The QCMR report consolidates information across the national carbon markets that the CER administers for the March Quarter 2025 (January to March 2025). It provides information on supply and demand trends and opportunities that may inform market decisions.

On this page

Highlights

- The first compliance year of the reformed Safeguard Mechanism has concluded with the outcomes delivered consistent with the reformed policy settings. Detailed data published by the Clean Energy Regulator (CER) on 15 April show:

- Emissions from safeguard facilities reduced from 138.7 million tonnes of carbon dioxide equivalent (Mt CO2-e) in 2022-23, to 136.0 Mt CO2-e.

- 142 facilities surrendered 1.4 million Safeguard Mechanism credit units (SMCs) and 7.1 million Australian carbon credit units (ACCUs) to manage their excess emissions.

- ACCUs surrendered for the 2023-24 compliance year have surpassed all pre-reform years.

- Looking forward, the CER expects tightening baselines to reduce SMC issuances and increase total ACCU and SMC surrenders. This will further strengthen facilities' incentive to make on-site emissions reductions.

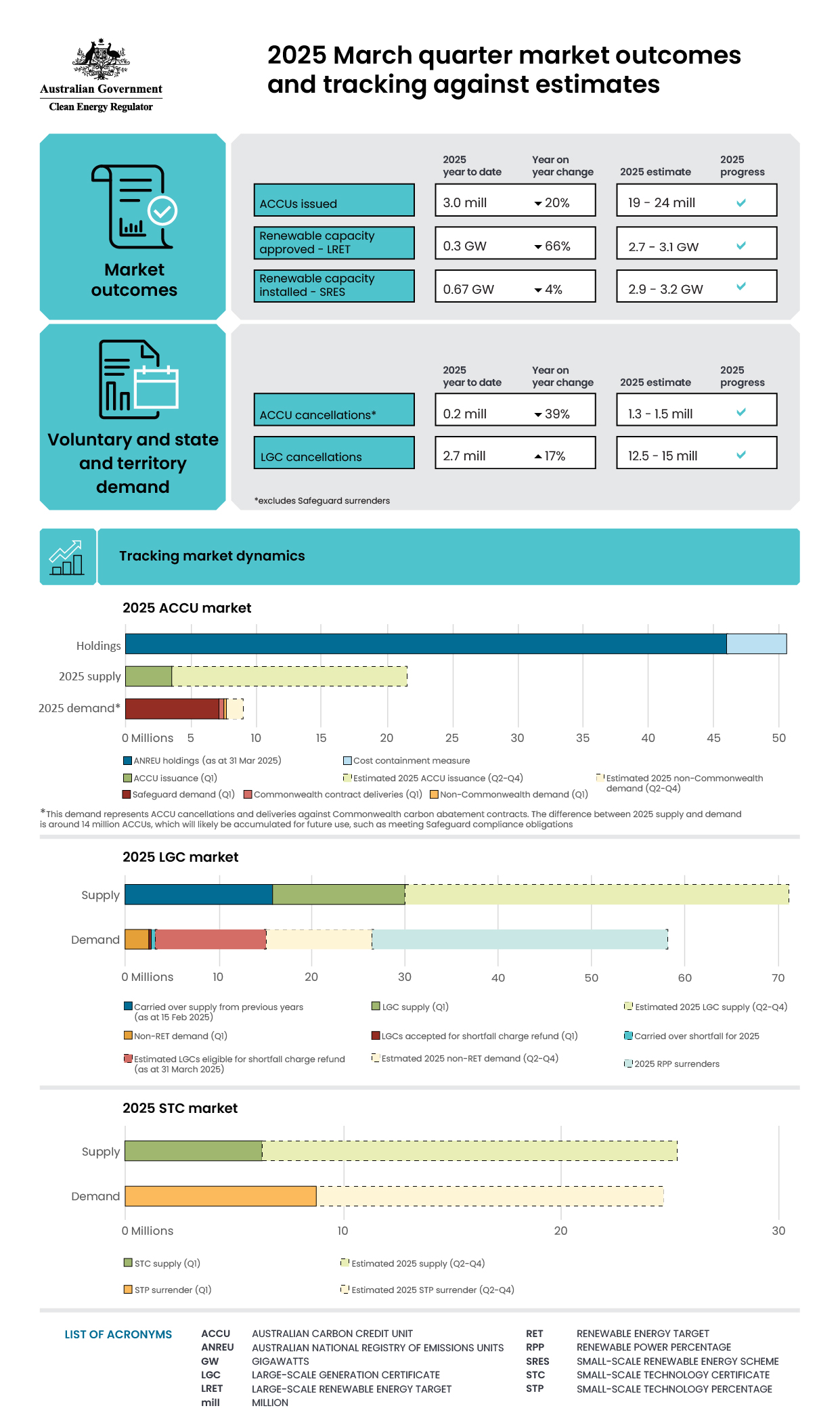

- ACCU issuances in 2025 are on-track to meet the projected range of 19 to 24 million. High volumes of crediting applications on-hand are likely to translate into stronger issuances over the year.

