Large-scale renewable electricity

Insights

- Generation from large-scale renewables is strong and continues to set records both overall and for wind generation.

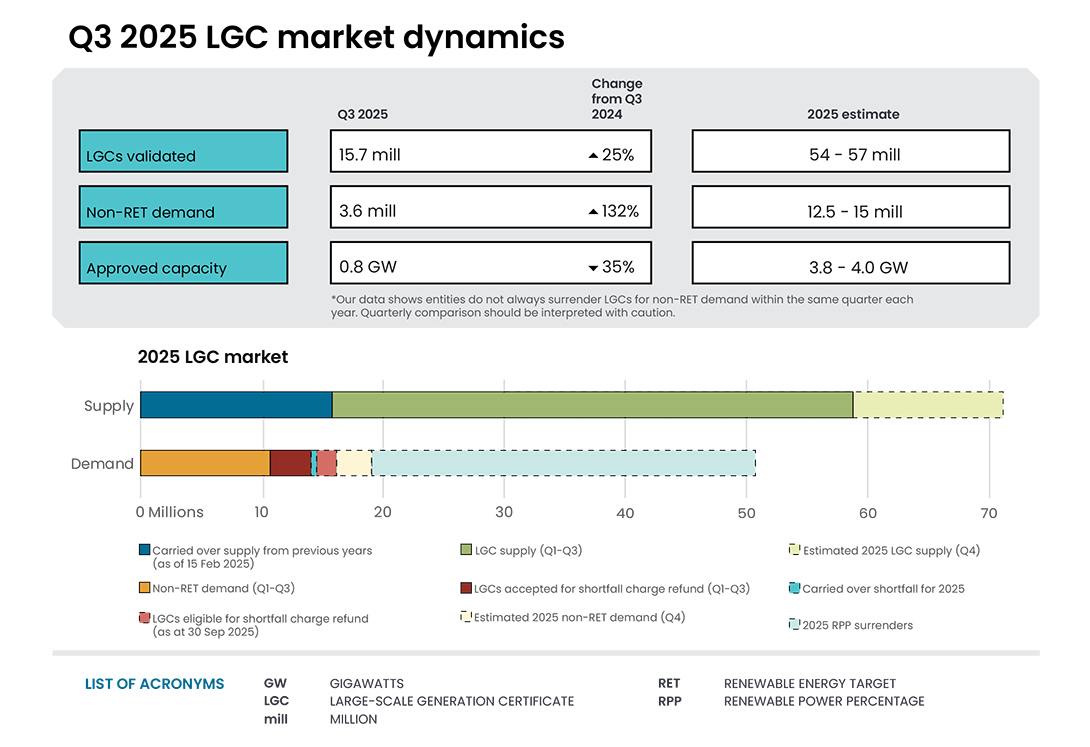

- A record 15.7 million LGCs were created over the quarter, with wind generation leading. Total 2025 LGC supply is expected to be around the upper bound of our estimated 54-57 million range for the year.

- In the NEM, renewables accounted for 42.7% of generation in Q3 on average, with wind contributing a record average of 18.1%.

- Capacity being added to the grid remains strong. Approved large-scale capacity is likely to reach 3.8 to 4.0 GW in 2025 – a good result immediately following a record year in 2024 of 4.3 GW. Combined with SRES capacity, the CER estimates close to 7 GW of renewable capacity will be added to the grid in 2025.

- 2026 Large-scale Renewable Energy Target (LRET) approvals are poised for a strong start with 2 renewable power stations totalling 0.8 GW recently gaining connection approval from Australian Energy Market Operator (AEMO). The CER anticipates receiving applications for these power stations in the coming months.

- The development pipeline remains healthy with up to 5.9 GW of committed capacity in the CER’s LRET data that may be submitted for accreditation under the LRET in 2026 and beyond.

- While the renewable energy projects reaching FID have been lower in 2025 than recent years, we are expecting up to 1.5 GW to be announced in Q4 with announcements strengthening over 2026.

