Key messages

- Australian carbon credit unit (ACCU) holdings in Australian National Registry of Emission Units (ANREU) accounts increased to 27.6 million.

- Deliveries to the Commonwealth Emissions Reduction Fund Delivery (CERFD) account increased to 1 million ACCUs by August 2023, reducing availability to the secondary market.

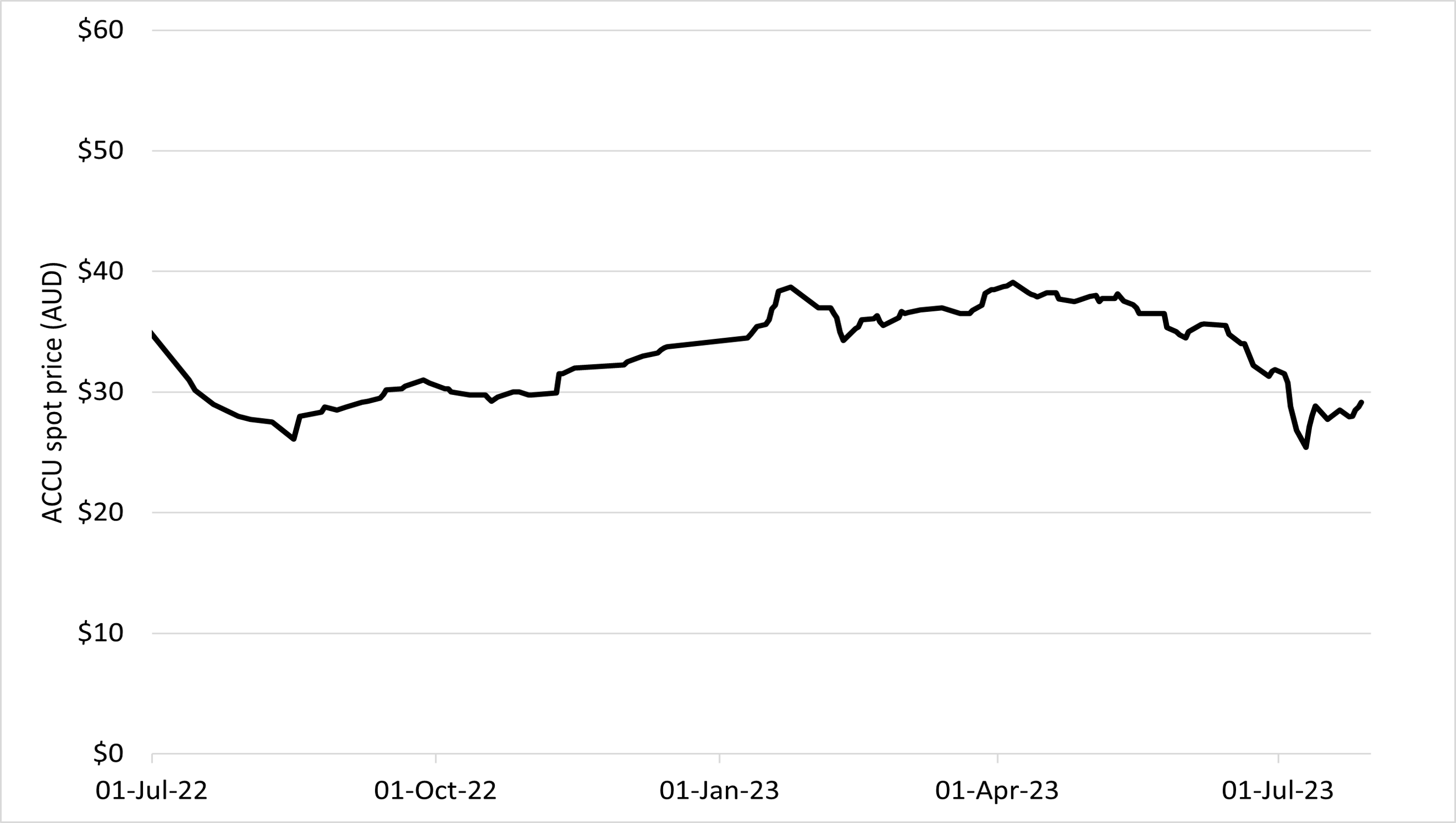

- The ACCU spot price recovered from end of financial year sell off to hover around $32 by mid-August.

