Insights

- The 4th pilot exit window for fixed-delivery carbon abatement contracts was announced on 26 April 2024. This window covers contract deliveries scheduled over the 18-month period from 1 July 2023 to 31 December 2024. It includes a 20% delivery requirement for all milestones in this period before the residual contract amount can exit. We expect around 2 to 4 million ACCUs will be delivered under contract and added to the 1.9 million ACCUs in the cost containment measure at the end of Q1 2024.

- 15 million ACCUs are eligible to exit, once the 20% delivery requirement is met. We expect between 9 and 15 million may be made available to the market. This will depend on project status and the decision-making of project proponents.

- 15 million ACCUs are eligible to exit, once the 20% delivery requirement is met. We expect between 9 and 15 million may be made available to the market. This will depend on project status and the decision-making of project proponents.

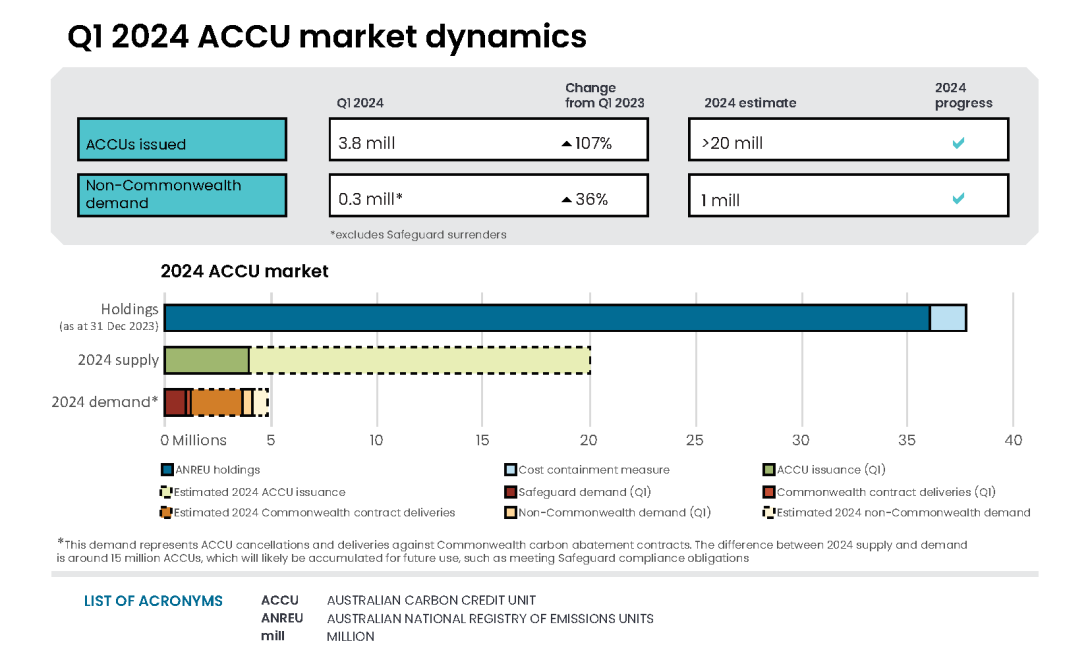

- In Q1 2024, ACCU holdings increased by 2.4 million. There were 3.8 million ACCUs issued and 1.4 million ACCUs cancelled/surrendered in Q1 2024. This included 0.90 million ACCU surrenders for 2022-23 Safeguard compliance. We expect at least 20 million ACCUs to be issued in 2024. Holdings in the Australian National Registry of Emissions Units (ANREU) are expected to progressively increase to over 50 million ACCUs by the end of 2024.

- We have revised our analysis of ACCU holdings to be more informative and provide greater transparency, especially around holdings of intermediaries and Safeguard entities. This analysis found at least half of ACCU holdings are likely for Safeguard purposes. It is challenging to be precise as entities can hold and cancel ACCUs on behalf of another entity.

- In Q1 2024, Safeguard (excluding Safeguard related) account holdings increased by 4.6 million and 5 additional accounts were opened. Some Safeguard entities are likely yet to secure supply.

- In Q1 2024, Safeguard (excluding Safeguard related) account holdings increased by 4.6 million and 5 additional accounts were opened. Some Safeguard entities are likely yet to secure supply.

