What is the Product Guarantee of Origin?

The Product Guarantee of Origin (PGO) is part of the Guarantee of Origin Scheme. The PGO shows where a product has come from, how it was made, and its emission intensity throughout its life cycle.

Under the PGO, producers, exporters and consumers can use digital certificates to prove where a product was made and the associated emissions from its:

- production, including upstream emissions

- transport

- storage.

This allows Australian producers to make confident, objective and credible claims about the products they make.

How to participate in the PGO

Find out the steps you need to take to participate in the PGO.

PGO certificates

Why participate?

The PGO allows producers to:

- prove emissions intensity claims

- access government incentives (like the Hydrogen Headstart program and the Hydrogen Production Tax Incentive)

- differentiate their products in competitive markets.

It allows consumers to:

- demonstrate their claims about the use of low emissions-intensity products (e.g. from 2025–26, National Greenhouse and Energy Reporting (NGER) Scheme reporters will be able to claim renewable gas use through PGO certificates)

- trust that emissions intensity claims are backed by government-verified data

- make informed choices based on verified emissions information.

Stay up to date

Sign up to get the latest updates about the PGO.

How it works

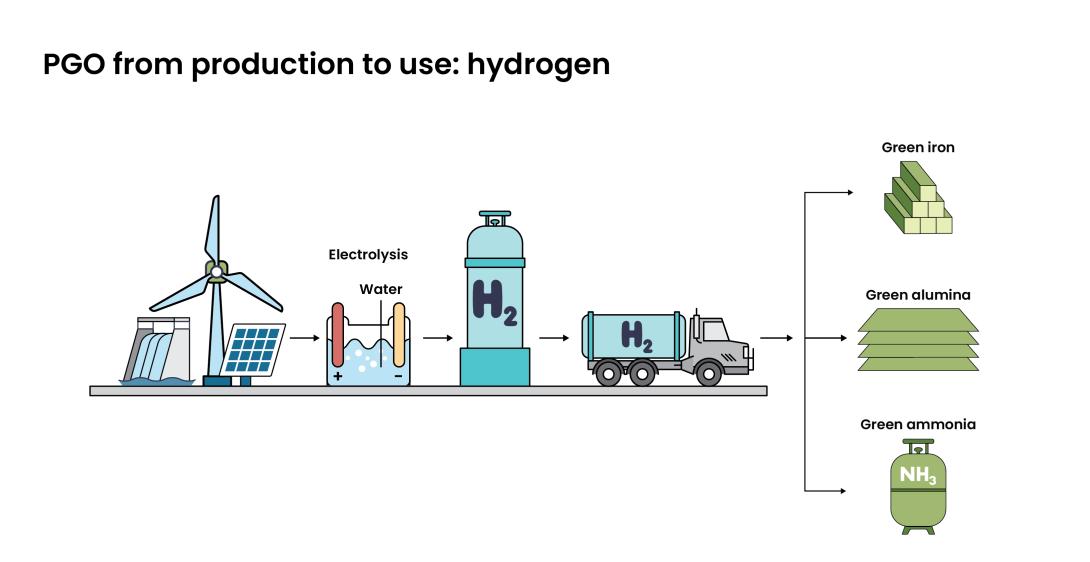

PGO certificates can be created by registered producers for eligible products. As the product moves through the supply chain, extra information is added to the certificate. Certificate information includes:

- production: where and how the product is made, including its emissions intensity at the point of production

- delivery: how the product is transported and stored (e.g. pipeline, truck, ship), including its emissions intensity with post-production emissions included

- consumption: where and how the product is used or exported (e.g. hydrogen used by an ammonia manufacturer).

Certificates also include information specific to a product batch, like the purity and the emissions intensity of the product as it moves along the supply chain. Emissions associated with consumption are not included on PGO certificates.

Certificates are published on the GO Register so consumers can compare how products were made and handled.

Who can participate

Australian businesses can register and apply to certify products made using specific methods.

The scheme is currently open to businesses involved in the production, transport and consumption of hydrogen produced by electrolysis. In 2026, it will expand to include other products, such as:

- hydrogen via other production pathways

- low-carbon liquid fuels

- green metals

- biomethane.

Need help applying?

We’re here to support you through the process and help you understand the requirements. For support, follow our steps to participate or email us at pgo@cer.gov.au.

Hydrogen Production Tax Incentive

The Hydrogen Production Tax Incentive is a refundable tax offset of $2 per kilogram of eligible hydrogen. It will apply to hydrogen produced in income years between 1 July 2027 and 30 June 2040, for a maximum of 10 years.

The incentive will support medium to large scale production of renewable hydrogen in Australia. As part of the Future Made in Australia package, this offset will help companies start production while the market is still developing.

The Clean Energy Regulator and Australian Taxation Office (ATO) will jointly administer the incentive:

- We’ll administer the GO Scheme, where certificates verify the details of your eligible hydrogen production.

- The ATO will administer the tax offset claimed in your company tax return.

Visit the ATO’s website to learn more about the Hydrogen Production Tax Incentive tax offset.

Our role

We administer the PGO by:

- assessing and approving registered person and profile applications

- registering PGO certificates

- ensuring scheme compliance.

The Department of Climate Change, Energy, the Environment and Water oversees the policy of the GO Scheme. Visit the department’s website for more information about the GO Scheme.

Legislative framework

- Future Made in Australia (Guarantee of Origin) Act 2024

- Future Made in Australia (Guarantee of Origin Charges) Act 2024

- Future Made in Australia (Consequential Amendments and Transitional Provisions) Act 2024

- Future Made in Australia (Guarantee of Origin) Rules 2025

- Future Made in Australia (Guarantee of Origin Charges) Regulations 2025

- Future Made in Australia (Guarantee of Origin) Methodology Determination 2025