Australian environmental markets

Insights

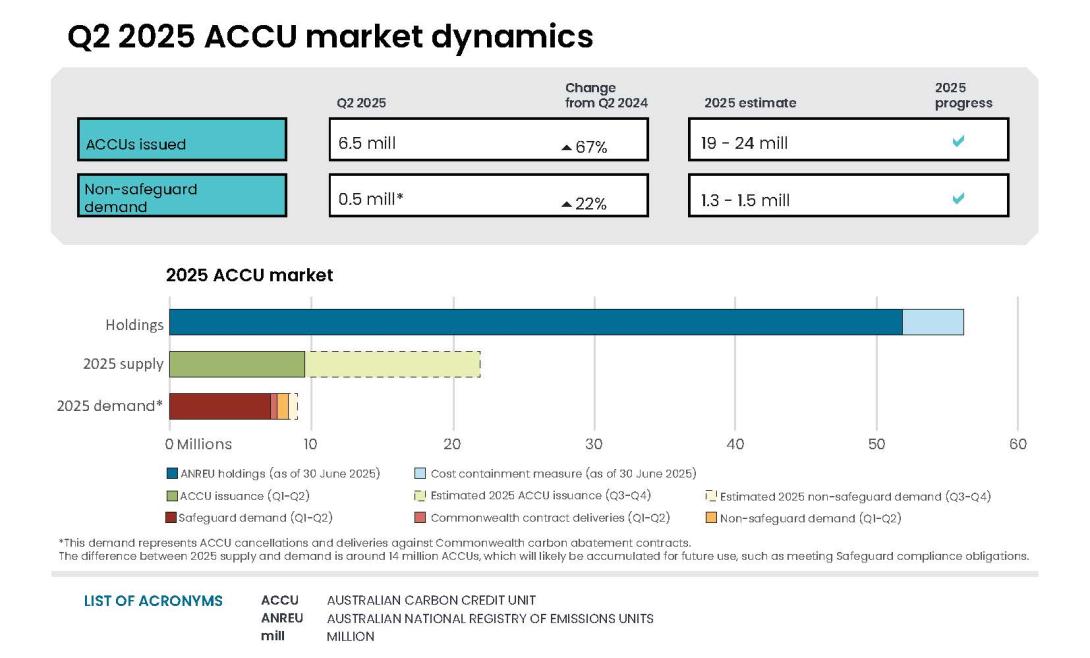

- The Australian carbon credit unit (ACCU) supply for 2025 remains strong, with 6.5 million ACCUs issued in Q2 2025. The total issuance for the first half of the year was a record 9.5 million ACCUs. Annual supply is tracking to meet the CER’s estimated range of 19-24 million.

- Given the time to develop, implement and credit new projects, it is expected that ACCU supply to 2030 will be dominated by existing projects and projects currently being developed and registered.

- As existing projects reach the end of their crediting period, new methods and project development will be critical to securing future ACCU supply.

- Recent progress on new ACCU methods includes the Department of Climate Change, Energy, the Environment and Water (DCCEEW) consulting on a new draft landfill gas method and new proposed savanna fire management methods. Integrated farm and land management and other proponent-led methods remain in development.

- Market sentiment and commentary has shifted away from concern regarding tightening supply following DCCEEW’s consultation on these new methods.

- Moving into the second year of the reformed Safeguard Mechanism and beyond, ACCUs and Safeguard Mechanism credit units (SMCs) will remain a vital part of compliance strategies. Safeguard entities will likely secure supply early to meet future compliance obligations. However, the importance of on-site abatement continues to grow as facility baselines decline.

- ACCU and SMC market dynamics continue to be largely determined by safeguard demand. ACCU supply is expected to go through cycles of tightening due to the complex balance of issuance, method development and safeguard demand.

- The CER expects to migrate ACCUs from the Australian National Registry of Emissions Units (ANREU) to the Unit and Certificate Registry in late 2025. Once migrated, ACCUs will include additional information requested by the market. Market participants will then be able to trade and surrender both ACCUs and SMCs from the same Registry.

- The first Nature Repair Market project has been registered, and another 2 applications are being assessed.