- The outlook for voluntary LGC demand remains strong. In the LGC market, non-RET cancellations were 10.8 million in the first 3 quarters of 2025 – already surpassing the 2024 total of 10.4 million.

- National Greenhouse and Energy Reporting Scheme (NGER) reporters have cancelled almost half of the 2025 year-to-date total that may be declared through optional market-based accounting.

- Increased uptake of voluntary market-based reporting is welcome and will drive ongoing growth in demand and the integrity of claims in relation to sourcing of renewable energy.

- An additional 2.1 million Greenpower cancellations were finalised in November. Total non-RET cancellations for the year now sit at 14 million.

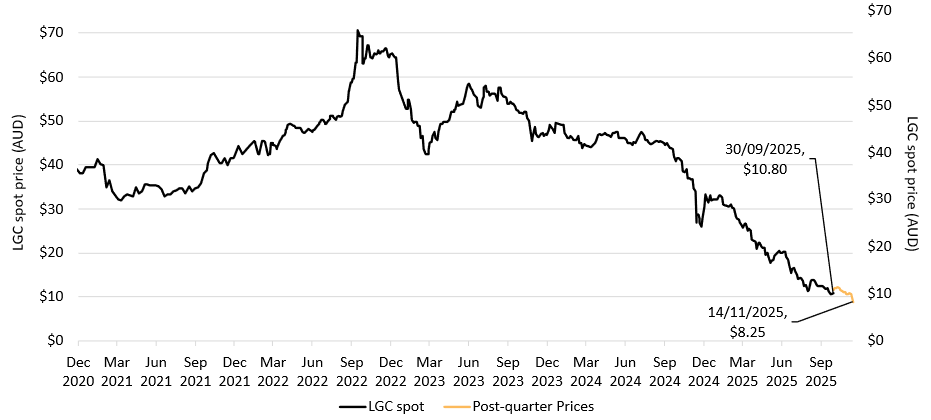

- The LGC price fell from $16 to $10.80 in Q3 and was $8.25 on 14 November. The current price is expected to incentivise increased voluntary cancellations.

- The Renewable Electricity Guarantee of Origin (REGO) Scheme launched on 3 November. During the period up to the end of 2030 when both REGO and the LRET are active, facilities already registered under the LRET can create either LGCs or REGOs for each unit of electricity.

On this page

- Market dynamics

- Strong LRET approvals in 2025

- Capacity Investment Scheme (CIS) update

- Power stations holding more LGCs; non-RET cancellations hit record

- Renewable Electricity Guarantee of Origin scheme now live

- Supplementary figure

Market dynamics

| Supply | Demand | |

|---|---|---|

| Supply carried over from previous years (as of 15 Feb 2025) | 15.9m | - |

| LGC supply (Q1-Q3 2025) | +42.8m | - |

| Estimated 2025 LGC supply (Q4 2025) | +11.2m to +14.2m | - |

| Non-RET demand (Q1-Q3 2025) | - | -10.8m |

| Estimated 2025 non-RET demand (Q4 2025) | - | -1.7m to -4.2m |

| 2025 RPP surrenders (before any shortfall) | - | -32.0m |

| LGCs accepted for shortfall charge refund (Q1-Q3 2025) | - | -3.4m |

| Estimated shortfall charge refund (Q4 2025) | - | -0.4m |

| Carried over shortfall for 2025 (less than 10% of liability) | - | -0.4m |

| Estimated balance as of 15 Feb 2026^ | 18.2m to 23.7m | |

Notes:

- There is a total of 8.8 million LGCs in shortfall that are eligible for shortfall refunds to be claimed, representing $573.9 million in consolidated revenue. This excludes LGCs in shortfall from entities under administration.

- Estimated 2025 LGC supply, and non-RET demand (Q4) based on the range of CER estimates for 2025 LGC creations (54 to 57 million) and non-RET surrenders (12.5 million to 15 million) after subtracting Q1-Q3 2025 figures.

