Safeguard and Australian carbon credit unit (ACCU) schemes

Insights

- 2023-24 Safeguard Mechanism data published by the CER on 15 April 2025 shows that the reformed scheme is progressing well.

- Emissions from safeguard facilities reduced from 138.7 million tonnes of carbon dioxide equivalent (Mt CO2-e) in 2022-23, to 136.0 Mt CO2-e.

- The scheme creates incentives for reduced emissions intensity and approximately 8.3 million Safeguard Mechanism credit units (SMCs) have been issued to 62 facilities with emissions below their baselines.

- 142 facilities surrendered 1.4 million SMCs and 7.1 million Australian carbon credit units (ACCUs) to manage their excess emissions.

- The volume of ACCUs surrendered exceeded the total volume surrendered in all years pre-reform.

- The scheme achieved a compliance rate of 98% amongst 219 facilities.

- Baselines will generally continue to decline at 4.9% per year to 2030. Tightening baselines will progressively strengthen the incentive facilities have to identify, invest in, and deliver on-site emission reductions.

- Facilities will need to develop a clear strategy for managing compliance obligations that balances the sourcing and use of ACCUs and SMCs with the facility's plans for direct emission reductions.

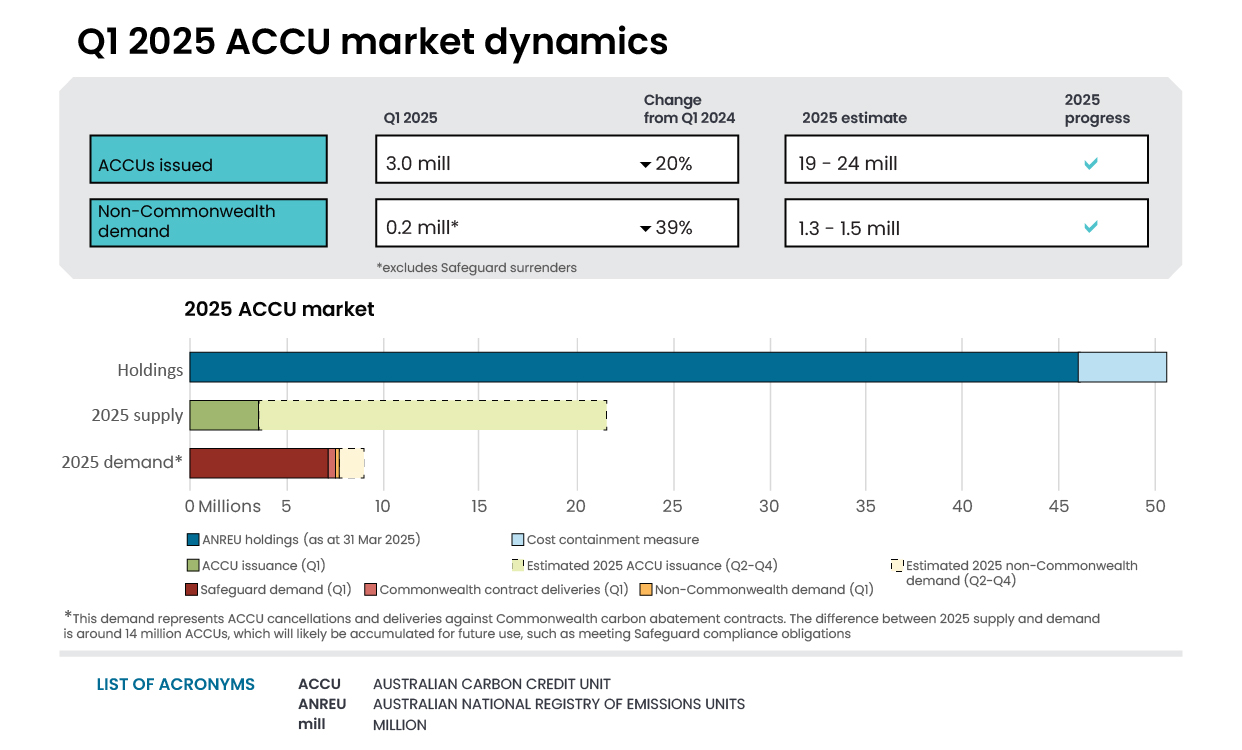

- ACCU holdings fell from around 50 million to 46 million over the quarter.

- This is due to surrenders from safeguard and safeguard related entities holding an estimated 27.9 million at the end of Q1 2025, down from 31.2 million at the end of Q4 2024.

