Key messages

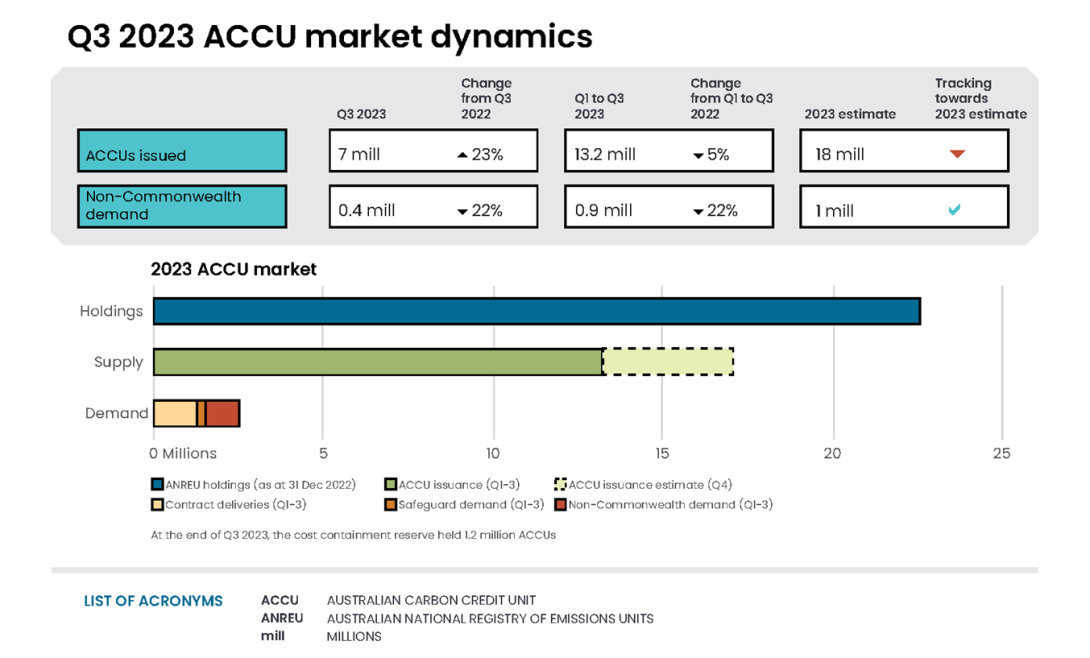

- A quarterly record 7 million ACCUs were issued in Q3 2023 following lower issuances than usual of 6.2 million in the first half (H1) of 2023.

- The expected ACCU supply for 2023 has been downgraded from 18 to 17 million.

- At the end of Q3 2023, the cost containment reserve held 1.2 million ACCUs.

- In Q3 2023, Australian National Registry of Emissions Units (ANREU) holdings increased by 5.9 million to 33.5 million.

- Direct Safeguard entity holdings grew by 2.3 million ACCUs and project proponent holdings increased by 2.2 million.

- 0.3 million ACCUs were voluntarily cancelled in Q3 2023.

- At the end of Q3 2023, 0.8 million ACCUs had been voluntarily cancelled, just short of the record total 0.9 million for 2022.