On this page

- Progressing the second year of the reformed Safeguard Mechanism

- Strong ACCU issuances with some residual SMC issuances in Q2 2025

- Longer-term ACCU supply influenced by new methods

- Method development

- Six ACCU methods sunsetting with 2 under review

- ACCU and SMC holdings build ahead of the 2024-25 safeguard compliance period

- Non-safeguard related ACCU cancellations grow in Q2 2025

- Small increases in ACCU and SMC spot prices

- First Nature Repair Market project registered and 2 new methods under development

- Improvements to market data transparency and infrastructure

Progressing the second year of the reformed Safeguard Mechanism

With the first compliance year of the reformed Safeguard Mechanism successfully completed, safeguard entities will be turning their attention to potential on-site abatement opportunities and ensuring they have sufficient supply of ACCUs and SMCs to meet their upcoming 2024-25 compliance obligations.

While the result from the first year was promising, the continuing abatement challenge is substantial. Baselines will continue to decrease at a default rate of 4.9% per financial year, aligning with the scheme's 2030 emissions reduction target.

- For existing safeguard facilities, the scheme specifies a ‘hybrid’ approach to baselines, initially focusing on facility-specific emissions intensity values and gradually transitioning to industry-average values by 2030. This approach incentivises production in sectors with the lowest emissions intensity, while also considering individual facility circumstances to keep initial costs manageable. By starting with values closer to facility-specific metrics, costs are introduced in increments, allowing businesses time to plan and implement emissions reduction projects.

- For 2023-24, the industry-average to facility-specific emissions-intensity values ratio was 10:90 and for 2024-25 the ratio will shift to 20:80. The transition to industry-average emissions-intensity increases from 10% per year to 20% from the 2027–28 financial year.

- For new facilities, baselines will be determined using emissions intensity values set using international best practice levels and adapted for the Australian context. The baseline for shale gas facilities is set to zero tonnes of carbon dioxide equivalent (CO2-e) per year.

Overall, the combination of a shift to industry averages and annual declining baselines creates incentives for both onsite emissions reduction projects and demand for ACCUs and SMCs. While on-site abatement is critical, many of the required investments will take time, and the use of robust offsets remains essential to support this transition, particularly for hard-to-abate sectors. The CER expects to publish preliminary estimates of gross and excess emissions positions later this year.

Looking beyond 2030, the Australian Government has submitted Australia’s next Nationally Determined Contribution (NDC) under the Paris Agreement to the United Nations Framework Convention on Climate Change (UNFCCC) and published a new Net Zero Plan. The Net Zero Plan and NDC includes Australia’s 2035 emissions reduction target of a 62 – 70% reduction on 2005 levels, calculated as an emissions budget for the years 2031 to 2035. Settings under the existing Safeguard Mechanism will be reviewed in 2026-27, including the decline rate for the period to 2035, to ensure the scheme’s design is appropriately calibrated and effectively delivering emissions reductions in line with Australia’s targets. These processes will continue to involve consultation led by DCCEEW and advice from the Climate Change Authority (CCA).

| Q2 2025 | ||

|---|---|---|

| Supply | Demand | |

| Balance carried forward from Q1 2025 | 46.0m | - |

| Change during the quarter | ||

| ACCU supply | +6.5m | - |

| ACCU Scheme contract deliveries* | - | -0.1m |

| Non-Commonwealth cancellations | - | -0.5m |

| Safeguard surrenders | - | -0.2m** |

| Net balance at the end of Q2 2025 | 51.7m | |

| Cost containment measure | 4.3m | |

Notes:

- Totals may not sum due to rounding.

- *This refers to ACCUs delivered under Commonwealth carbon abatement contracts in the quarter. These ACCUs are held in the cost containment measure and are available to eligible Safeguard entities to purchase at a fixed price of $82.68 for 2025-26.