- 0.4 million ACCUs were delivered into the cost containment account, which reached 4.2 million at the end of the quarter.

- The ACCU market remained highly active in Q1 2025 with safeguard being the main driver of trading.

- Q1 2025 has seen the most ACCUs transacted in the Australian National Registry of Emissions Units (ANREU) of any quarter to date at 30.9 million. Safeguard and safeguard-related entities are a strong driver of this activity. Almost three quarters of the ACCUs transacted this quarter (22.1 million ACCUs) involved safeguard or safeguard related accounts.

- 2025 ACCU issuances remain on track to meet our projection of 19 to 24 million ACCUs.

Reformed Safeguard Mechanism progressing well

The CER published the final outcomes of the first compliance period of the reformed Safeguard Mechanism on the statutory deadline of 15 April 2025, updating estimates published in the Q4 2024 QCMR. The 2023–24 safeguard publication includes the first data from the reformed scheme after declining baselines were introduced. The data shows that results align with the expectations established through the reformed policy settings. Key highlights included:

- Emissions from safeguard facilities reduced from 138.7 million tonnes of carbon dioxide equivalent (Mt CO2-e) in 2022-23, to 136.0 Mt CO2-e.

- Aggregate baselines for 2023–24 were 136.1 Mt CO2-e. At a scheme level, the emissions intensity determinations (EIDs) removed nearly all the 'headroom' from aggregate facility baselines. Aggregate headroom is the difference between total covered emissions and total baselines. EIDs set facility-specific emissions-intensities for each product produced at a safeguard facility, based on the facility's historical production and emissions data.

- 7 EIDs were varied to reflect a change in the relevant facilities' emissions because of a move to a higher order method for estimating methane and other emissions. These variations helped ensure consistency between baseline calculation and annual emissions reporting.

- Ensuring consistency is important, and stops facilities from receiving a windfall gain of SMCs. Where a change in method results in a facility's emissions decreasing, a variation makes a corresponding reduction to the facility's EID, so the facility is not eligible for SMCs purely as a result of changing method.

- Method 1 generally allows for the use of default emission factors based on state or national averages. Higher order methods are more rigorous and in principle provide greater accuracy but require more active measurement effort. They generally involve varying degrees of on-site sampling, analysis, or direct measurement. Use of a higher order method may result in either an increase or decrease in emissions, compared to the amount estimated using Method 1.

- Of the 7 EID variations, 2 resulted in an increased EID for the relevant production variable, while 5 resulted in a decreased EID.

- The 7 variations included 4 for coal mines which moved from estimating emissions based on coal production to more precise estimates based on on-site measurement.

- Following surrender of SMCs and ACCUs by facilities above their baseline, 214 safeguard facilities were not in an excess emissions situation on 1 April, complying with the requirements of the Safeguard Mechanism.

- 62 facilities received 8.3 million SMCs because their emissions were below their baseline.

- 142 facilities incurred a liability of 9.2 Mt CO2-e because their emissions were above their baseline. These facilities surrendered 7.1 million ACCUs and 1.4 million SMCs to manage their excess emissions. Twenty-six facilities accessed flexibility measures, for example deferring liabilities through multi-year monitoring periods or borrowing.

- 5 facilities remain in excess due to being in administration or entering an enforceable undertaking to bring their facility into compliance following demonstration of financial hardship.

The significant increase of surrendered ACCUs, from 1.2 million in 2022-23 to 7.1 million in 2023–24, is a result of the reformed scheme. Safeguard entities can use SMCs and ACCUs to manage their excess emissions while onsite emissions reduction plans are developed and executed.

DCCEEW emissions projections indicate that over the next couple of years, declining baselines can be expected to reduce SMC issuances and increase total ACCU and SMC surrenders until facilities deliver the required decline in emissions from investment in low emissions intensive technology. The CER has seen increased investments in emissions reduction projects and will continue to track, analyse and publish de-identified information about safeguard entities' compliance strategies, including for onsite abatement.

Holdings in the ANREU fell from 49.9 million at the end of 2024 to 46.0 million at the end of Q1 2025, excluding the cost containment measure. This reduction was driven by surrenders made by safeguard entities over the quarter. Holdings in safeguard and safeguard related accounts fell by 3.3 million but still make up around 60% of all ACCU holdings. In addition, around 0.4 million ACCUs were delivered to the Commonwealth over the same period, increasing the cost containment account to 4.2 million ACCUs.