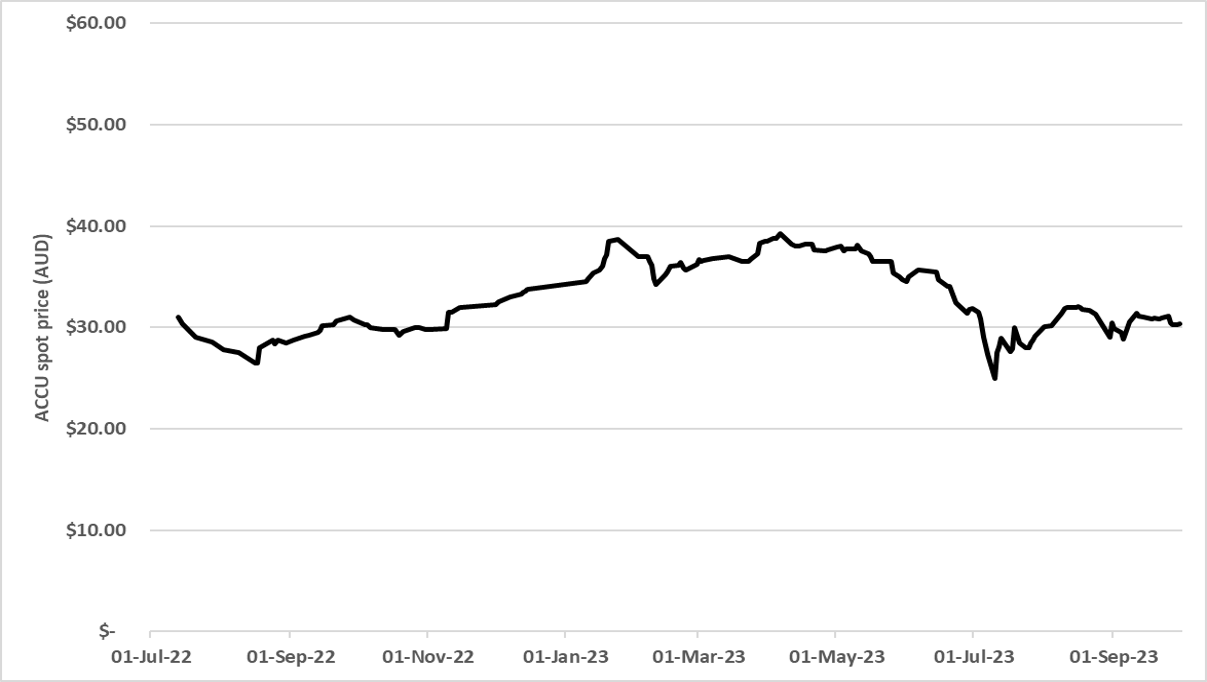

- The ACCU price remained stable between $30.50 and $32.00 for Q3 2023.

Market dynamics

In Q3 2023, the reported generic ACCU spot price recovered from the end of financial year level, as discussed in the Q2 2023 QCMR, to stabilise between $30.50 and $32.00. Human induced regeneration (HIR) ACCUs continued to trade at about $4 over the generic ACCU price.

Generic Australian carbon credit unit (ACCU) reported spot price

July 2022 to September 2023 Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the ACCU generic spot price. The generic spot price refers to the price of ACCU spot trades with an unspecified method.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

Data as at 1 October 2023.

By the end of Q3 2023, there were 1.2 million ACCUs in the cost containment reserve. The reserve includes ACCUs that have been delivered against Commonwealth carbon abatement contracts since 12 January 2023. 0.7 million ACCUs were delivered in Q3 2023, the lowest level of contract deliveries since Q2 2015.

In addition, 0.8 million ACCUs have been voluntarily cancelled in the first 3 quarters of 2023.

ACCU holdings rose across all categories in the Australian National Register of Emissions Units (ANREU) (Figure 1.4). The increases in direct holdings by Safeguard entities (up by 2.3 million) and project proponents (up by 2.2 million) stand out.

The low level of carbon abatement contract deliveries combined with increased ACCU holdings by project proponents suggests they may be keeping their sales options open. This could include anticipated future buying by more Safeguard entities. However, if the ACCU spot price stays around $31, some project proponents may decide to make material deliveries against carbon abatement fixed delivery contracts rather than selling at the spot price. For example, some fixed delivery contracts are at prices well above the $12.70 weighted average. A commercial premium to double the contract price is usually required for fixed contract holders to decide to sell at the spot price rather than deliver against carbon abatement contracts.

Potential fixed delivery contract volume for the remainder of this financial year is about 15 million ACCUs, with the majority scheduled for June 2024. Noting, requests can be made to deliver early or reschedule milestones in line with the Clean Energy Regulator’s (CER) contract management process. The level of potential buying by or on behalf of Safeguard entities for the remainder of the financial year, and the price they would be prepared to pay, is unknown.

As discussed in the Q2 2023 QCMR, the ability to deliver ACCUs under contract provides an effective floor price. Where delivered, ACCUs are held in the cost containment reserve and can only be sold to Safeguard facilities that exceed their baseline. The price to access these ACCUs is $75 in 2023-24. At the current spot price, if the level of Q3 2023 buying/holding of ACCUs by Safeguard entities and intermediaries does not step up materially before the end of the financial year, it is possible larger volumes may be delivered against carbon abatement contracts.

Accumulation of ACCUs by Safeguard entities and intermediaries in Q3 2023, without any real change in the spot price, suggests there is currently plenty of liquidity in the ACCU market.

It is possible that more Safeguard entities may start buying ACCUs from early in the 2024-25 financial year as they settle their compliance plans and prepare for the first compliance date of 31 March 2025 under the reformed Safeguard Mechanism. By then, some Safeguard entities and intermediaries may hold long positions. We also understand some landholders hosting ACCU projects may be holding ACCUs for their own emissions reduction claims and/or as an investment in anticipation of price rises.

