The QCMR report consolidates information across the national carbon markets that the Clean Energy Regulator (CER) administers for the September Quarter 2025 (July to September 2025). It provides information on supply and demand trends and opportunities that may inform market decisions.

On this page

Highlights

- New and continuing Clean Energy Regulator (CER) programs are accelerating carbon abatement for Australia.

- The Cheaper Home Batteries Program has exceeded expectations. We expect to receive around 175,000 valid battery applications corresponding to a total usable capacity of 3.9 GWh by the end of 2025. To put this in context, this is more capacity than the 5 biggest utility-sized batteries currently operational in the National Electricity Market (NEM).

- Around 6 GWh of storage capacity could be installed under the scheme by the end of the 2025-26 financial year.

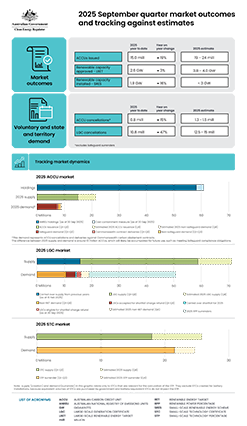

- In the large-scale electricity sector, a record 15.7 million Large-scale Generation Certifications (LGCs) were created over the quarter, led by wind generation. Renewable energy capacity being added to the grid is also strong. Approved large-scale capacity is likely to reach 3.8 to 4.0 GW in 2025 – a good result immediately following a record year in 2024 of 4.3 GW.

- Combined with small-scale capacity, the CER estimates close to 7 GW of renewable capacity will be added to the grid in 2025.

- Final investment decisions (FID) could reach 2.5 GW in 2025. This is based on an estimate of 1.5 GW being announced in Q4. While the renewable energy projects reaching FID have been lower in 2025 than recent years, we are expecting announcements to strengthen over 2026.

- Preliminary CER data for the second year of the reformed Safeguard Mechanism suggests the Safeguard Mechanism is continuing to work as intended, indicating that covered emissions reduced by 2.4% from 135.9 MtCO2-e in 2023-24 to 132.7 MtCO2-e in 2024-25. Responsible emitters of 59 facilities reported covered emissions below their baseline and may be eligible for an approximate total of 7 million Safeguard Mechanism credit units (SMCs). This would be a decrease in SMC eligibility of 15.7% from the 8.3 million issued in 2023-24. Covered emissions for 143 facilities exceeded their baselines, totalling 13.7 MtCO2-e in potential excess.

- Australian carbon credit units (ACCUs) have been successfully migrated from Australian National Registry of Emissions Units (ANREU) accounts into the new Unit and Certificate Registry. This means from 11 November 2025, account holders have greater visibility of and access to information about each ACCU, including method, location, and issuance date.

- Total ACCU supply for 2025 may be towards the higher end of our 19 to 24 million projected range. A total of 5.5 million ACCUs were issued in Q3 2025, bringing the year-to-date total to 15 million. An additional 7.3 million ACCUs were under application with the CER at the end of Q3 2025. Looking further ahead, the ACCU supply pipeline appears strong. It is supported by the development of new ACCU methods and new and existing project registrations.

- On 3 November 2025, the Guarantee of Origin (GO) Scheme was launched. It includes the Product Guarantee of Origin (PGO), a voluntary certification framework that tracks the emissions intensity of products and the Renewable Electricity Guarantee of Origin (REGO) scheme.

- Individuals need to be a registered person under the scheme to be eligible to create and transact certificates from registered facilities. As of 14 November, the CER has received 3 applications (1 PGO and 2 REGO) for individuals to become registered persons.

Click on the image below to download a full-sized version.

Ways to read the report

Data workbook

QCMR data workbook - September quarter 2025 ( 1.83 MB xlsx )The QCMR data workbook – September Quarter 2025 contains the data underlying the figures in the report as well as additional data.

Updated: 27 November 2025

Changes

Updated:

- Figure 1.6 – Generic Australian carbon credit unit (ACCU) and Safeguard Mechanism credit unit (SMC) volume weighted average spot price (updated with post quarter data)

- Figure 2.2 – Large-scale generation certificate (LGC) reported spot and forward prices (updated with post quarter data)

- Figure 2.7 – Large-scale certificate (LGC) spot price (updated with post quarter)

- Figure 3.2 – Distribution of validated battery installations by size range for residential systems (graph split into 2 – one for residential, the other for non-residential)

- Figure 3.8 - Small-scale technology certificate (STC) reported spot and clearing house prices (updated with post quarter data)

New:

- Figure 1.1 – Estimated Australian carbon credit units (ACCUs) issuances (in millions) in 2025

- Figure 3.3 - Distribution of validated battery installations by size range for non-residential systems (split from 3.2)

- Figure 3.4 – Distribution of validated battery installations by installation type

Media release

Read the media release: Carbon Markets continue to support Australia’s climate change goals