- ^ Sum of all supply items, less the sum of all demand items. This assumes no further shortfall is taken for the 2025 compliance year.

LGC creations are a function of eligible renewable generation capacity and how much of that capacity is used to produce electricity, which in turn is a function of weather conditions and economics.

A record 15.7 million LGCs were created over the quarter, with around 11.0 million from wind generators. Following a Q2 record, total 2025 LGC supply is expected to be around the upper bound of our estimated 54-57 million range for the year.

The strong quarter for wind-driven LGC creations follows a year where a ‘wind drought’ in late autumn to early winter 2024 affected output from wind generators in some regions. Overall, creations from wind technologies have been 3.7 million higher so far in 2025 than same period last year. This healthy lift in creations has more than offset the drop-off in creations from hydro which is at a 7-year low, at less than 0.5 million year-to-date. Hydro makes up only a small proportion of the LGC supply – it has a relatively large share of ‘below baseline’ electricity that is not eligible for LGC creations. This means that the LGC creations can be quite volatile from smaller proportional changes in generation. Below baseline electricity is now eligible for the REGO scheme, as discussed below.

Generation incentivised by the LRET to date contributes to record renewable penetration. AEMO data show that average renewable penetration reached a new high in Q3 2025, with 42.7% in the NEM and 36.4% in Western Australia’s Wholesale Electricity Market (WEM), up from 39.3% and 35.2% respectively in Q3 2024. In the NEM, wind generation reached a record quarterly average of 4,676 MW – up 16% compared with the same period last year. Grid-scale solar also rose by 16%, averaging 1,699 MW, marking a new high for the third quarter. In the WEM, the quarter saw a new peak in renewable penetration for a 5-minute interval, which reached 83.2%.

The LGC markets continue to respond to the increasing LGC supply with LGC spot prices falling to $10.80 from $16.50 at the beginning of Q3 2025, with forward prices following broadly similar trajectories.

Description

This figure shows the number of LGCs validated by technology type over time.

This figure is interactive. Hover over/tap each segment to see the number of LGCs. Hover over/tap along the line to see the annual total. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Waste coal mine gas is no longer eligible to create LGCs as of 2021. Validations in 2021 reflect LGCs that were created prior to 2021.

Large-scale generation certificate (LGC) reported spot and forward prices

Note: This figure is not interactive.

Description

This figure shows the daily closing LGC spot price and calendar year forward prices over time.

Small print

For example, Cal25 is the 2025 calendar year, where an agreement is made to buy/sell LGCs at a specified price in 2025. Pricing data is compiled from trades reported by CORE markets and may not be comprehensive. Prices are shown from 1 December 2020 to 14 November 2025.

Strong LRET approvals in 2025

With more than 3.3 GW already approved and another 0.9 GW under assessment, capacity approved under the LRET could reach 4 GW for the second year in a row. Combined with SRES capacity, the CER estimates close to 7 GW of renewable capacity will be added to the grid in 2025. In addition, industry intelligence suggests that an additional 0.8 GW of large-scale capacity may be submitted to the CER for approval by the end of 2025. This sets up a strong start to 2026 for LRET approvals.

Since the end of Q3, media is reporting that King Rocks Wind Farm (105 MW) has begun construction and the Blind Creek solar/battery project (300 MW) has reached financial close. There are 3 more projects for 1.1 GW we are tracking which, based on publicly available information from the companies, could achieve FID late this year or early in 2026. Those projects are:

- Eurimbula Solar Farm – (Queensland, 696 MW)

- Waddi Wind Farm – (Western Australia, 108 MW)

- Palmer Wind Farm – (South Australia, 288 MW)

This would bring the annual total to around 2.5 GW. We have seen low FID years before. FID in 2023 had a similar result with around 2.3 GW being announced before rebounding to over 4 GW in 2024. While capacity reaching FID has been down on 2024, the CER is still tracking around 21 GW of capacity in projects that are categorised as probable in our LRET supply data. Based on CIS auction results we expect FIDs for 2026 to be stronger, particularly in the second half of the calendar year. The CER will publish its 2026 outlook in the Q4 2025 QCMR.