- Despite the continued high levels of accumulation by Safeguard entities, the ACCU spot price remained around $34 in Q1 2024. This suggests there is sufficient liquidity around this price. As noted in previous QCMRs, over $30 represents a reasonable commercial premium for most contract holders to pay the contract milestone exit fee and sell ACCUs on the market. Differentiation in the ACCU market between different ACCU methods, and associated price premiums, appears to be maturing. Co-benefit quality is receiving increasing attention and attracting a premium price.

On this page

- Market dynamics

- Strong supply in Q1 supports an expected 2024 supply record

- New project registrations

- 4th pilot exit arrangement window announced with a 20% delivery requirement

- At least half of holdings are likely for Safeguard compliance

Market dynamics

Table 1: Australian carbon credit unit (ACCU) supply and demand summary for Q1 2024

| Balance carried forward from Q4 2023 | 36.2 m |

|---|---|

| ACCU supply | +3.8 m |

| ACCU Scheme contract deliveries | -0.20 m |

| Non-Commonwealth cancellations | -0.29 m |

| Safeguard surrenders | -0.90 m |

| Net balance at the end of Q1 2024 | 38.6 m |

| Cost containment measure balance | 1.9 m |

Voluntary demand represented 0.20 million of the total 1.2 million ACCUs cancelled/surrendered in Q1 2024. Compliance demand from the Safeguard Mechanism and state and territory requirements represented the remaining 1 million cancelled/surrendered ACCUs. Safeguard is emerging as the dominant source for ACCU demand. As Safeguard baselines decline, entities are likely to need more ACCUs to meet their compliance obligations. This is especially so for entities in harder to abate industries.

Description

This figure shows ACCU cancellations by demand source over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU cancellations exclude deliveries against Commonwealth carbon abatement contract milestones. The classifications used in the figure are uniform across ACCU and large-scale generation certificate (LGC) cancellations. Noting, Safeguard demand is included for ACCUs only.

Covered activities for each classification

Voluntary demand

Cancellations made against voluntary certification programs such as Climate Active, and any sort of organisational emissions or energy targets.

Local, state and territory government demand

Cancellations on behalf of local, state and territory governments, for example to offset emissions from state fleets or meet emissions reduction targets.

Compliance demand

Cancellations by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, to meet Environmental Protection Authority requirements.

Safeguard demand

ACCUs surrendered to meet Safeguard Mechanism compliance.

Other demand

All activity not covered in the previous categories, primarily due to a lack of available information.

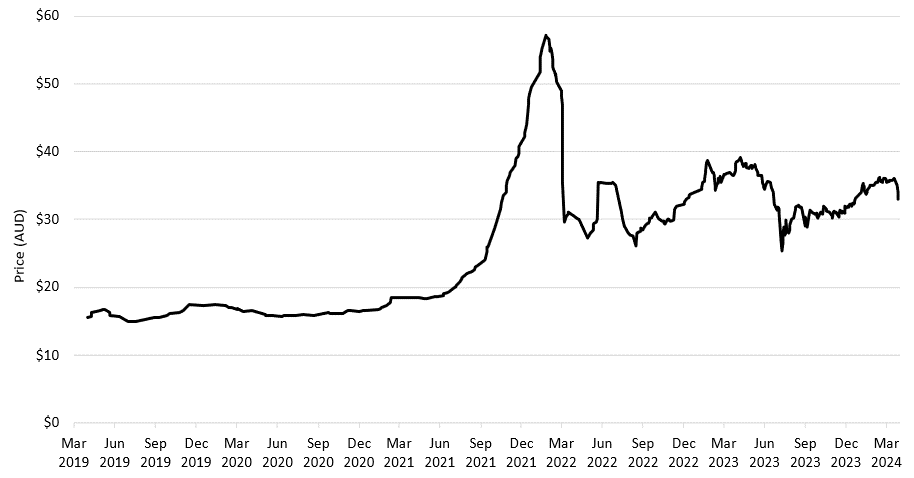

In Q1 2024, the generic ACCU spot price opened at $33.75. Prices remained stable over January, increasing in February to around $36 ahead of the Safeguard surrender deadline and peaking on 18 March at $36.30. Prices then fell closing Q1 2024 at $33.75.

Generic Australian carbon credit unit (ACCU) reported spot price

March 2019 to March 2024 Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU spot price over time. The generic spot price refers to the price of spot trades for ACCUs with an unspecified method.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

Data as at 1 April 2024.