- Soil carbon issuance under the 2021 method starts, with 151,000 ACCUs issued to 2 projects.

- 18 million ACCUs expected to be issued in 2023.

- 4.1 million ACCUs were released in the third pilot exit window as part of the fixed delivery exit arrangements.

Reported ACCU spot prices trended down over Q2 2023 from $39 in early April to $31.85 at the end of June. Following the end of the financial year, motivated sellers saw the ACCU price dip temporarily to $24.00. The spot price rebounded to $28.50 by the end of the following day. Spot prices recovered further to $32.00 by mid-August. Analysis and market intelligence suggests this activity was largely due to a number of intermediaries selling down their market positions to free up capital.

At the end of Q2 2023, ANREU holdings had increased by 3.8 million to 27.6 million ACCUs. Transactions in the ANREU indicate some Safeguard Mechanism entities are accumulating ACCUs, with Safeguard Mechanism account holdings increasing from 2.2 million over the year to 3.1 million by 30 June 2023. However, as discussed below, intermediaries and others may be holding for Safeguard Mechanism entities.

Holdings in the Commonwealth Emissions Reduction Fund Delivery (CERFD) account are also increasing, totalling over 1 million ACCUs at the end of August 2023.

To 30 June 2023, we have issued 6.2 million ACCUs. We expect to issue about 18 million ACCUs in 2023. Incremental growth in the annual issuance of ACCUs is likely for the foreseeable future.

Intermediaries take an active role in the carbon market

Participation in the carbon market can be broadly categorised according to the role of account holders in the ANREU. As at 30 June 2023, there were 343 ANREU accounts that held ACCUs (Figure 1.1). We have refreshed our analysis to identify Safeguard Mechanism accounts. Safeguard Mechanism accounts are accounts where Safeguard Mechanism entities control a single account, or in cases where Safeguard Mechanism entities control multiple accounts, only the accounts that have surrendered ACCUs for Safeguard Mechanism compliance purposes or specify a facility, have been included. As some of these accounts also engage in trading activity from time to time, holdings of ACCUs within this category may fluctuate. We anticipate the number of accounts in this category will increase as more Safeguard Mechanism entities enter the market.

Safeguard Mechanism facilities will be required to reduce net emissions by more than 200 million tonnes by 2030. As Safeguard Mechanism entities progressively develop and implement their compliance strategies in the coming years, demand for ACCUs is expected to increase and the market to tighten.

Holdings in Safeguard Mechanism accounts have increased 0.9 million to 3.1 million ACCUs in the 12 months to June 2023.

Safeguard Mechanism entities must surrender ACCUs to avoid being in an excess emissions situation for the compliance period ending 30 June 2023 by the 29 February 2024 deadline. For more information, refer to the key dates for the 2022-23 and 2023-24 compliance years.

The increase in holdings of ACCUs by Safeguard Mechanism associated accounts is less than the 5.5 million increase in the accounts of intermediaries over the same period. While accounts of intermediaries represent 13% of the 343 accounts, they hold 35% of total private holdings of ACCUs. ACCUs can be held for Safeguard Mechanism compliance in multiple ways including through third parties and intermediaries, longer term offtake agreements and forward contracts.

Description

This graph shows holdings of ACCUs in Australian National Registry of Emissions Units (ANREU) accounts by different holder categories.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Category | Project proponent | Business and government enterprise | Intermediary | Safeguard |

|---|---|---|---|---|

| Definition | An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator. | Account holders that do not have a direct link to ACCU Scheme projects. These include voluntary participants and local government entities that are accumulating for voluntary or compliance purposes. | Account holder's primary operation is to facilitate trading of units between the supply and demand sides of the market. This also includes accounts who have accumulated ACCUs through the secondary market without known scheme obligations, offset use, or carbon trading/offset services. | Account holders are Safeguard Mechanism entities that control a single account, or in cases where Safeguard Mechanism entities control multiple accounts, only those that have surrendered ACCUs for Safeguard Mechanism compliance purposes or specify a facility are included. Some Safeguard Mechanism accounts also engage in trading activity that may result in holdings fluctuations within this category. |

| Balance at end of quarter (millions of ACCUs) | 9.0 | 5.7 | 9.8 | 3.1 |

| Number of accounts | 204 | 61 | 45 | 33 |

Accounts with nil volume at the end of the quarter are excluded.