Description

This figure shows the volume of ACCUs in account holdings in the Australian National Registry of Emissions Units (ANREU) accounts by market participation category from 1 January 2019 to 31 March 2025. Accounts have been categorised as: project proponent, intermediary, safeguard, safeguard related, government, business, and cost-containment measure.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. ACCU holdings data has been revised to include all accounts. Historical values may change retrospectively. This is due to changes in the classification of ANREU accounts as new information is made available to us.

Category definitions

Project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Safeguard

Account holders are safeguard entities that control a single account, or in cases where safeguard entities control multiple accounts, only those that have surrendered ACCUs for safeguard compliance purposes or have specified a facility are included. Some safeguard accounts also engage in trading activity, which may result in holding fluctuations in this category.

Safeguard related

Account holders are companies, such as subsidiaries, that are related to registered safeguard entities. These accounts do not specify a facility or have not surrendered ACCUs for safeguard compliance purposes. These ACCU holdings may be used for future safeguard compliance purposes.

Intermediary

An account holder’s primary operation is to facilitate trading of ACCUs between the supply and demand sides of the market. This also includes accounts that have accumulated ACCUs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Government

Account holders are government entities that are accumulating for voluntary or compliance purposes.

Business

Account holders do not have a direct link to ACCU Scheme projects. Account holders include participants that are accumulating for voluntary purposes.

Cost containment measure

ACCUs that have been delivered under Commonwealth carbon abatement contract milestones after 12 January 2023. These ACCUs will be available to eligible safeguard entities under the cost containment mechanism.

Market dynamics

| Q1 2025 | ||

|---|---|---|

| Supply | Demand | |

| Balance carried forward from Q4 2024 | 49.9m | |

| Change during the quarter: | ||

| ACCU supply | +3.0m | |

| ACCU Scheme contract deliveries* | -0.4m | |

| Non-Commonwealth cancellations | -0.2m | |

| Safeguard surrenders^ | -6.4m | |

| Net balance at the end of Q1 2025 | 46.0m | |

| Cost containment measure | 4.2m | |

*This refers to ACCUs delivered under Commonwealth carbon abatement contracts in the quarter. These ACCUs are held in the cost containment measure. These ACCUs are available to eligible Safeguard entities for purchase at a fixed price of $79.20 for 2024-25.

^Total safeguard surrenders for the 2023-24 compliance year were 7.1 m as some were surrendered in other quarters. Totals may not sum due to rounding.

| Q1 2025 | ||

|---|---|---|

| Supply | Demand | |

| Balance carried forward from Q4 2024 | N/A | |

| Change during the quarter: | ||

| SMC supply | +8.3m | |

| Safeguard surrenders | -1.4m | |

| Net balance at the end of Q1 2025 | 6.9m | |

The generic ACCU weighted-average spot price fell from around $35 at the end of 2024 to around $33 by the end of this quarter. Prices recovered over April and May, reaching just under $36 by 23 May.

The generic ACCU weighted-average spot price fell from around $35 at the end of 2024 to around $33 by the end of this quarter. Prices recovered over April and May, reaching just under $36 by 23 May.

SMCs were transacted on the new Unit and Certificate Registry for the first time in Q1. A total of 32 transactions totalling 3.0 million SMCs, have been recorded since they were first issued into the Unit and Certificate Registry in January. 1.8 million SMCs appear to have been traded within related corporate entities to manage obligations across a corporate group.

The small volumes of SMC trades are in line with the CER's expectations, discussed in previous QCMRs, that most entities will surrender or bank their own SMCs in the early periods of the reformed Safeguard Mechanism to manage future obligations. SMC trades reported with a price were $0.50 - $2 lower than the generic spot price of an ACCU at the time. This differential likely reflects that ACCUs have alternative uses, including purchase and/or cancellation for voluntary purposes and corporate emissions reporting, while SMCs may only be surrendered for safeguard compliance purposes.

On 12 March, the CER announced that carbon abatement contract holders will be allowed to reschedule their milestone to the end of 2025. The outcomes of the fourth pilot exit window which closed on 31 December 2024 are informing Australian Government consideration of future exit arrangements, including whether they should be made permanent or varied.

Generic Australian carbon credit unit (ACCU) volume weighted average spot price

Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU spot price from December 2019 to 16 May 2025. The price on 16 May was $35.34 and the final spot price for Q1 2025 was $33.08 on 31 March 2025.

Small print

The generic spot price refers to the daily volume weighted average price of spot trades for ACCUs with an unspecified method. Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive. Prices are shown from 1 December 2019 to 23 May 2025.