The premium for HIR ACCUs narrowed over Q1 2024. It started 2024 at $2.90 and ended Q1 2024 at $1.05. For several days in March 2024, generic ACCUs and HIR ACCUs were reported as trading at the same price. Differentiation in the ACCU market between different ACCU methods, and associated price premiums, appears to be maturing. Co-benefit quality is receiving increasing attention. Increased buying to meet compliance requirements may indicate a change in the willingness to pay high premiums for ACCUs without clear and defined co-benefits. The stratification of ACCU pricing by method is a watch point for 2024.

While there appears to be adequate supply, the ACCU market remains active. This is demonstrated by the ACCU price remaining stable. Market intelligence also shows a high volume of ACCUs are being traded both on the spot and derivative markets. It is likely many entities are securing supply to meet their future needs. This includes compliance and voluntary emission reduction claims. We expect this to continue, especially with the declining baselines commencing under the reformed Safeguard Mechanism and other initiatives and climate actions, such as legislated emission reduction targets.

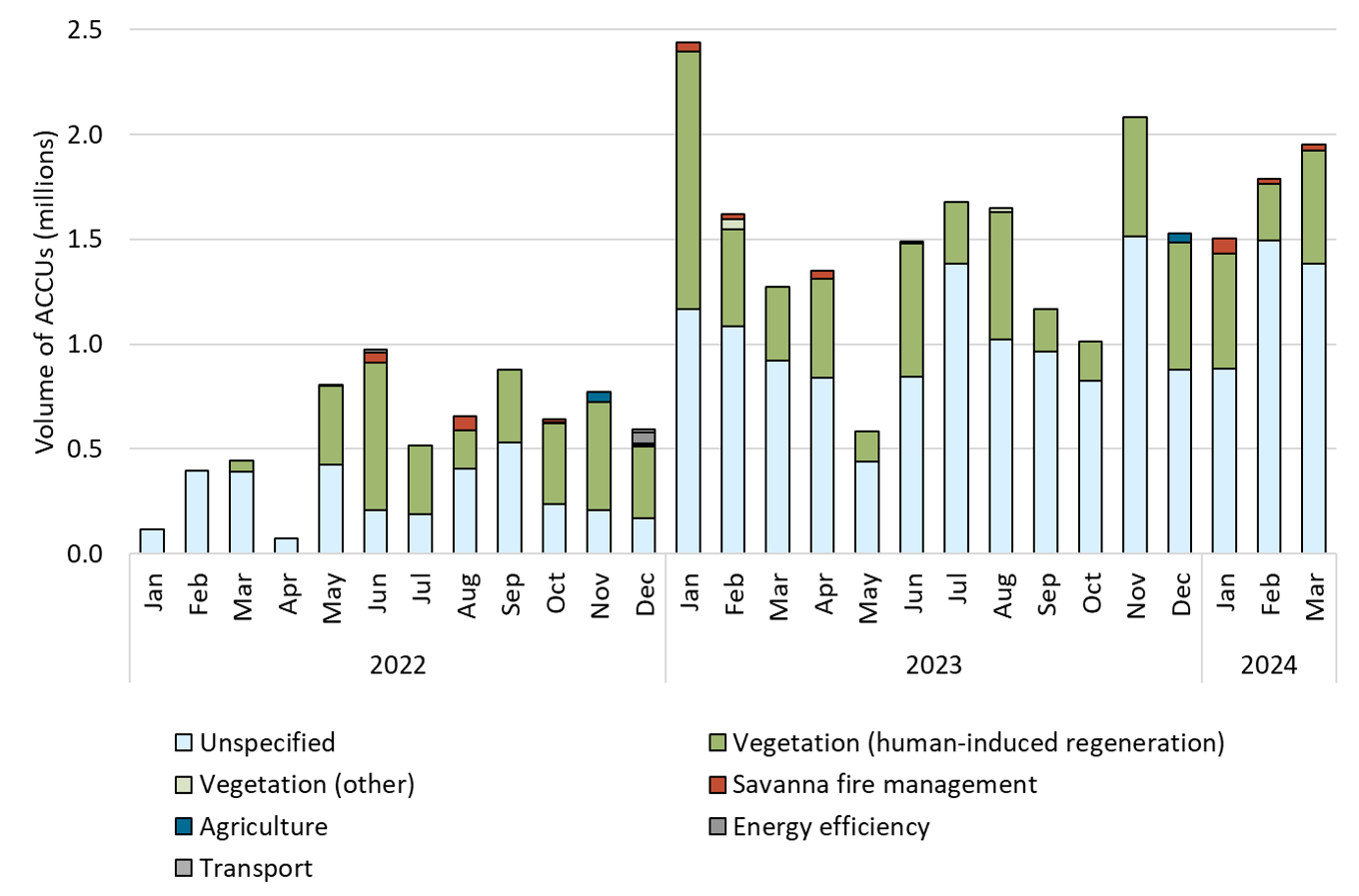

Strong supply in Q1 supports an expected 2024 supply record

In Q1 2024, 3.8 million ACCUs were issued. This indicates a strong start to an anticipated record of at least 20 million ACCUs to be issued in 2024.

Description

This figure shows ACCUs issued by method type over time. ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive methods and savanna fire management.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

A high volume of projects are expected to claim ACCUs for the first time in 2024. In Q1 2024, 6 projects claiming for the first time were issued 0.54 million ACCUs. This is 43% of the 1.3 million ACCUs issued to projects claiming for the first time over the whole of 2023. At the end of Q1 2024, crediting applications totalling 0.58 million ACCUs were under assessment for 29 projects claiming for the first time.

At the end of Q1 2024, crediting applications totalling 4.3 million ACCUs were under assessment. As mentioned in the Q4 2023 QCMR, the report by Associate Professor (Honorary) Cris Brack found HIR projects are demonstrating regeneration and project proponents are implementing the project activities.

There are 1,823 ACCU projects with the potential to supply ACCUs in the future. On average, projects start generating ACCUs 2 to 3 years after they are registered. As nearly half of these projects have been registered since 1 January 2022, we expect new supply of ACCUs to remain strong in coming years. More information on projects that have yet to claim ACCUs is available in the project register.

Description