Totals may not sum due to rounding.

The rate of new ANREU accounts being opened is increasing. This reflects the growing interest in the carbon offset market. In 2022-23, 147 new accounts were created, compared to 177 in 2021-22 and 41 accounts in 2020-21. This increase in new accounts coincided with the surge in the ACCU spot price in the second half of 2021 and early 2022.

Of the 324 accounts that have been opened since 1 July 2021, only 97 (30%) have been used for ACCU transactions and are included in Figure 1.1. The remaining 227 accounts are yet to enter the market. It seems a significant proportion of the accounts opened in the past 12 months are for trading purposes. While these accounts are largely yet to engage in the market, some may be poised to participate in the market with any material shifts in ACCU price/volume. It will be interesting to monitor what level of involvement, if any, these accounts may have in the future.

End of financial year sale on ACCUs

The reported ACCU spot price declined by 18% over the quarter to $31.85 by the end of June. The new financial year appears to have triggered a small cohort of motivated sellers to dispose some of their ACCU inventory. On 10 July the ACCU spot price dipped to $24.00 on the back of a 6 day sell-off before rebounding to $28.50 by the end of the following day (see Figure 1.2). Analysis of transactions during this period indicates the sell-off was largely contained to accounts of intermediaries.

By mid-August 2023, the reported ACCU spot price lifted to around $32. This price is double the average contract price plus a commercial premium.

Generic Australian carbon credit unit (ACCU) spot price

July 2022 to July 2023 Note: This figure is not interactive.

Description

This graph shows the volume weighted average of ACCU generic spot price. The generic spot price refers to the price of ACCU spot trades with an unspecified method.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

Data as at 3 August 2023.

Holdings for the cost containment measure increase

Since 12 January 2023, ACCUs delivered to the Commonwealth under carbon abatement contracts are held in the Commonwealth Emissions Reduction Fund Delivery (CERFD) account in the ANREU. These ACCUs will be made available to Safeguard Mechanism facilities that exceed their baseline through the cost containment measure. These Safeguard Mechanism facilities may apply to the CER to purchase the required number of ACCUs at a fixed price. In 2023-24, the price of these ACCUs is set at $75. Thereafter, the price will be indexed by the Consumer Price Index (CPI) plus an additional 2% per annum.

At the end of June 2023 there had been little change to the 0.4 million balance in the CERFD account since it was last reported in the Q1 2023 QCMR. During July and August 2023, this more than doubled, with 0.6 million ACCUs delivered in the CERFD account. This raised the total holdings to 1 million by 22 August 2023. The ACCU method types in the CERFD account are a mix of vegetation (from 6 different methods), waste and energy efficiency.

Many reasons may motivate participants to deliver on their contracts rather than use the pilot exit arrangements. During this period, most of the deliveries were from higher priced fixed delivery contracts. As we previously explained in the Q1 2023 QCMR, this behaviour reflects commercial considerations at current ACCU spot prices. In the absence of substantive Safeguard Mechanism buying, current ACCU prices could continue to incentivise deliveries against Commonwealth fixed-delivery contracts.

Fixed delivery Commonwealth contracts provide an effective floor price for ACCUs

The average fixed delivery contract price was $16.32 and $15.53 from the 10th (March 2020) and 11th (September 2020) Emissions Reduction Fund auctions, respectively. These are the weighted average prices for each Australian carbon credit unit contracted. Some contracts would be for a higher price, and some lower. The average price across all auctions is about $12.10.