Safeguard Mechanism the primary source of ACCU demand

0.2 million ACCUs were cancelled for non-safeguard purposes in the first quarter. This was lower than the 0.3 million cancelled over the same period last year. ACCU cancellations for non-safeguard purposes do not follow a clear pattern. Typically, fewer of these cancellations are made in Q1, although this can fluctuate significantly.

A comparison of the ACCU methods used for safeguard surrender indicates these are broadly in line with the share of those methods in total holdings, including those accounts not associated with a safeguard entity. As would be expected, ACCU classes that trade without a price premium were favoured by entities seeking least cost compliance.

Description

This figure is split into 2 bar charts showing the number of ACCUs cancelled by demand source in each quarter from 1 January 2019 to 31 March 2025. The figure is split due to the scale of safeguard demand being significantly greater than other sources of demand. The first chart has demand sources as follows: voluntary, compliance and government. The second chart shows demand from safeguard only.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU cancellations exclude deliveries against Commonwealth carbon abatement contract milestones. This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations. Noting, safeguard demand is included for ACCUs only. ACCU cancellations for safeguard purposes reflect when the cancellation occurred on the Australian National Registry of Emission Units (ANREU), and may differ slightly to the compliance year. For more data on the Safeguard Mechanism, including Safeguard Mechanism Credit issuance and surrenders, see the CER’s 15 April safeguard data release on the CER website.

Covered activities for each classification

Voluntary demand

Cancellations made against voluntary certification programs such as Climate Active and any sort of organisational emissions or energy targets.

Government demand

Cancellations by or on behalf of government entities. For example to offset emissions from vehicle fleets or meet voluntary emissions reduction targets.

Compliance demand

Cancellations made by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, this includes cancellations to meet Environmental Protection Authority requirements.

Safeguard demand

Surrenders made by safeguard entities to meet Safeguard Mechanism compliance.

Description

This figure shows the percentage of Australian National Registry of Emissions Units (ANREU) holdings at the end of 2024 and safeguard surrenders for the most recent compliance period by methods. The methods are listed as follows: human-induced regeneration, landfill gas, savanna fire management, avoided deforestation, and other.

This figure is interactive. Hover over/tap each segment to see the proportion of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

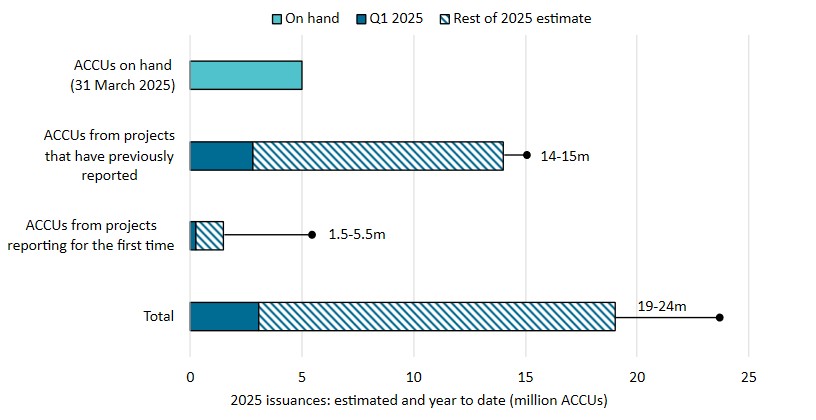

ACCU issuances expected to lift over the rest of 2025

3.0 million ACCUs were issued in Q1, lower than the 3.8 million in the same period last year. Lower total issuances were largely driven by lower issuances to Waste projects as the CER processed registrations and method variations ahead of methods sunsetting on 1 April. This included waste methods such as the landfill gas and alternative waste treatment methods. The CER registered 89 projects in the quarter, including a record 14 waste projects. ACCU issuances to waste projects totalled 0.4 million this quarter, compared with 1.5 million in Q1 2024. The CER expects that a backlog of crediting applications for waste methods will be cleared throughout Q2.

Q1 also saw project registrations by safeguard entities. During the quarter a record 9 coal mine waste gas projects were registered ahead of the method sunsetting. These projects are linked to coal facilities covered by the Safeguard Mechanism. These ACCU projects relate to electricity displacement at safeguard facilities, but not to covered emissions under the Safeguard Mechanism. Facilities earning credits under these projects therefore will be able to generate ACCUs despite being covered by the Safeguard Mechanism and may choose to use the ACCUs for safeguard compliance.