- ** 0.2 million ACCUs were surrendered to meet 2023-24 safeguard compliance during the quarter. This occurred after the surrender deadline as part of an enforceable undertaking.

| Q2 2025 | ||

|---|---|---|

| Supply | Demand | |

| Balance carried forward from Q1 2025 | 6.9m | - |

| Change during the quarter | ||

| SMC supply | <100,000 | - |

| Safeguard surrenders | - | <100,000 |

| Net balance at the end of Q2 2025 | 6.9m | |

Strong ACCU issuances with some residual SMC issuances in Q2 2025

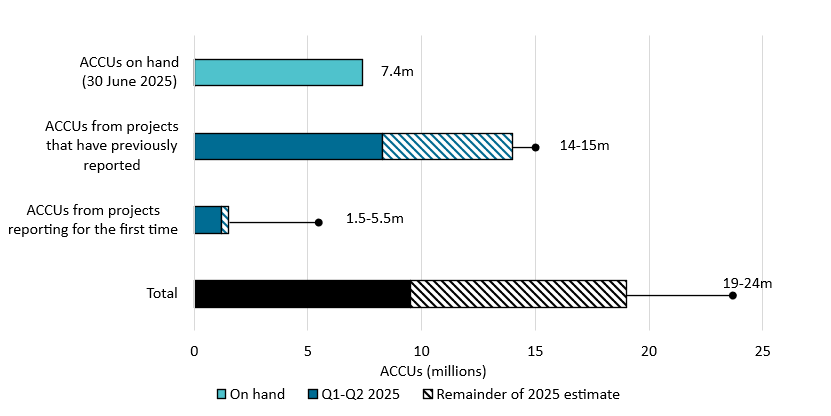

ACCU supply is on track to meet the CER’s estimated range of 19 to 24 million for 2025.

In Q2 2025, 6.5 million ACCUs were issued, 67% higher than the 3.9 million in the same period last year. In Q2 2025, around 0.97 million ACCUs were issued to 37 projects claiming for the first time. The backlog of waste method crediting applications discussed in the Q1 2025 Quarterly Carbon Market Report (QCMR) was cleared in Q2 2025. This led to the second highest quarter for waste ACCU issuances (2.6 million).

Processing times have declined with a continued focus on the timely assessment of crediting applications supported by quality applications being submitted that require fewer requests for further information. At the end of Q2 2025, around 200 crediting applications were on hand for an estimated total of 7.4 million ACCUs, 82% of which were submitted in the quarter.

Description

This figure shows ACCUs issued by method type and annually over time.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Hover over/tap on the line to see the annual total ACCU issuance per year. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive and savanna fire management.

Other includes energy efficiency, industrial fugitives, agriculture, transport and facilities method types.

Where a safeguard facility with emissions below its baseline is eligible for SMCs, there is no deadline by which these SMCs must be claimed. In Q2 2025, one entity claimed 18,600 SMCs relating to the 2023-24 compliance period. On 1 August 2025, the 2023-24 safeguard data highlights were updated accordingly. At the end of Q2 2025, 185,000 SMCs are yet to be claimed.

In Q2 2025, 99 ACCU Scheme projects were registered, including 57 under the soil carbon methods. Additionally, 37 avoided deforestation projects finished their crediting periods. A further 11 avoided deforestation projects will finish their crediting period in 2025. Once projects finish their crediting periods and submit a certificate of entitlement for their final ACCUs, they will no longer contribute to ACCU supply.

The native forests protected by these projects must be maintained for their permanence period, which for all but one of these projects is 100 years. The projects must continue to submit reports every 5 years. If any reversal of abatement is recorded, the CER has the power to require the relinquishment of ACCUs. In 2024, 1.9 million ACCUs were issued to the 48 avoided deforestation projects finishing their crediting periods this year, contributing 10% of total 2024 supply. After these 48 avoided deforestation projects have completed their crediting periods, 14 active avoided deforestation projects will remain.

On 21 May 2025, crediting period and permanence period dates were added to the ACCU project register as part of the first tranche of transparency updates. Further information on these updates see more ACCU project register transparency improvements.

Estimated Australian carbon credit unit (ACCU) issuances (in millions) in 2025

Note: This figure is not interactive.

Description

This figure shows ACCUs issued in Q1-Q2 2025 and the remainder of the 2025 estimate by category and total. This figure also shows ACCUs on hand from claims being assessed as at 30 June 2025.

Small print

Totals may not sum due to rounding. Category details:

ACCUs on hand (30 June 2025)

These ACCUs may be issued in 2025 depending on assessment outcomes.