This figure shows the volume of ACCUs issued to and the number of projects claiming for the first time each year. For 2024, ACCU issuance and the number of projects are as at 31 March. The figure also includes estimated issuance for Q2-Q4 2024.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Hover over/tap along the line to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

New project registrations

In Q1 2024, 93 ACCU projects were registered, including:

- 39 soil carbon projects

- 22 environmental planting projects.

- This method will expire on 30 September 2024. The Department of Climate Change, Environment, Energy and Water (DCCEEW) is prioritising remaking the Reforestation by Environmental or Mallee Planting (EP) method. In May 2024, DCCEEW delivered an exposure draft to the Emissions Reduction Assurance Committee (ERAC). Public consultation will occur in mid-2024.

- 12 native forest from managed regrowth projects, the highest recorded in a quarter.

- This record is likely due to the method expiring on 31 March 2024. A peak in project registrations typically occurs in the quarter a method expires.

- 11 plantation forestry projects

- 9 projects from other methods

In Q1 2024, 6 projects were revoked and the crediting period for 3 projects ended.

Description

This figure shows registered projects under the Australian Carbon Credit Unit (ACCU) Scheme by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture- other' to highlight growth in the soil carbon sector. The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

To the end of Q1 2024, 2,141 ACCU projects have been registered under the ACCU Scheme. Of which:

- 609 projects have claimed ACCUs

- 288 projects have been revoked

- 30 projects have completed their crediting periods

- 854 projects are conditionally registered – these projects are ineligible to be issued ACCUs until all regulatory approvals and eligible interest holder agreements are supplied to the Clean Energy Regulator

- 360 projects are yet to claim ACCUs.

4th pilot exit arrangement window announced with a 20% delivery requirement

In Q1 2024, Commonwealth carbon abatement contract deliveries remained low at 0.20 million ACCUs as contract holders awaited an announcement on future pilot exit windows. The average contract price of these deliveries was $14.43, higher than the average for all fixed delivery contracts at $12.60. This meant, for these ACCUs, the potential commercial gain from participating in a future exit window was lower than delivering.

On 26 April 2024, the 4th pilot exit arrangement window was announced, covering scheduled deliveries from 1 July 2023 to 31 December 2024. This window also introduced the requirement for at least 20% of the fixed delivery contracted ACCUs to be delivered to the Commonwealth before the remaining can exit.

