increased demand required for safeguard compliance is likely to see the ACCU market tighten.

Preliminary data for the second year of the reformed Safeguard Mechanism

Preliminary CER data for the second year of the reformed Safeguard Mechanism has shown further encouraging signs and suggests the Safeguard Mechanism is continuing to work as intended.

Under the Climate Change Act, the CER provides preliminary data to the Climate Change Authority for their Annual Progress Report on climate policies. The Minister for Climate Change and Energy must have regard to the report when advising Parliament about the effectiveness of policies, including the Safeguard Mechanism, in the Annual Climate Change Statement.

The preliminary data indicates that for the 2024-25 safeguard compliance period:

- Covered emissions reduced by 2.4% from 135.9 MtCO2-e in 2023–24 to 132.7 MtCO2-e in 2024–25.

- Responsible emitters of 59 facilities reported covered emissions below their baseline and may be eligible for an approximate total of 7 million SMCs. This would be a decrease of 15.7% from the 8.3 million issued in 2023-24.

- Covered emissions for 143 facilities exceeded their baselines, totalling 13.7 MtCO2-e in potential excess. Responsible emitters can manage excesses in a variety of ways, including by surrendering ACCUs and/or SMCs, or accessing flexible compliance measures.

The preliminary data is subject to change. It is based on reports submitted to the CER under the National Greenhouse and Energy Reporting (NGER) Scheme as of 31 October 2025. Each year, the CER conducts an assurance program to ensure the accuracy and completeness of NGER data. Where errors are identified, the CER may require resubmission of NGER reports. The preliminary data also does not fully consider the approval of any ongoing flexibility measure applications, such as trade-exposed baseline adjustments. The final data will be published by 15 April 2026.

Our 2024-25 Safeguard preliminary insights report provides more detail.

The Industry Sector Plan was released in September 2025, alongside the other 5 sectoral plans and the Net Zero Plan. It provides an overview of the pathway for Australia’s industry and waste sectors to contribute to meeting Australia’s 2030, 2035 and 2050 emissions targets.

An important support for industrial transformation is the ability to reliably track and certify low emissions products and renewable electricity. The GO Scheme, which is administered by the CER, provides such a support as detailed in Box 1.

Non-safeguard related ACCU cancellations lower after a strong Q2

In Q3 2025, 0.2 million ACCUs were cancelled for non-safeguard demand, including for voluntary, non-safeguard compliance and government purposes. This brought the total to 0.8 million for the first 3 quarters of 2025. We expect the lower end of our 2025 estimated range of 1.3 to 1.5 million ACCU cancellations, excluding safeguard surrenders, to be observed for 2025.

While Q3 2025 non-safeguard cancellations were lower following a large Q2 in 2025, looking across 2024 and 2025 to date, volumes appear similar:

- In the first 3 quarters of 2025, the average cancellation size was 1,630 ACCUs, similar to the annual average in 2024 (1,710). Q3 2025 was the first quarter since Q1 2018 where the average cancellation size was less than 1,000.

- The volume of cancellations in the first 3 quarters of 2025 was lower, with 520 total cancellations at the end of Q3 2025 compared to 538 in 2024.

Market intelligence suggests voluntary cancellations could rise to around 3 million by 2030. This is driven by increasing commitments by governments and companies looking to offset emissions with high integrity, domestic based offsets.

Product Guarantee of Origin (PGO)

On 3 November 2025, the GO Scheme was launched. It includes PGO, a voluntary certification framework that tracks the emissions intensity of products through PGO certificates. The GO Scheme also verifies renewable electricity through REGO certificates, as discussed in the large-scale renewable chapter of this report.

The PGO Scheme enables businesses to create certificates that provide credible, internationally aligned verification of where a product was made, how it was produced, and its lifecycle emissions intensity. The transparency provided by PGO certificates will help Australian producers to make confident, objective, and credible claims about the products they make. Unlike REGO certificates, PGO certificates cannot be transferred or retired. The GO register on the CER website will publish information about participants and profiles registered in the PGO and PGO certificates. The draft register provides further detail of the sort of data we will publish, including product type, production pathway, PGO certificate status and production emissions intensity for the batch.

PGO certificates will be used to access incentives under the Australian Government’s Future Made in Australia initiative. This includes the $6.7 billion Hydrogen Production Tax Incentive, $4 billion Hydrogen Headstart program, and the $2 billion Green Aluminium Production Credit. PGO certificates can also be used to demonstrate the use of low emissions-intensity products when reporting scope 1 emissions under the NGER Scheme and the Safeguard Mechanism from the 2025-26 reporting period.