We will continue to report on the ACCU volume held in the cost containment reserve and holdings in the ANREU, by holding category, that could be sold.

| Balance carried forward from Q2 2023 | 27.6m |

|---|---|

| ACCU supply | +7.0m |

| Actual scheme contract deliveries | -0.7m |

| Safeguard Mechanism demand | 0 |

| Non-Commonwealth demand | -0.4m |

| ACCU relinquishment | 0 |

| Net balance at the end of Q3 2023 | 33.5m |

| Holdings balance available for cost containment measure | 1.2m |

Insights

- Record quarterly ACCU supply, with 7 million ACCUs issued

- The HIR method expires

- Pilot arrangements for fixed delivery exits continue to facilitate market liquidity

- Holdings increase, including Safeguard accounts

- Voluntary cancellations continue to grow

Record quarterly ACCU supply, with 7 million ACCUs issued

In Q3 2023, we issued a quarterly record 7 million ACCUs. In the first 3 quarters of 2023, we issued 13.2 million ACCUs. We initially expected to issue 18 million ACCUs in 2023. However, we have revised our 2023 estimate to 17 million ACCUs. This in part reflects the increased time to complete HIR gateway audits. The section 215 gateway audits are in line with a direction made by the Minister for Climate Change and Energy in May 2023. The issuance of landfill gas credits is also down compared to the same time last year.

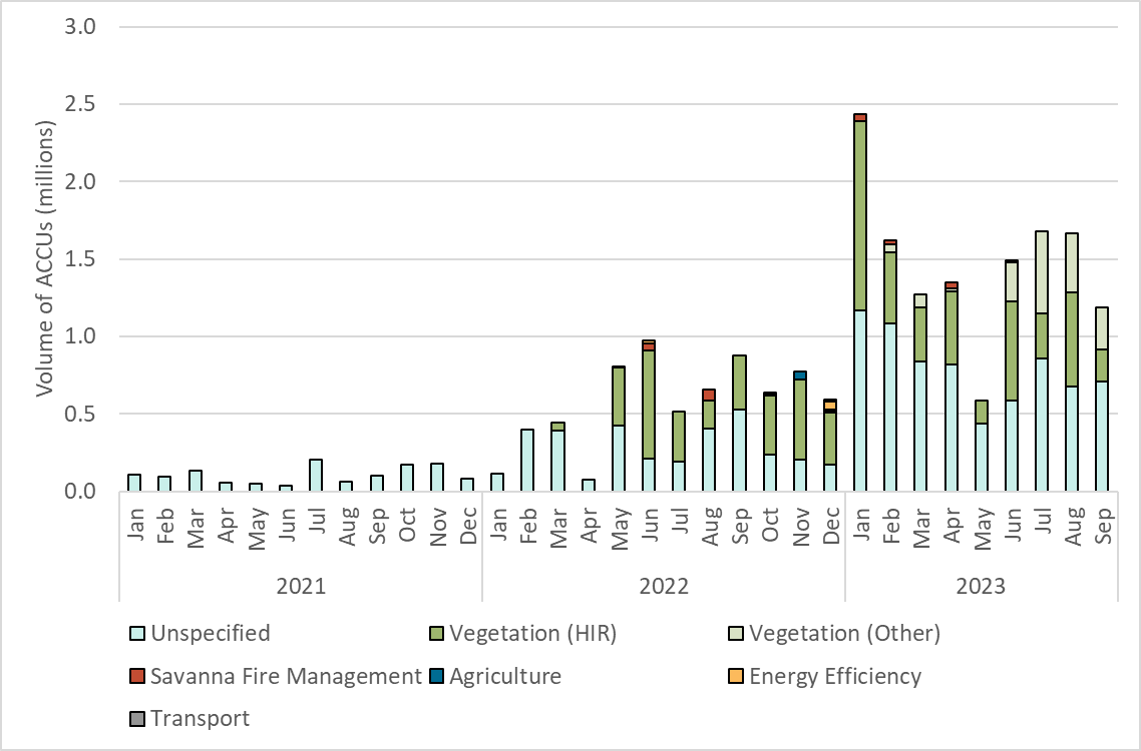

The 7 million ACCUs issued in Q3 2023 included:

- 3.3 million from vegetation projects, of which 2.3 million were from HIR projects

- 1.9 million from waste projects, the majority of which were from landfill gas projects

- 0.8 million from savanna fire management projects

- 0.6 million from industrial fugitives projects.

The remaining were from a combination of agriculture, energy efficiency and transport projects.