ACCUs from projects that have previously reported

This is an estimate based on factors such as the typical timing and volume of ACCUs per claim.

ACCUs from projects reporting for the first time

This is an estimate based on factors such as the typical timing and volume of first issuances. This category is the main driver of uncertainty for the 2025 estimate.

Description

This figure shows registered projects under the ACCU Scheme by method type and annually over time.

This figure is interactive. Hover over/tap each data point to see the number of projects registered. Hover over/tap on the line to see the annual total of registrations per year. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture - other' to highlight growth in the soil carbon sector. The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Other includes energy efficiency, agriculture - other, savanna fire management, transport, industrial fugitives, facilities and carbon capture method types.

Revoked projects are excluded.

For more detail on registered projects, refer to the project register.

Longer-term ACCU supply influenced by new methods

ACCU supply is expected to grow over the coming years, driven by additional methods, and expected increases in project registrations. Recent progress on new ACCU methods includes DCCEEW consulting on a new draft landfill gas method, a proposed variation of the animal effluent management method, a new abatement calculation tool for savanna fire management, 2 new proposed savanna fire management methods and ongoing work to develop the proposed Integrated Farming and Land Management method. These supply-side developments have likely contributed to shifting market sentiment with less concern around tightening supply in coming years.

The future ACCU supply-demand balance will be influenced by decisions on both the supply and demand side that naturally have long lead times:

- On the supply side, the average lead time from project registration to first credit issuance is just under 2 years.

- On the demand side, the dominant source is safeguard entities’ who will consider the lead time and cost-effectiveness of onsite decarbonisation investments, impacting their future ACCU demand.

These characteristics suggest periodic cycles of tightening supply can be expected over time.

The CER will continue to monitor and analyse trends in these increasingly complex and interconnected markets.

Sources of ACCU supply and the CER’s approach to projection

Future ACCU supply will come from:

- new credits from existing projects

- credits from new projects using existing methods

- credits from new projects using new methods, comprised of those that are under development and those that will be developed in the future.

Historically, the QCMR has provided projections of (1) for the current calendar year. This is broken down into credits where claims are ‘on hand’, credits from projects that have reported in the past, and credits from existing projects that are yet to report.

Considering (2), CER analysis of ACCU project development timeframes suggests that almost all projects that will contribute to Australia’s 2030 emissions reduction target will have already started development.

Over time, the CER expects to expand the projections in quarterly updates to cover (2) and methods under development (3), and to extend the timeframe of the analysis. This QCMR presents work on (3) with landfill gas method abatement estimates discussed below. Overall, CER’s approach will provide the market with a more holistic, informed, and longer-term outlook on projected ACCU supply based on CER ACCU Scheme data. These quarterly updates complement Australia’s official annual emissions projections produced by DCCEEW.

Method development

Market participants have shown increased interest in and sensitivity to the potential impact of new methods on ACCU supply over the last quarter. As methods sunset or are reviewed, and new methods are developed the CER expects market interest will be sustained and amplified.

It is important to note that all changes to methods and the making of new methods are subject to public consultation and consideration by the Emissions Reduction Assurance Committee (ERAC) that provides advice to the Minister on the making of new methods. The ERAC is yet to provide advice for methods under consultation. Great care should be taken in making assumptions about the potential volume and timing of ACCU supply until the methods are finalised. Crediting will depend on the final method settings, and the choices made by individual project proponents.

Six ACCU methods sunsetting with 2 under review

ACCU methods automatically end or ‘sunset’ after 10 years. This means no new projects can be registered under these methods once sunset, but existing projects continue as normal. The following methods are sunsetting on 1 October 2025:

- Beef cattle herd management 2015

- Estimating sequestration of carbon in soil using default values 2015

- Facilities 2015

- Oil and gas fugitives 2015

- Reducing greenhouse gas emissions from fertiliser in irrigated cotton 2015

- Reforestation and afforestation 2.0 2015

These methods, except for beef cattle herd management and reforestation and afforestation, have had low or no uptake since creation. These methods will be reviewed by the ERAC, who will consider and provide advice on the potential to remake the methods.