The PGO Scheme will initially certify hydrogen produced by electrolysis. It will expand to a range of products such as low-carbon liquid fuels, green metals and biomethane. These certification pathways are currently being developed by DCCEEW and will roll out progressively from 2026. We will report on PGO Scheme developments in future QCMRs.

Description

This figure shows ACCU voluntary, compliance, and government cancellations quarterly and the annual total over time.

This figure is interactive. Hover over/tap each section to see the number of ACCUs cancelled in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU cancellations exclude deliveries against Commonwealth carbon abatement contract milestones, surrenders for safeguard purposes, and transfers to the Commonwealth Regulatory Additionality Holding Account. This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations.

Category definitions

Voluntary

Cancellations made against voluntary certification programs and any sort of organisational emissions targets.

Compliance

Cancellations made by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, cancellations to meet Environmental Protection Authority requirements.

Government

Cancellations by or on behalf of government entities. For example to offset emissions from vehicle fleets or meet voluntary emissions reduction targets.

ACCU and SMC spot prices rise as safeguard entities consolidate holdings

The generic ACCU volume-weighted average spot price rose from $35.45 at the end of Q2 2025 to $37.43 at the end of Q3 2025, sitting at $36.65 on the 14 November 2025 data cut off. This time last year a similar run up in prices and activity occurred as safeguard entities purchased ACCUs ahead of the surrender deadline.

During Q3 2025, 30 transactions for a total 553,000 SMCs were recorded in the Unit and Certificate Registry. The SMC spot price increased over Q3 2025 from $35.00 to $37.50, continuing to follow ACCU prices. The SMC spot price sat at $38.22 on 5 November 2025, the latest trade as of the 14 November 2025 data cut off. Since July 2025, the reported SMC spot price has remained around $0.50 lower than the generic ACCU spot price on average.

Generic Australian carbon credit unit (ACCU) and Safeguard Mechanism credit unit (SMC) volume weighted average spot price

Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU and SMC spot prices over time.

Small print

The generic spot price refers to the daily volume weighted average price of spot trades for ACCUs with an unspecified method and SMCs. Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive. Prices are shown from 1 December 2020 to 14 November 2025.

Nature Repair Market update

At the end of Q3 2025, one project has been registered and 2 applications for projects under the inaugural scheme method remain on hand with the CER. Method development continues. DCCEEW consultation on the proposed enhancing native vegetation method closed on 4 November 2025. The proposed method would support projects that enhance biodiversity in areas with existing native vegetation. DCCEEW consultation on the proposed protect and conserve method opened on 17 November 2025 with submissions due 15 December 2025. This method aims to support long-term protection and conservation of biodiversity on land across Australia.

Integrity and transparency updates

The Climate Change Authority is required to review the CFI Act every 3 years. The CFI Act supports the ACCU Scheme. The Climate Change Authority is preparing its fifth review and will report in August 2026. A public consultation seeking input to inform the 2026 review opened on 20 October and will close on 8 December 2025.

Supplementary figures

Description

This figure shows SMC holdings in Unit and Certificate Registry (UCR) accounts by market participation quarterly over time.

This figure is interactive. Hover over/tap each section to see the number of SMCs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. Historical values may change retrospectively. This is due to changes in the classification of UCR accounts as new information becomes available.

Category definitions

Safeguard

Account holders are safeguard entities that control a single account, or in cases where safeguard entities control multiple accounts, only those that have surrendered SMCs for Safeguard compliance purposes or have specified a facility are included. Some safeguard accounts also engage in trading activity, which may result in holding fluctuations over time.

Intermediary

An account holder’s primary operation is to facilitate the trading of SMCs between the supply and demand sides of the market. This also includes accounts that have accumulated SMCs through the secondary market without known compliance obligations.

Safeguard related

Account holders are companies, such as subsidiaries, that are related to registered safeguard entities. These accounts do not specify a facility or have not surrendered SMCs for safeguard compliance purposes. These SMC holdings may be used for future safeguard compliance purposes.

ACCU project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to ACCU Scheme projects has been determined based on the available ACCU Scheme project information. Entities may have linkages to ACCU Scheme projects that have not been disclosed to the Clean Energy Regulator.

Description

This figure shows ACCU surrenders by safeguard entities by quarter and the annual total over time.

This figure is interactive. Hover over/tap each section to see the number of ACCUs surrendered in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU surrenders are made by safeguard entities to meet Safeguard Mechanism compliance. For more data on the Safeguard Mechanism, including Safeguard Mechanism credit unit issuance and surrenders, refer to safeguard data.