Description

This figure shows ACCUs issued by method type over time. ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive methods and savanna fire management.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

The HIR method expires

In Q3 2023, 75 new HIR projects were registered before the HIR method expired according to the 10-year sunset arrangement. These projects are estimated to have a potential abatement of over 65 million tonnes of carbon dioxide equivalence (CO2-e). Now that the method has expired, no new projects can be registered under the HIR method. Existing projects can continue to generate ACCUs for the remainder of their crediting periods, which can be up to 25 years.

In total, there are 529 HIR projects registered which have been issued 40 million ACCUs. More information on these projects is available in the project register. The register includes information on carbon estimation areas, which is the area where the carbon management activity takes place. We also publish an interactive project map. The map shows the volume, location and type of projects happening across Australia.

The reported spot price for HIR ACCUs maintained its premium of about $4 over generic ACCUs during Q3 2023.

Description

This figure shows registered projects under the Australian Carbon Credit Unit (ACCU) Scheme by method type for each quarter. So far in 2023 most projects have been registered under vegetation methods.

This figure is interactive. Hover over/tap each segment to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture - other' to highlight growth in the soil carbon sector.

'Agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Pilot arrangements for fixed delivery exits continue to facilitate market liquidity

On 18 September 2023, the outcome of the third pilot exit window for fixed delivery exit arrangements was announced. This window was for fixed delivery contract holders with milestones falling between 1 January and 30 June 2023, with an extension to 31 August 2023 available under transitional arrangements. Of the eligible 9.3 million ACCUs due for delivery in that period, 4.1 million were released from Commonwealth carbon abatement contracts. That is, instead of the ACCUs being delivered to the CER, they may be made available to the market. Of the remaining 5.2 million ACCUs, 0.8 million were delivered to the CER and the rest will be rescheduled as part of our normal carbon abatement contract management process.

As discussed in the Q2 2023 QCMR, if the ACCU spot price is at least double the carbon abatement contract price plus a commercial margin, it may incentivise contract holders to exit from fixed delivery contracts and then sell or contract the ACCUs to other parties. This creates an effective floor for the ACCU price. Carbon abatement contracts, both fixed and optional delivery, are a means to de-risk projects and ensure cash flow. The ACCU review discussion paper consultation considered if and how future exit arrangements may work. The consultation closed 3 October 2023 and was run by the Department of Climate Change, Energy, the Environment and Water (DCCEEW).

The 3 fixed delivery pilot exit arrangements have resulted in 8.4 million ACCUs being released from carbon abatement contracts. This volume represents 63% of the total ACCUs that could have exited. As a result, the ACCU market liquidity has increased. In the same period, 5 million ACCUs were delivered against carbon abatement contracts to the CER.

From 15 November 2023, the carbon abatement contract register includes information on contract volume that has been released through fixed delivery pilot exit arrangements or through lapsed optional delivery milestones.

In Q3 2023, 0.7 million ACCUs were delivered against carbon abatement contracts to the CER. These deliveries were generally against higher price contracts and included some optional deliveries.

Since the first exit arrangement pilot window on 4 March 2022, we have seen significant increases in overt Safeguard entity holdings. We expect acquisitions to continue as ACCUs can be purchased at a lower price in the market compared to accessing the cost containment reserve ($75 in 2023-24). We also expect companies are still working through potential in-situ emissions reduction investment plans.

The cost containment reserve currently includes ACCUs from 11 different methods, including environmental planting and regeneration methods. The method with the most ACCUs in the reserve is avoided deforestation (667,000), followed by landfill gas (290,000).

Any ACCUs can be delivered to fulfil a fixed delivery carbon abatement contract milestone, regardless of the method they come from. In contrast, ACCUs delivered under optional delivery contracts must be from the project connected to the contract. A preliminary review of the cost containment reserve shows that 250,000 landfill gas ACCUs were delivered under avoided deforestation contracts. While approximately 57,000 avoided deforestation ACCUs were delivered under HIR contracts. It is too early to call any pattern in market behaviour. Factors such as current holdings profile, secondary market premiums and project status (such as project revocation), likely all play a role.