New landfill gas method

The draft new landfill gas method is with the ERAC to determine if it meets the offsets integrity standards following public consultation which closed in June 2025. The new method addresses recommendation 10 of the Independent Review of Australian Carbon Credit Units (Chubb Review) to have upward sloping baselines. This accounts for the business-as-usual emissions reduction likely to occur at landfills without the ACCU Scheme.

It is proposed that projects transitioning to the new landfill gas method will be able to extend their crediting period for up to 12 years. The extension is significant as 74 landfill gas projects (representing 43% of total landfill gas projects) have crediting periods ending in 2026. These projects account for around 3.8 million ACCUs each year, and about 80% of annual issuances from landfill gas projects.

The extension of crediting periods means that projects ending in 2026 would remain a material part of ACCU supply until 2038. CER estimates that issuances to landfill gas projects could fall from current levels of 4 to 5 million ACCUs to below 4 million over time. This gradual decline is driven by upwards sloping baselines under the new method. The CER will continue to monitor supply impacts from the new landfill gas method, which depends on factors such as the number of new projects registered and when existing projects transition to the new method.

New savanna fire management methods

DCCEEW is developing 2 new savanna fire management methods. On 14 August 2025, DCCEEW released public consultation material on the methods.

For the first time, a savanna fire management method is proposed to account for sequestered carbon in living and dead biomass, enabled by improvements in scientific modelling. On 13 June 2025, the Savanna Carbon Accounting Model (SavCAM), which is proposed to estimate abatement from these methods, was released for testing by DCCEEW. The tool incorporates the latest science and an independent assessment by the Commonwealth Scientific and Industrial Research Organisation (CSIRO) has confirmed its abatement estimates are valid. Because the proposed method would credit sequestration in these additional carbon pools, SavCAM shows that on average, credited abatement for most projects is likely to be higher than under earlier savanna fire management calculators.

ERAC will formally invite public submissions on the methods, possibly commencing in October 2025. The feedback will inform the ERAC’s assessment of whether the methods meet the legislated Offset Integrity Standards, prior to making a recommendation in relation to the proposed methods.

ACCU and SMC holdings build ahead of the 2024-25 safeguard compliance period

At the end of Q2 2025, ACCU holdings, excluding the cost containment measure, rebounded to 51.7 million. This followed ACCU holdings dipping to 46.0 million at the end of Q1 2025 after the surrender period for the 2023-24 safeguard compliance year. Safeguard and safeguard-related holdings had the largest increase, rising from 27.4 million at the end of Q1 to 29.8 million at the end of Q2 2025. Business holdings (that is, holdings by businesses for their own voluntary purposes) also had a large proportional increase of 64%, rising from 0.4 million ACCUs at the end of Q1 to 0.6 million ACCUs at the end of Q2 2025. Holdings are categorised based on the available information for accounts, so values should be treated as estimates.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts by market participation and the cost containment measure over time.

This figure is interactive. Hover over/tap each section to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. ACCU holdings data include all ANREU accounts. Historical values may change retrospectively due to changes in the classification of ANREU accounts as new information becomes available.

Definitions

Project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Safeguard

Account holders are safeguard entities that control a single account, or in cases where safeguard entities control multiple accounts, only those that have surrendered ACCUs for safeguard compliance purposes or specified a facility are included. Some safeguard accounts also engage in trading activity, which may result in holding fluctuations over time.

Safeguard-related

Account holders are companies, such as subsidiaries, that are related to registered safeguard entities. These accounts do not specify a facility and have not surrendered ACCUs for safeguard compliance purposes. These ACCU holdings may be used for future safeguard compliance purposes.

Intermediary

An account holder’s primary operation is to facilitate the trading of ACCUs between the supply and demand sides of the market. This includes accounts that have accumulated ACCUs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Government

Account holders are government entities that are accumulating for voluntary or compliance purposes.

Business

Account holders do not have a direct link to ACCU Scheme projects and include participants that are accumulating for voluntary purposes.

Cost containment measure

ACCUs that have been delivered under Commonwealth carbon abatement contract milestones after 12 January 2023. These ACCUs are available to eligible safeguard entities under the cost containment mechanism.