Description

This figure shows the capacity of large-scale wind and solar power stations approved by the Clean Energy Regulator to generate large-scale generation certificates over time.

This figure is interactive. Hover over/tap each segment to see the capacity. Hover over/tap on each circle to see the annual total. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Solar and wind hybrid projects are grouped under the wind category. Totals may not sum due to rounding.

Description

This figure shows the capacity and four quarter rolling average of large-scale renewable power stations to reach a final investment decision over time.

This figure is interactive. Hover over/tap each bar to see the capacity. Hover over/tap along the line to see the rolling average. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The Clean Energy Regulator tracks public announcements. Data may be incomplete and may change retrospectively. Totals may not sum due to rounding.

Capacity Investment Scheme (CIS) update

The outcome of CIS Tender 4 for renewable generation in the NEM was announced on 9 October and saw 20 successful bids totalling 6.6 GW of capacity. In an indication of the depth of potential renewable projects, the CIS continues to be strongly oversubscribed, with a further 19 GW of (unsuccessful) bids submitted in Stage A of Tender 4.

Across CIS Generation Tenders 1 and 4, there is now around 13 GW of renewable generation capacity (wind and solar) announced under the CIS, with the CER’s LRET supply data indicating 12.5 GW of this being pre-FID. The CIS targets early-stage projects which are to be delivered by 2030. Successful proponents are offered underwriting contracts (known as CIS Agreements) which include detailed project delivery milestones. As the more advanced Tender 1 projects totalling over 5.5 GW progress, there is a real potential for these projects in combination with non-CIS projects to achieve a strong year for FID announcements in 2026.

The 20 successful projects under Tender 4 mark a shift toward solar projects that support dispatchable energy at times of high demand. Of the 20 projects, 8 were wind and 12 solar. More than half of the successful projects (11 of the 12 solar projects and one wind) included co-located storage.

The rise of battery integration in large-scale solar projects underscores the growing role of storage in making use of solar output at times when demand is higher.

Power stations holding more LGCs; non-RET cancellations hit record

LGC holdings in power station accounts are at a record 12.9 million and for the first time represent the largest component of categorised holdings. This dynamic is emerging as the LGC supply continues to outpace demand and the originating power stations are holding an increasing amount of the residual LGC supply. While power station holdings will fluctuate as spot trades and contracts are fulfilled, the overall trend of increased holdings may continue, depending in particular on the level of voluntary demand.

Description

This figure shows LGC holdings in Renewable Energy Certificate (REC) Registry accounts by market participation category over time.

This figure is interactive. Hover over/tap each data point to see the number of LGCs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Holdings are for registered LGCs as at the end of the quarter and exclude any pending transactions. Accounts are categorised according to their primary role or function based on transaction patterns and the name of the account. An account's category is subject to change. Totals may not sum due to rounding.

Category definitions

Liable entity

Account holder is a liable entity.

Power station

Account holder has created LGCs.

Non-RET (voluntary)

Account holder has surrendered LGCs voluntarily. This includes accounts labelled as 'GreenPower' in the REC registry.

Non-RET (compliance)

Account holder has surrendered LGCs voluntarily for non-RET compliance reasons (for example, desalination plants) or the account holder is a Safeguard entity or related to a Safeguard entity.

Non-RET (government)

Account holder has surrendered LGCs voluntarily and is a government entity.

Intermediary

Account holder has transacted/received over 10,000 LGCs and does not fit into any of the other categories.

Other

Account holder does not fit into any of the other categories.

There were 3.6 million non-RET LGC cancellations in Q3, bringing the total to 10.8 million in the first 3 quarters of 2025. This is 0.4 million higher than all 2024 non-RET cancellations.