Description

This figure shows the number of projects registered under the ACCU scheme by method type in each quarter between 1 January 2019 to 31 March 2025. The method types are the following: vegetation, agriculture – soil carbon, waste, and other.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture- other' to highlight growth in the soil carbon sector. The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Method types other than vegetation, 'agriculture - soil carbon', and waste have been aggregated in the chart. These represent a small number of registrations.

Revoked projects are excluded from this chart. Please refer to the Project Register on our website for more detail on registered projects.

Description

This figure shows the number of ACCUs issued each quarter by method type between 1 January 2019 to 31 March 2025. The method types listed are the following: vegetation, waste, savanna fire management, and other.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive methods and savanna fire management.

Method types other than vegetation, waste, and savanna fire management have been aggregated in the chart. These represent a small number of total issuances.

Issuances for the year remain on track to meet the CER's expected range of 19 to 24 million. The CER received high volumes of ACCU crediting applications in the first quarter. This, in combination with lower issuances, saw the volume of ACCUs claimed that could be issued ('ACCUs from claims on hand') increase from 3.7 million at the end of 2024 to around 5.0m by the end of the quarter. Issuances will increase over coming quarters as these claims are processed.

Looking forward, ACCU supply is expected to be influenced by new methods. As discussed in the previous QCMR, the Australian Government is developing 4 methods. The Emissions Reduction Assurance Committee released the new draft landfill gas method for feedback on 19 May. Once finalised, this method will help support ACCU supply as existing landfill gas projects reach the end of their crediting period. Exposure drafts for other department led methods are expected to be delivered over the course of 2025. Proponents are leading development of a further 4 new prioritised methods.

Estimated Australian carbon credit unit (ACCU) issuances in 2025

Note: This figure is not interactive.

Description

This figure shows the volume of ACCUs issued in Q1 2025 and the remainder of our yearly estimate. This figure also shows how many ACCUs are on hand from claims still being processed.

Small print

Totals may not sum due to rounding. Estimated ACCU issuances for 2025 consists of the following:

ACCUs on hand

This refers to the volume of ACCUs claimed on submissions received by the CER and are being processed as at 31 March 2025. These ACCUs may be issued in 2025 depending on assessment outcomes.

ACCUs from projects that have previously reported

This refers to ACCUs that are predicted to be claimed by and issued to projects that have previously claimed ACCUs. This is an estimate and is based on factors such as the typical timing and volume of ACCU submissions for such projects.

ACCUs from projects reporting for the first time

This refers to the volume of ACCUs that could be claimed by projects reporting for the first time. This is an estimate and is based on a combination of factors including the typical timing and volume of first submissions. This category is the main driver of uncertainty in the overall estimate for 2025.

Increased transparency for the ACCU Scheme

The CER is committed to transparency for all its schemes. Recent amendments to the legislative rules underpinning the ACCU scheme supported by the CER mean that we can now make more project information available.

Due to legislative secrecy provisions, the CER can only publish legislatively required information on the ACCU project register. The rules underpinning the ACCU Scheme prevent the CER publishing any non-public data unless the data is already public or where disclosure is required or permitted. For example, data may be shared with specific government agencies to assist them in carrying out their statutory responsibilities.

The 2022 Independent Review of ACCUs recommended changes to strengthen transparency. The Australian Government agreed in principle to all recommendations from the Independent Review. Subsequent amendments made to the Carbon Credits (Carbon Farming Initiative) Act 2011 and the Carbon Credits (Carbon Farming Initiative) Rule 2015 (CFI Rule) in April 2023 and December 2024 respectively. The amendments aim to underpin public trust in the ACCU Scheme by improving transparency.

Amendments to the CFI Rules were developed following public consultation and the data is being published in 3 stages in May, June and July. On 21 May, the CER added crediting period and permanence period dates to the project register.

These changes increase transparency by providing more clarity on how abatement is achieved and estimated. They will allow stakeholders to better inform their own analysis, including forecasts of ACCU supply, and to better perform due diligence.

Some of this information may be subject to change over time. For example, project proponents can apply to vary a project's crediting period start date, which may impact the timing of ACCU supply forecasts. These changes will be published on the project register as it is updated monthly.

The CER is also making it easier for project proponents to voluntarily release extra information about their projects. This information is published alongside the project register.

First Nature Repair Market method released

The first method under the Nature Repair Market was released on 1 March. Eligible projects under this method can earn a biodiversity certificate by improving biodiversity from replanting native forest and woodland ecosystems in previously cleared land. Proponents may be able to stack a biodiversity project with an ACCU project if the respective legislative requirements for each scheme are met.