At the end of Q2 2025, 18 safeguard corporate groups held over double the ACCUs surrendered to meet their 2023-24 compliance obligation. However, these ACCUs could be held for a range of purposes in addition to safeguard compliance, including surrender against voluntary targets, or for another entity.

With varying hedging strategies, safeguard entities’ ACCU holdings are only one indication of a forward ACCU position and may be an underestimation. For example, market intelligence suggests safeguard entities are entering into longer-term offtake agreements with ACCU projects, where the safeguard entities agree to buy a share or all the future ACCUs issued. In this case the future holdings of ACCUs cannot be determined as these agreements are not visible.

More broadly, carbon market dynamics are evolving as safeguard entities look to secure their future supply of ACCUs and SMCs at the desired price to meet potential excess emissions. The market has observed the rise of more sophisticated derivative instruments and use of futures contracts as safeguard entities and financial intermediaries hedge against potential future ACCU price movements.

At the end of Q2 2025, 6.9 million SMCs were held in the Unit and Certificate Registry. Of these, 6.7 million were held by a safeguard or safeguard-related entity and 0.2 million SMCs were held by intermediaries. Most SMCs (88%) were held by the responsible emitter they were issued to or a related entity, including subsidiaries or other entities in the same corporate family. SMCs are not offsets and can only be surrendered to meet safeguard compliance obligations. As such, it is unsurprising for SMC holdings to be concentrated in the receiving entities account in the early years of the reformed scheme.

Description

This figure shows SMC holdings in Unit and Certificate Registry (UCR) accounts by market participation over time.

This figure is interactive. Hover over/tap each section to see the number of SMCs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. SMC holdings data include all accounts. Historical values may change retrospectively due to changes in the classification of UCR accounts as new information becomes available.

Definitions

Safeguard

Account holders are safeguard entities that control an account or multiple accounts for the issuance or surrender of SMCs. Some safeguard accounts also engage in trading activity, which may result in holding fluctuations over time.

Intermediary

An account holder’s primary operation is to facilitate the trading of SMCs between the supply and demand sides of the market. This also includes accounts that have accumulated SMCs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Safeguard-related

Account holders are companies, such as subsidiaries, that are related to registered safeguard entities. These accounts do not specify a facility or have not surrendered SMCs for safeguard compliance purposes. These SMC holdings may be used for future safeguard compliance purposes.

Non-safeguard related ACCU cancellations grow in Q2 2025

The lower end of the CER’s estimated range of 1.3 to 1.5 million ACCU cancellations, excluding safeguard surrenders, is expected to be observed in 2025. In Q2 2025, 0.5 million ACCUs were cancelled for voluntary, non-safeguard compliance and government purposes, bringing the total to 0.7 million for the first half of 2025.

Description

This figure shows ACCU voluntary, compliance, and government cancellations.

This figure is interactive. Hover over/tap each section to see the number of ACCUs cancelled in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU cancellations exclude deliveries against Commonwealth carbon abatement contract milestones. This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations.

Covered activities

Voluntary

Cancellations made against voluntary certification programs and any sort of organisational emissions targets.

Compliance

Cancellations made by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, cancellations to meet Environmental Protection Authority requirements.

Government

Cancellations by or on behalf of government entities. For example to offset emissions from vehicle fleets or meet voluntary emissions reduction targets.

Description

This figure shows ACCU surrenders by safeguard entities annually over time.

This figure is interactive. Hover over/tap each section to see the number of ACCUs surrendered in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Includes surrenders made by safeguard entities to meet Safeguard Mechanism compliance. Refer to 2023–24 baselines and emissions data for more data on the Safeguard Mechanism, including Safeguard Mechanism Credit issuance and surrenders.