Consistent with previous pilot exit windows it is likely a high volume of eligible ACCUs will exit. The ACCU price has remained stable at over $30, which is twice the average contract price plus a commercial premium for most contracts. Market intelligence also suggests many fixed delivery contract holders can quickly secure a buyer for their ACCUs.

We expect around 2 to 4 million ACCUs to be delivered and 9 to 15 million ACCUs to exit. This will depend on the project status and the decision-making of project proponents.

At least half of holdings are likely for Safeguard compliance

At the end of Q1 2024, there were 38.6 million ACCU holdings in the ANREU. This is an increase of 2.4 million ACCUs over the quarter.

We have further augmented the analysis of ACCU holdings compared to previous QCMRs. This shows half (51%) of holdings are held in Safeguard or Safeguard related accounts. The volume held by Safeguard entities is likely higher as other accounts, such as intermediaries and project proponents, could hold ACCUs on their behalf.

In Q1 2024, the number of Safeguard (excluding Safeguard related) accounts holding ACCUs increased by 11 to 54 in total. ACCUs held in these 54 accounts reached 12 million ACCUs, an increase of 4.6 million over the quarter. Of the 11 additional accounts, 5 accounts were opened in Q1 2024 and the rest were reclassified based on the account’s behaviour leading into the Safeguard surrender period.

The 54 Safeguard accounts cover 107 (49%) of the total 219 Safeguard facilities.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts by market participation category over time.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Accounts with nil volume at the end of the quarter are excluded. Totals may not sum due to rounding. Refer to the March Quarter QCMR workbook for the number of accounts in each category.

Category definitions

Project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Business

Account holders do not have a direct link to ACCU Scheme projects.

Account holders include participants that are accumulating for voluntary purposes.

Government

Account holders are government entities that are accumulating for voluntary or compliance purposes.

Intermediary

An account holder’s primary operation is to facilitate trading of ACCUs between the supply and demand sides of the market. This also includes accounts that have accumulated ACCUs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Safeguard

Account holders are Safeguard entities that control a single account, or in cases where Safeguard entities control multiple accounts, only those that have surrendered ACCUs for Safeguard compliance purposes or that have specified a facility are included. Some Safeguard accounts also engage in trading activity, which may result in holding fluctuations within this category.

Safeguard related

Account holders are companies, such as subsidiaries, that are related to registered Safeguard entities. These accounts do not specify a facility or have not surrendered ACCUs for Safeguard compliance purposes. These ACCU holdings may be used for future Safeguard compliance purposes.

Cost containment measure

ACCUs that have been delivered under Commonwealth carbon abatement contracts after 12 January 2023. These ACCUs will be available to eligible Safeguard entities under the cost containment mechanism.

Revised category method

To categorise each account, we consider:

- The behaviour of the account, such as trading and cancellations to meet Safeguard obligations

- The name of the account

If account behaviour changes we will reclassify and update values in future QCMRs.

Notes on the revised categories:

- The project proponent category remains. Some accounts linked to local, state and territory governments were reclassified into the new ‘Government’ category.

- The business and government enterprise category was split into 2 categories, 'Business’ and ‘Government’. Business represents non-Safeguard holdings.

- The intermediary category remains. Some accounts were reclassified into the new ‘Safeguard related’ category. The Safeguard related category includes accounts that are owned by related companies, such as subsidiaries, to the legally registered Safeguard entity. These accounts do not specify a facility or have not surrendered ACCUs for Safeguard compliance purposes. These ACCU holdings may be used for future Safeguard compliance purposes.

- The Safeguard category remains unchanged.

Supplementary figures

Description

This figure shows ACCU cancellations by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

These ACCU cancellations in the Australian National Registry of Emissions Units (ANREU) are for purposes other than deliveries against Commonwealth carbon abatement contract milestones or surrenders for Safeguard Mechanism compliance obligations. These ACCU cancellations could be voluntary to show progress towards reducing net scope 1 emissions or to meet state or territory regulatory requirements.

Reported Australian carbon credit unit (ACCU) spot trades by method type

January 2022 to March 2024 Note: This figure is not interactive.

Description

This figure shows the reported volume of ACCUs traded in the spot market by method type over time.

Small print

Spot trade data is compiled from trades reported by CORE markets and Jarden, and may not be comprehensive.