- Q1 2025 was a record Q1 for large scale electricity generation in both of Australia's major electricity grids. Renewable energy in the National Electricity market (NEM) averaged 43% this quarter. Renewable penetration will continue to grow, supported by a healthy approvals and investment pipeline.

- The CER approved 1.7 gigawatts (GW) of new large-scale generation capacity by 31 May. With 1.2 GW of applications on hand we expect to exceed the lower end of the projected 2.7 to 3.1 GW range for 2025.

- The large-scale generation certificate (LGC) market is in surplus, despite growing voluntary demand. This reflects the success of policies including the Large-scale Renewable Energy Target (LRET) in driving investment and accelerating the deployment of renewable energy projects. As a result, LGC prices have declined as long expected.

- The LGC price decline is unlikely to materially impact investment because the drivers of investment are changing, with the Capacity Investment Scheme and other policies supporting investment.

- From 1 July 2025, the Small-scale Renewable Energy Scheme (SRES) will expand to include small-scale battery systems under the Cheaper Home Batteries Program.

- This will reduce the upfront cost of a typical battery by around 30%. The discount will be based on the solar battery's usable capacity and will gradually decrease until 2030.

- The Australian Government will regularly purchase STCs, equivalent to the amount created from batteries, through the Clearing House.

- The number of STCs that liable entities must purchase to meet their SRES liabilities will not change. This means that the cost of the Cheaper Home Batteries Program is met by the government rather than being passed through to electricity prices.

- 2025 installed rooftop capacity is on track to fall within our projected range of 2.9 to 3.2 GW, with the potential for further upside due to the Cheaper Home Batteries Program.

Click on the image below to download a full-sized version.

Ways to read the report

Data workbook

The QCMR data workbook – March Quarter 2025 contains the data underlying the figures in the report as well as additional data.

Updated: 12 June 2025

Changes

Updated:

- Figure 1.2 - Generic Australian carbon credit unit (ACCU) volume weighted average spot price

- Figure 1.3 - Australian carbon credit unit (ACCU) cancellations by demand source

- Figure 1.5 - Registered Australian carbon credit unit (ACCU) Scheme projects by method type

- Figure 1.6 - Australian carbon credit units (ACCUs) issued by method type

- Figure 2.1 - Large-scale generation certificates (LGCs) validated by technology type

- Figure 2.2 - Large-scale generation certificate (LGC) spot price

- Figure 2.3 - Large-scale generation certificate (LGC) reported spot and forward prices

- Figure 2.4 - Approved large-scale wind and solar capacity in gigawatts (GW)

- Figure 2.6 - Final investment decision capacity in gigawatts (GW) for large-scale renewable generation

- Figure 2.7 - Large-scale generation certificate (LGC) holdings (in millions) by market participation

- Figure 2.8 - Non-Renewable Energy Target (non-RET) large-scale generation certificate (LGC) cancellations by demand source

- Figure 3.2 - Small-scale technology certificate (STC) reported spot and clearing house prices

- Figure 3.5 - Air source heat pump installations by state and territory and associated small-scale technology certificate (STC) validations

- Figure 3.7 - Replacement small-scale rooftop solar as a proportion of total installations by state and territory

- Figure 3.8 - Small-scale rooftop solar installed capacity in megawatts (MW) by state and territory

New:

- Figure 1.4 - Total Australian carbon credit unit (ACCU) holdings and ACCUs surrendered for safeguard compliance: comparison by method

- Figure 1.7 - Estimated Australian carbon credit unit (ACCU) issuances in 2025

- Figure 2.5 - Large-scale generation certificate (LGC) validations compared to demand

- Figure 3.6 - Small-scale commercial system size distribution in kilowatts (kW), 2020 to 2024

Removed:

- Figure 1.1 - Australian carbon credit units (ACCUs) issued to and the number of projects claiming for the first time

- Figure 1.8 - Australian carbon credit unit (ACCU) cancellations by method type

Media release

Read the media release: Strong year expected for carbon markets