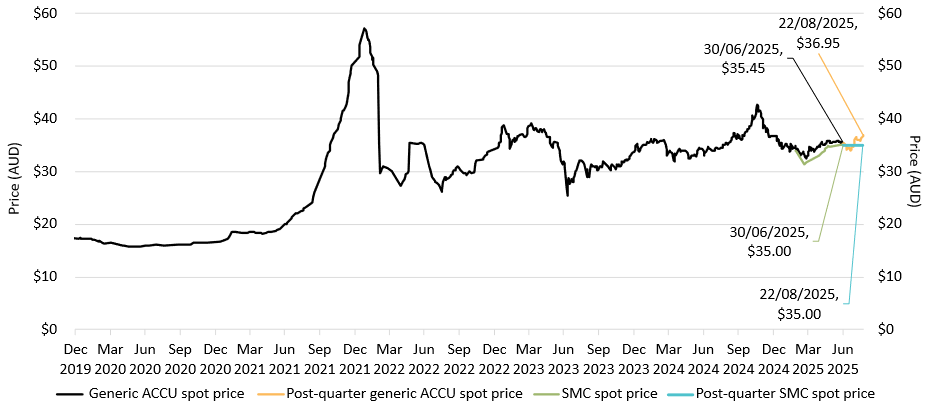

Small increases in ACCU and SMC spot prices

The generic ACCU weighted-average spot price rose from around $33 at the end of Q1 2025 to around $35.50 at the end of Q2 2025. Prices increased to around $36.95 on 22 August 2025. Generic (no avoided deforestation) ACCU trades made up 61% of reported transactions in Q2 2025. This is despite generic, generic (no avoided deforestation) and human-induced regeneration ACCUs trading at similar prices. Transactions involving safeguard or safeguard-related entities fell from 43% in Q1 2025 to 33% in Q2 2025. This is expected to increase later in the year ahead of the 31 March 2026 safeguard surrender deadline.

As expected, there was limited SMC trading in Q2 2025. During Q2 2025, 27 transactions for a total 375,000 SMCs were recorded in the Unit and Certificate Registry. The SMC spot price increased over Q2 2025 from $33.00 to $35.00. However, SMC transactions are low compared to ACCU transactions, and the market is new, resulting in prices being more volatile. The price spread between SMCs and ACCUs has tightened. In April 2025, the reported SMC price was around $1.80 lower than the generic ACCU spot price, tightening to around $0.50 lower at the end of June 2025.

Generic Australian carbon credit unit (ACCU) and Safeguard Mechanism credit unit (SMC) volume weighted average spot price

Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU and SMC spot prices over time.

Small print

The generic spot price refers to the daily volume weighted average price of spot trades for ACCUs with an unspecified method and SMCs. Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive. Prices are shown from 31 Dec 2019 to 22 August 2025.

First Nature Repair Market project registered and 2 new methods under development

On 12 August 2025, the CER approved the first project under the Nature Repair Market. The Biodiversity Market Register on the CER’s website provides details on the first registered project. The Biodiversity Market Register will be updated regularly. At the end of Q2 2025, there were 2 applications on-hand for Nature Repair Market projects. Both applications and the approved project overlap with existing ACCU Scheme projects. Proponents may be able to streamline implementation and administration of each project when delivered in this manner.

At the end of Q2 2025, another two Nature Repair Market methods were under development by DCCEEW.

Improvements to market data transparency and infrastructure

More ACCU project register transparency improvements

As reported in the Q1 2025 QCMR, amendments to the Carbon Credits (Carbon Farming Initiative) Rule 2015 allowed the CER to publish more information in the ACCU project register. Updates were actioned in 3 stages over May to July 2025. Changes since the Q1 2025 QCMR include the type of estimation or modelling approach used by the project to calculate carbon abatement and where applicable, abatement modelling start dates. These changes increase transparency to support market participation and informed decision making. The CER is also making it easier for project proponents to voluntarily publish additional information about their project on the register. This will provide even greater transparency and information to the market.

ACCU migration to the Unit and Certificate Registry is on track

The Unit and Certificate Registry is built on Trovio’s CorTenX technology. It will continue to deliver a modern and secure place to hold and transfer units and certificates to support Australia’s expanding carbon and environmental markets.

The Unit and Certificate Registry currently holds SMCs. ACCUs are on track to be migrated from ANREU in late 2025. The forthcoming Renewable Electricity and Product Guarantee of Origin certificates and Nature Repair Market biodiversity certificates will also be held in the unit and certificate registry.

