What’s on this page?

Highlights

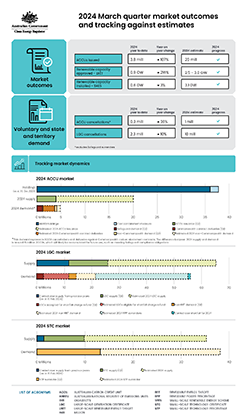

- The Australian carbon credit unit (ACCU) market has shifted, with demand for compliance purposes emerging as the primary demand source for ACCUs. In Q1 2024, 1 million of the 1.2 million ACCUs cancelled were for compliance purposes. This included 0.90 million for Safeguard compliance. Our revised analysis shows continued accumulation has resulted in half of ACCU holdings being in Safeguard or Safeguard related accounts. These ACCUs will likely be used by Safeguard entities to meet compliance obligations as Safeguard baselines decline. The 4th pilot exit window for fixed delivery contract milestones between 1 July 2023 and 31 December 2024 was announced on 26 April 2024. Under this exit window, contract holders must deliver at least 20% of each milestone (to be held in the cost containment measure) before being able to exit the rest of the delivery volume if they choose to.

- The ACCU spot price remained around $34 in Q1 2024. This is twice the contract price plus a commercial premium for most contracts. We expect around 2 to 4 million ACCUs to be delivered to the Commonwealth and 9 to 15 million ACCUs to exit via the 4th pilot exit window.

- A record Q1 supply of 13.8 million large-scale generation certificates (LGCs) were validated in Q1 2024. This was a strong start to the expected annual supply record of 52 to 54 million LGCs in 2024. There was also a Q1 record of 0.87 gigawatts (GW) of large-scale renewable power station capacity approved by the Clean Energy Regulator to generate LGCs. This new capacity may contribute up to 1.7 million LGCs each year at full generation.

- Increasing supply is aligning with increasing non-Renewable Energy Target (non-RET) demand. Market intelligence suggests many entities are securing future supply to meet voluntary 100% renewable energy by 2025 commitments. This is supported by 9.6 million (46%) of the 21.1 million LGC holdings being held for non-RET demand.

- In Q1 2024, 0.72 gigawatts (GW) of large-scale renewable power station capacity reached a final investment decision. This is a continuation of the higher levels of investment seen at the end of 2023.

- The 2024-25 Budget included a measure to fast track the initial phase of the Guarantee of Origin Scheme. This phase includes green hydrogen and bringing forward work on green metals, including iron, steel and aluminium. It also includes certification for renewable energy beyond 2030 through renewable energy Guarantee of Origin certificates.

- In Q1 2024, 0.64 GW of small-scale rooftop solar capacity was installed by Australian households and businesses. This is similar to the 0.66 GW installed in Q1 2023 and in line with an expected 3.1 GW for 2024. Around 23,800 air source heat pumps were also installed in the quarter.

- For the Q1 2024 compliance period, 100% surrender and compliance rates were achieved. The STC clearing house fell into a deficit of 2.2 million STCs immediately prior to the surrender deadline.

Click on the image below to download a full-sized version.

Data workbook

QCMR data workbook - March Quarter 2024 ( 2.61 MB xlsx )

The QCMR data workbook – March Quarter 2024 contains the data underlying the figures in the report as well as additional data.

Media release

Read the media release: Reformed Safeguard Mechanism drives ACCU demand.