Under the pilot fixed delivery exit arrangements (‘pilot exit arrangement’), contract holders may choose to exit contract milestone deliveries, within specified exit windows, by making an exit payment instead of delivering ACCUs for the contracted price. The exit payment is calculated by multiplying the contract price by the quantity of outstanding ACCUs for the milestone. The process is undertaken in line with existing clauses in carbon abatement contracts (including clause 9.3). The Government is currently consulting on whether the pilot structured exit arrangements for fixed delivery contracts should be made permanent.

For the pilot exit arrangement to make commercial sense, contract holders need to be able to obtain an acceptable commercial premium above double the contract price on the secondary market. This provides an effective floor price for the secondary market as, if prices are below this level, it would make commercial sense for contract deliveries to be made to the Commonwealth.

The generic spot price for ACCUs is currently around $32 which offers only a modest premium for exits from early auction contract deliveries.

There are still about 80 million ACCUs due to be delivered against fixed delivery contracts by the end of 2029. Contract deliveries now increase the available volume in the CERFD account for potential future use in the CCM.

While the major source of demand will likely come from Safeguard Mechanism entities looking to secure ACCUs against their future liability, market intelligence suggests that many Safeguard Mechanism entities are yet to fully develop their compliance strategies. Some are considering opportunities for emissions reduction at source and may be waiting to see if they can secure financial support through the Powering the Regions Fund (PRF).

The Safeguard Transformation Stream Round 1 grant opportunity through the PRF fund opened in August 2023. The first grants are scheduled to be awarded in early 2024. Further batched assessments are also planned for 2024. Grants of $500,000 to $50,000,000 are available on a competitive basis. This is for trade-exposed Safeguard Mechanism facilities that are not new or expanded coal or gas production facilities to make investments that reduce scope 1 emissions. This process may give a clearer indication of the scale and timing of projects to reduce emissions at source and produce Safeguard Mechanism credit units (SMCs). As reported in the Q1 2023 QCMR, projects that deliver material emissions reductions will typically be large multi-year projects that will take time to design, contract, finance, build and commission. SMC availability will be influenced by production variables that are currently under consideration.

The Government is currently consulting on whether the pilot structured exit arrangements for fixed delivery contracts should be made permanent. We will continue to report on market dynamics and ACCUs delivered to the CERFD account to help inform how the market views availability.