The Unit and Certificate Registry will enrich the information associated with each ACCU, and in future will enable more digital interoperability. Responses to the consultation run in late 2024 by the CER indicated broad support for interoperability, to allow external account holder systems and third-party platforms to connect to the Registry. In July and August 2025, the CER held targeted consultation to inform prioritisation of interoperability functions and models. Next steps for wider public consultation will be published on the CER website in the coming months.

The Unit and Certificate Registry will make it easier to view, filter and sort holdings by attributes. Attributes are immutable pieces of information, such as project method and location. The CER consulted on additional attributes during April and May 2025. A full list of these attributes will be published on the CER website prior to the ACCU migration.

The CER expects to add more functionality such as customised tagging of units and certificates within the next year. These additions align with information collected for the project register and in response to feedback received from consultations on the Unit and Certificate Registry.

Once ACCUs are migrated to the Unit and Certificate Registry, ANREU will remain operational to host certified emission reductions. In the first half of 2025, certified emission reductions were valued at $0.31 - $0.77, depending on vintage. Insights from CER discussions with holders of certified emission reductions suggest the trading environment for these units is uncertain. Many market participants are looking for buyers and voluntary cancellation options. Timing on when trading activity and cancellations may occur seems to be driven by a range of factors. These include corporate annual emissions inventory cycles, forward contract delivery timeframes, and expectations around future demand.

The CER will continue to prioritise the useability, functionality and interoperability of the Unit and Certificate Registry.

Understanding certified emission reductions

In addition to units and certificates issued by the CER, the ANREU holds international certified emission reductions issued under the UNFCCC Clean Development Mechanism (CDM). The CDM allows for the generation of certified emission reductions in ‘non-Annex I countries’ (predominantly developing countries) which could be traded or cancelled to meet Annex I countries’ emissions targets under the Kyoto Protocol. A certified emission reduction represents one tonne of CO2-e.

The Kyoto Protocol’s second commitment period concluded in 2020. However, at this stage there is no international agreement to formally close the CDM, under which certified emission reductions are issued. Some activities under the CDM have applied to transition to the Paris Agreement Crediting Mechanism established under Article 6.4 of the Paris Agreement. Transition arrangements are underway with elements remaining subject to decisions by parties to the Paris Agreement under the UNFCCC. The issuance of certified emission reductions is expected to taper off as the remaining supply of as-yet credited pre-2020 abatement runs out.

The CER is required to maintain ANREU for the holding, trading, and cancellation of certified emission reductions in Australia. This aligns with the Australian National Registry of Emissions Units Act 2011 and is consistent with Australia’s international obligations under the Kyoto Protocol and Paris Agreement. International negotiations on the future of the international transaction log, including connecting with national registries (including ANREU) are ongoing.

At the end of Q2 2025, 10.0 million certified emission reductions were held in 25 ANREU accounts. Most accounts are held by environmental consultation services, major manufacturers, and energy providers. Certified emission reductions continue to be cancelled. In the first half of 2025, 0.9 million certified emission reductions in ANREU were cancelled for voluntary purposes by 13 entities. This is smaller than previous years such as 2023, where 13 million were cancelled for voluntary purposes and 21.8 million for compliance purposes across the year. Since 2010, 146.2 million certified emission reductions have been held in ANREU, of which:

- Most (61.6 million) were cancelled for voluntary purposes

- 21.8 million were cancelled for compliance purposes

- 52.6 million were transferred to an account outside Australia, so further details are unavailable from ANREU.

Integrity and transparency

Over Q2 2025, the CER reviewed and verified the status of projects that have missed or are near their reporting deadline. When projects miss their reporting deadlines, the CER actively engages with project proponents to bring them back into compliance. However, some projects are not reporting because the project is no longer proceeding. This may be because regulatory approvals or consents could not be obtained, or the proponent has chosen not to proceed with the project.

During Q2 2025, the CER contacted 70 projects proponents regarding missed reporting deadlines. The CER expects some of these projects to be revoked over the coming months. Project revocations are a standard compliance process to ensure the ACCU Scheme operates with integrity. While this may result in fewer active ACCU projects, this will have a negligible impact on overall projected ACCU supply as a percentage of revocations is already assumed in ACCU supply projections.