Around 5.3 million of the 2025 non-RET cancellations have been linked to 47 NGER reporters, demonstrating that some NGER reporters are already taking action with regard to their scope 2 emissions. This is up from 2.7 million LGCs cancelled by 34 NGER reporters over the same period in 2024. Commitments to meet 100% renewable energy in 2025 are driving a significant proportion of this uplift. As NGER reporters are also tranche 1 participants of mandatory climate-related financial reporting, these requirements may also influence voluntary offsetting of some scope 2 emissions through voluntary LGC purchases.

Since the end of Q3, there has been an additional 3.2 million cancellations with Greenpower clients contributing 2.1 million of that additional volume in November. The 2025 year-to-date total now sits at 14 million.

As noted in previous QCMRs, lower LGC prices may incentivise increased demand from voluntary buyers, with the potential for increased purchases from existing entities and/or the entry of new voluntary buyers. Industry intelligence suggests there is an uptick in interest for LGCs from energy retailers who are making enquiries on behalf of customers, driven by lower LGC prices. Buyers may emerge to take advantage of the lower price through spot trades and forward contracts.

Description

This figure shows non-RET LGC cancellations by demand source over time.

This figure is interactive. Hover over/tap each bar to see the number of LGCs cancelled. Click/tap on the items in the legend to hide/show data in the figure.

Small print

This classification system is uniform across Australian carbon credit unit (ACCU) and LGC cancellations.

Covered activities for each classification

Voluntary demand

Cancellations made against voluntary certification programs such as Climate Active and any sort of organisational emissions or energy targets.

Government demand

Cancellations by or on behalf of government entities. For example to offset emissions from vehicle fleets or meet voluntary emissions reduction targets.

Compliance demand

Cancellations made by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example to meet Environmental Protection Authority requirements.

Renewable Electricity Guarantee of Origin scheme now live

The Renewable Electricity Guarantee of Origin (REGO) scheme commenced on 3 November and is now in operation alongside the RET. The REGO scheme will provide an ongoing renewable electricity certification mechanism once the RET ends in 2030, with more sources eligible, and the ability to view more information on each certificate, such as the time electricity was generated.

The following are eligible facility types under the REGO scheme:

- Accredited power stations – facilities that have been accredited in the Large-scale Renewable Energy Target (LRET). This includes ‘below-baseline’ generators with pre-1997 generation baselines. Below-baseline generators are eligible to produce REGOs for all their generation, but certificates for generation below a generator’s legacy baseline will be labelled as ‘below-baseline REGOs’ and have restrictions on what they can be retired for.

- Electricity generation systems – facilities that generate electricity from eligible renewable sources and are not accredited power stations in the LRET.

- Energy storage systems – facilities that can store energy and release electricity. Storage facilities are required to demonstrate that the electricity they have stored is from renewable sources to be eligible to create REGOs from subsequent electricity dispatch. This can be demonstrated through a direct supply relationship with an eligible renewable electricity generation system, or through the retirement of REGOs or surrender of LGCs.

- Aggregated systems – multiple generation or storage systems managed as a single facility. Aggregated systems cannot be registered in the scheme until rules are legislated.

More information on the REGO scheme can be found on Renewable Electricity Guarantee of Origin.

Individuals need to be a registered person under the scheme to be eligible to create and transact REGOs for the electricity generation from registered renewable electricity facilities. As of 14 November, the CER has received 2 applications for individuals to become registered persons in the scheme. We anticipate that the first REGOs from registered renewable electricity facilities will be created in early 2026.

REGO certificates are tradeable like LGCs, but unlike the RET there are no annual scheme targets. Only LGCs can be surrendered for compliance under the RET. During the period up to the end of 2030 when both schemes are active, facilities already registered under the LRET have the option to create either LGCs or REGOs for each unit of electricity.

The CER will report on REGO in each future QCMR, with our analysis evolving as the scheme matures.

Supplementary figure

Large-scale generation certificate (LGC) spot price

Note: This figure is not interactive.

Description

This figure shows the daily closing LGC spot price over time.

Small print

Spot price data is compiled from trades reported by CORE markets and may not be comprehensive. Prices are shown from 1 December 2020 to 14 November 2025.