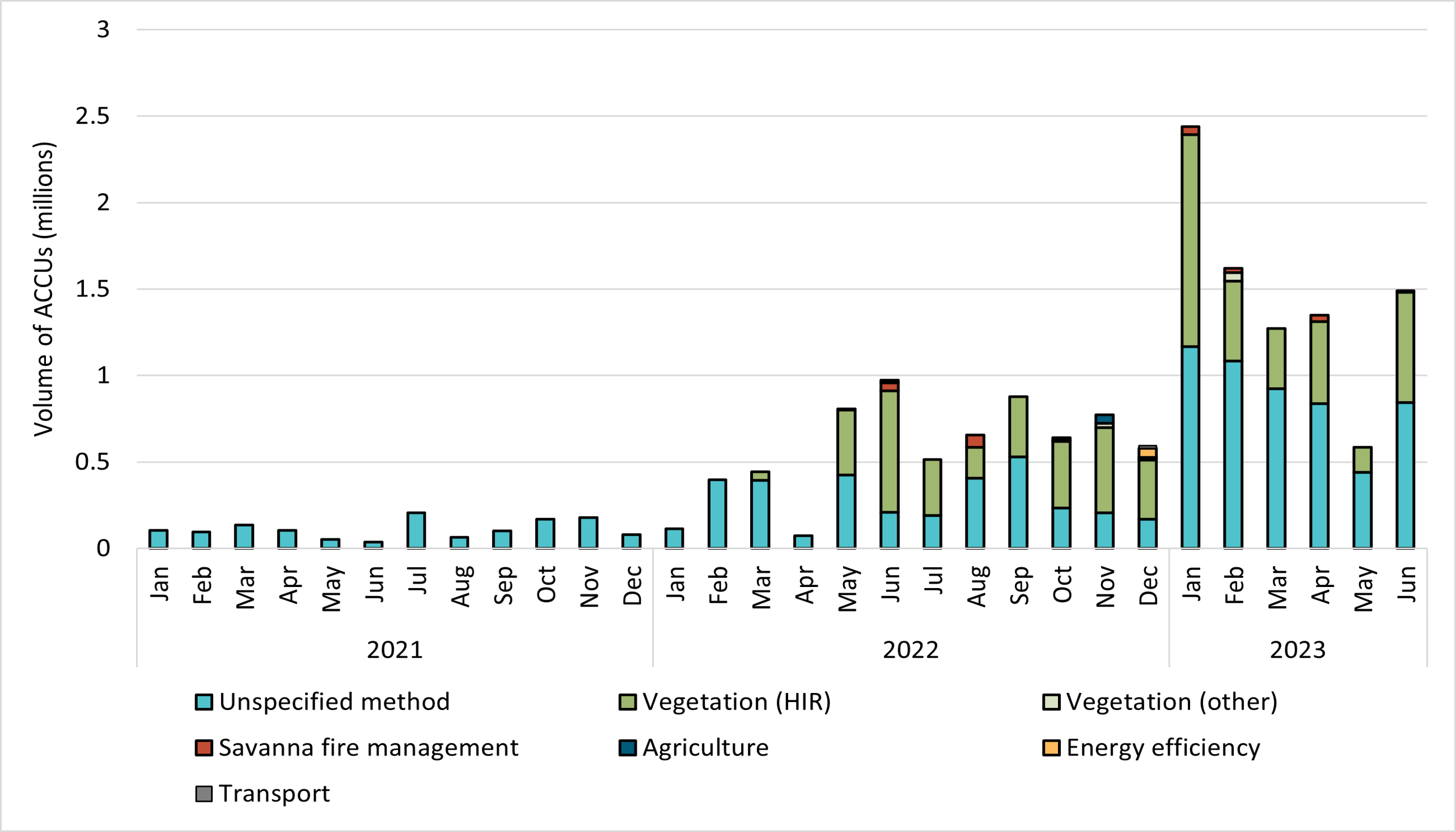

ACCU issuance delayed although claim volumes are strong

The volume of ACCUs issued in H1 2023 was lower because of the pause in crediting while the arrangements to implement Recommendation 8 of the ACCU review were put in place (Figure 1.3). Despite this, we still expect to issue about 18 million ACCUs in 2023.

Description

This graph shows Australian carbon credit units (ACCUs) issued by method type over time. ACCU issuance follows a seasonal pattern for certain method types including Industrial Fugitive methods and Savanna Fire Management as seen in the graph.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

In response to Recommendation 8 of the ACCU Review, projects registered under the human induced regeneration (HIR) method have been subject to additional assurance measures. This is to ensure that project proponents have evidence of the mechanisms contributing to the suppression of forest during the baseline period, and the implementation of project activities in response to these suppressors. This additional important step was applied to HIR projects on receipt of the next crediting applications. This temporarily delayed ACCU issuance. As assessments are completed, the issuance of ACCUs from HIR projects will resume.

The June quarter also saw the first ACCUs issued to 2021 soil carbon projects. A total of 151,000 ACCUs were issued to two projects covering approximately 5,500 hectares in Queensland.

Tax changes to support primary producers

In June 2023, the Treasury Laws Amendment (2023 Measures No.3) Bill 2023 was passed. This means primary producers that generate income from selling ACCUs can now treat it as primary production income. As a result, those earnings may be eligible for concessional tax treatment under the Farm Management Deposit Scheme or income tax averaging for such income.

The Farm Management Deposit Scheme allows primary producers to make deposits to reduce their taxable income in years of good cash flow, then draw down on that income by making withdrawals in years when needed. Similarly, tax averaging allows primary producers to even out their income tax liability from year to year. This reduces the effect of fluctuations in their taxable income on the marginal rates of tax that apply to them year to year. This new tax incentive may encourage primary producers to diversify their income by generating and selling ACCUs.