Holdings increase, including Safeguard accounts

ACCU holdings in the ANREU increased by 5.9 million during Q3 2023 with each participant type increasing. In Q3 2023:

- Safeguard entities grew by 2.3 million (72%)

- Project proponents grew by 2.2 million (24%)

- Business and government enterprises grew by 1.2 million (25%)

- Intermediaries grew by 0.2 million (2%)

Of the 2.3 million ACCUs acquired by Safeguard accounts, 1.7 million were from accounts of intermediaries, 0.2 million were from project proponents and the remaining 0.4 million were issued directly for their own ACCU projects.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts by different account holder categories.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Category | Project proponent | Business and government enterprise | Intermediary | Safeguard |

|---|---|---|---|---|

| Definition | An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator. | Account holders that do not have a direct link to ACCU Scheme projects. These include voluntary participants and local government entities that are accumulating for voluntary or compliance purposes. | Account holder's primary operation is to facilitate trading of units between the supply and demand sides of the market. This also includes accounts who have accumulated ACCUs through the secondary market without known scheme obligations, offset use, or carbon trading/offset services. | Account holders are Safeguard entities that control a single account, or in cases where Safeguard entities control multiple accounts, only those that have surrendered ACCUs for Safeguard compliance purposes or specify a facility are included. Some Safeguard accounts also engage in trading activity that may result in holdings fluctuations within this category. |

| Balance at end of the quarter (millions of ACCUs) | 11.3 | 6.1 | 10.7 | 5.4 |

| Number of accounts | 209 | 68 | 55 | 37 |

Accounts with nil volume at the end of the quarter are excluded.

Totals may not sum due to rounding.

The increase in project proponent holdings could be for a variety of reasons, including:

- forward contracts, where the ACCUs are effectively contracted to be sold to another entity

- expectation of potential future price increases

- anticipation of future demand from Safeguard entities

- waiting to see if there will be any changes to the fixed delivery pilot exit arrangements, including whether they will be made permanent.

As discussed in the market dynamics section, the increase in Safeguard holdings may indicate hedging behaviour to meet future compliance obligations. An additional 4 Safeguard accounts were created in Q3 2023, bringing the total to 37 accounts. Note that some Safeguard entities may also use their ANREU accounts for trading purposes.

Voluntary cancellations continue to grow

Non-Commonwealth ACCU cancellations include several categories such as voluntary, and compliance with local, state and territory obligations. Voluntary cancellations show corporate progress towards reducing net scope 1 emissions and to claim net low emissions products and services. For example, some companies offer the option to carbon offset services, such as flights, for a fee.

In Q3 2023, there were 0.4 million non-Commonwealth cancellations. Of this, 0.3 million were voluntary cancellations, bringing the total for the first 3 quarters of 2023 to 0.8 million. This is just short of the record 0.9 million total voluntary cancellations for 2022. We expect the voluntary component of non-Commonwealth cancellations to reach 1 million in 2023.

Description

This figure shows ACCU cancellations by demand source.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Classification | Covered activities |

|---|---|

| Voluntary demand | Cancellations made against voluntary certification programs such as Climate Active, and any sort of organisational emissions or energy targets. |

| Local, state and territory government demand | Cancellations on behalf of local, state and territory governments, for example, to offset emissions from state fleets or meet emissions reduction targets. |

| Compliance demand | Cancellations by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, to meet Environmental Protection Authority requirements. |

| Other demand | All activity not covered in the previous categories, primarily due to lack of information available. This grouping has declined substantially as part of these new classifications. |

This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations.

The Quarterly Carbon Market Report (QCMR) includes an analysis of cancellations of ACCUs in the Australian National Register of Emissions Units (ANREU) for purposes other than deliveries to the Emissions Reduction Fund (ERF) or surrenders for Safeguard Mechanism obligations. These cancellations could be voluntary to show progress towards reducing net scope 1 emissions or to meet state/territory regulatory requirements.

In the first 3 quarters of 2023, 0.5 of the 0.8 million ACCUs voluntarily cancelled were for Climate Active purposes.

The top industries that have voluntarily cancelled ACCUs in the first 3 quarters of 2023, include:

- Financial and insurance services (36%)

- Transport, postal and warehousing (25%)

- Electricity, gas, water and waste services (12%).

Compared to the same period last year, in the first 3 quarters of 2023, there was large growth in cancellations by industries related to:

- Arts and recreation services

- Retail trade

- Health care and social assistance.

Supplementary figures

Description

This figure shows ACCU cancellations by method type from 2019 to 2023. Vegetation and savanna fire management ACCUs are the most common units cancelled over this period.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The QCMR includes an analysis of cancellations of ACCUs in the Australian National Register of Emissions Units (ANREU) for purposes other than deliveries to the Emissions Reduction Fund (ERF) or surrenders for Safeguard Mechanism obligations. These cancellations could be voluntary to show progress towards reducing net scope 1 emissions or to meet state/territory regulatory requirements.

Reported Australian carbon credit unit (ACCU) spot trades by method type

January 2021 to September 2023 Note: This figure is not interactive.

Description

This graph shows reported ACCU spot trades by method type.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.