Supply/demand balance

Total ACCUs held in non-Commonwealth ANREU accounts increased by 3.8 million in Q2 2023 to 27.6 million. This is an increase of 16% compared to Q1 2023 (see Table 1.1).

While it is difficult to quantify the volume of ACCUs tied up in off-takes and direct bilateral trades, the supply of ACCUs in the next several years will be sufficient to meet expected Safeguard Mechanism compliance demand. This supply will likely tighten with each compounding year of baseline declines and as Safeguard Mechanism entities secure supply to meet future liability. The sooner Safeguard Mechanism entities look to secure longer-term ACCUs, the sooner the market will likely tighten.

| Balance carried forward from Q1 2023 | 23.8m |

|---|---|

| ACCU supply | +4.4m |

| Actual scheme contract deliveries | -0.2m |

| Safeguard Mechanism demand | -<0.1m |

| Non-Commonwealth demand | -0.3m |

| ACCU relinquishment | 0 |

| Net balance at the end of 2023 | 27.6m |

| Holdings balance available for cost containment measure | 0.4m |

Supplementary figures

Description

This graph shows Australian carbon credit unit (ACCU) cancellations by method type from 2019 to 2023. Vegetation and Savanna Fire Management ACCUs were the most common units cancelled over this period.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Transport and Energy Efficiency are excluded from the graph.

Description

This graph shows ACCU cancellations broken out by demand source.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Classification | Covered activities |

|---|---|

| Voluntary demand | Cancellations made against voluntary certification programs such as Climate Active, and any sort of organisational emissions or energy targets. |

| Local, state and territory government demand | Cancellations on behalf of local, state and territory governments, for example to offset emissions from state fleets or meet emissions reduction targets. |

| Compliance demand | Cancellations by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, to meet Environmental Protection Agency requirements. |

| Other demand | All activity not covered in the previous categories, primarily due to lack of information available. This grouping has declined substantially as part of these new classifications. |

This classification system is uniform across ACCU and LGC cancellations.

The QCMR includes an analysis of cancellations of ACCUs in the Australian National Register of Emissions Units (ANREU) for purposes other than deliveries to the ACCU Scheme or surrenders for Safeguard Mechanism obligations. These cancellations could be voluntary to show progress towards reducing net scope 1 emissions or to meet state/territory regulatory requirements.

Cancellations are experiencing an ongoing period of growth and evolution, including from sources outside of the previously used ‘voluntary demand’ description. To ensure this analysis remains impactful for participants and to better inform the market, the CER has redesigned this analysis as 'non-Commonwealth demand' and refined its approach to classifying cancellations to reflect the distinctions more accurately in the market.

Description

This graph shows the volume of ACCUs transacted on the secondary market.

This figure is interactive. Hover over/tap each bar to see the number of ACCUs. Hover over/click along the line to see the number of transactions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU market transactions refer to the transfer of ACCUs between accounts belonging to separate entities or corporate groups and does not include issuances, delivery to the Commonwealth for ACCU Scheme contracts, and surrenders or cancellations of ACCUs. Transactions involving the transfer of ACCUs between project proponents, between project proponents and project developers, and between accounts belonging to the same company and/or subsidiaries are excluded.

The CER publishes quarterly estimates of transfer activity in the Australian National Registry of Emissions Units (ANREU) associated with the secondary market to provide transparency on liquidity and activity to participants. This estimate is based on known connections between participants, may not be comprehensive and is subject to change.

Description

This graph shows new registered projects under the ACCU Scheme by method type for each quarter. So far in 2023 most projects have been registered under vegetation methods.

This figure is interactive. Hover over/tap each segment to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'Agriculture' method type has been segregated into 'Agriculture - soil carbon' and 'Agriculture - other' to highlight growth in the soil carbon sector.

'Agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Industrial Fugitives, Transport, Facilities and Carbon Capture method types are merged as 'Other' in the graph.

Reported Australian carbon credit unit (ACCU) spot trades by method type

January 2021 to June 2023 Note: This figure is not interactive.

Description

This graph shows reported ACCU spot trades by method type.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.