Key messages

- Demand for ACCUs is expected to rise materially as facilities covered by the Safeguard Mechanism (Crediting) Amendment Act 2023 prepare to meet their future obligations.

- Safeguard entities must reduce emissions by over 200 million tonnes to 2030.

- The trading volume in Q1 2023 reached a new record with 13 million ACCUs transacted in the secondary market. The average transaction parcel size was up 61% compared to Q1 2022.

- The spot generic ACCU price remained relatively flat at about $38 and has softened post Q1 2023.

- Auction 15 contracted 7.9 million tonnes of carbon abatement for optional delivery at an average price of $17.12.

Safeguard Mechanism reforms and the implications for the ACCU market

On 11 April 2023 the Safeguard Mechanism (Crediting) Amendment Act 2023 (the Act) became law. The Act requires Australia’s largest emitting facilities to significantly reduce emissions by an estimated total of over 200 million tonnes of carbon dioxide equivalents (CO2-e) by 2030. The amended Safeguard Rules, released on 5 May 2023, set out an overall scheme-wide decline rate of 4.9% per year to 2029-30. That means the abatement task gets bigger each year.

This baseline decline rate applies to all Safeguard facilities from 1 July 2023, including existing and new facilities, unless a differential trade exposed baseline adjusted (TEBA) facility rate has been approved.

The Safeguard reforms effectively provide a cap on emissions by setting a cumulative emissions budget of 1,233 million tonnes of CO2-e for the period 2020-21 to 2030-31. Covered facilities can meet their obligations by reducing onsite emissions, cancelling Safeguard Mechanism Credits (tradeable units known as SMCs generally created when a facilities' emissions are below its baseline) or by cancelling ACCUs. Flexibility provisions also apply. Find out more about the Safeguard Mechanism at the Department of Climate Change, Energy, the Environment and Water's website.

The reforms send a strong market signal to reduce emissions at their source where technology is available. Facilities that do so will avoid the cost of purchasing ACCUs or SMCs to reduce their net emissions each year. Facilities that succeed in lowering their emissions intensity below their baseline will generate SMCs, with the exception of landfills and facilities accessing borrowing arrangements or deemed surrender provisions. Actions to reduce emissions at source will reduce demand for ACCUs by Safeguard facilities.

However, projects that deliver material emissions reductions will typically be large multi-year projects in order to design, contract, finance, build and commission. In an efficient market, the lowest cost projects per tonne of abatement will likely get to a final investment decision (FID) first. Some companies may decide to move earlier to reduce emissions at source. In order to place themselves in a competitive position in a market where supply chains and customers are increasingly demanding carbon emissions reductions.

The expected cumulative emissions reduction for Safeguard entities is over 200 million tonnes to 2030. We expect substantial aggregate ACCU supply to 2030, including from new projects, which will need to be complemented by material emissions at source over the period to 2030.

There is no legal limit on the number of ACCUs each Safeguard facility can cancel, however, total ACCUs available to be purchased in the period to 2030 will be finite, so there is an aggregated economic limit. Our analysis indicates sufficient ACCU supply available in the market in the short term. This will likely tighten with each compounding year of baseline declines and as Safeguard entities secure supply to meet future liability.

As noted in the Q4 2022 Quarterly Carbon Market Report (QCMR) we are expecting incremental increase in new ACCU supply in the near term. It is difficult to predict ACCU supply out to 2030 with a range of factors at play including some methods sunsetting, crediting periods ceasing for some projects and uncertainty on what new methods may be made and when. At the end of Q1 2023, there were about 24 million ACCUs in the Australian National Registry of Emissions Units (ANREU). We are expecting to issue just over 18 million ACCUs in 2023.

While the first acquittal end-date under the Safeguard reforms of 1 April 2025 may currently seem a way off, it will be important that those subject to the Safeguard consider investing in on-site emissions reductions, new ACCU projects and/or securing future ACCU supply to keep under declining baselines.

The pace, scale and timing of onsite emissions reductions at Safeguard facilities is difficult to predict. The price of ACCUs and SMCs will be instrumental in driving action. Availability of technology, commercial viability, access to capital, resourcing and supply chain constraints and opportunity to fuel switch to renewables will also impact the scale and timing of emissions reduction at source – and influence future demand for ACCUs.

For transparency, where a Safeguard facility surrenders ACCUs equal to more than 30% of its baseline, it will be required to make a statement to the Clean Energy Regulator (CER) setting out why onsite abatement has not been undertaken. These statements, excluding commercially sensitive information, will be made public on our website.

In addition to ACCU demand from Safeguard Mechanism reforms we are still seeing rising demand for ACCUs from businesses wanting to voluntarily reduce their net emissions, albeit from a low base (see Figure 1.5). Key drivers of this trend are increased interest in low emissions products and services from investors, customers and supply chains as well as the government’s proposed introduction of mandatory climate-related financial disclosure for large Australian companies.

Initial market spot ACCU price response

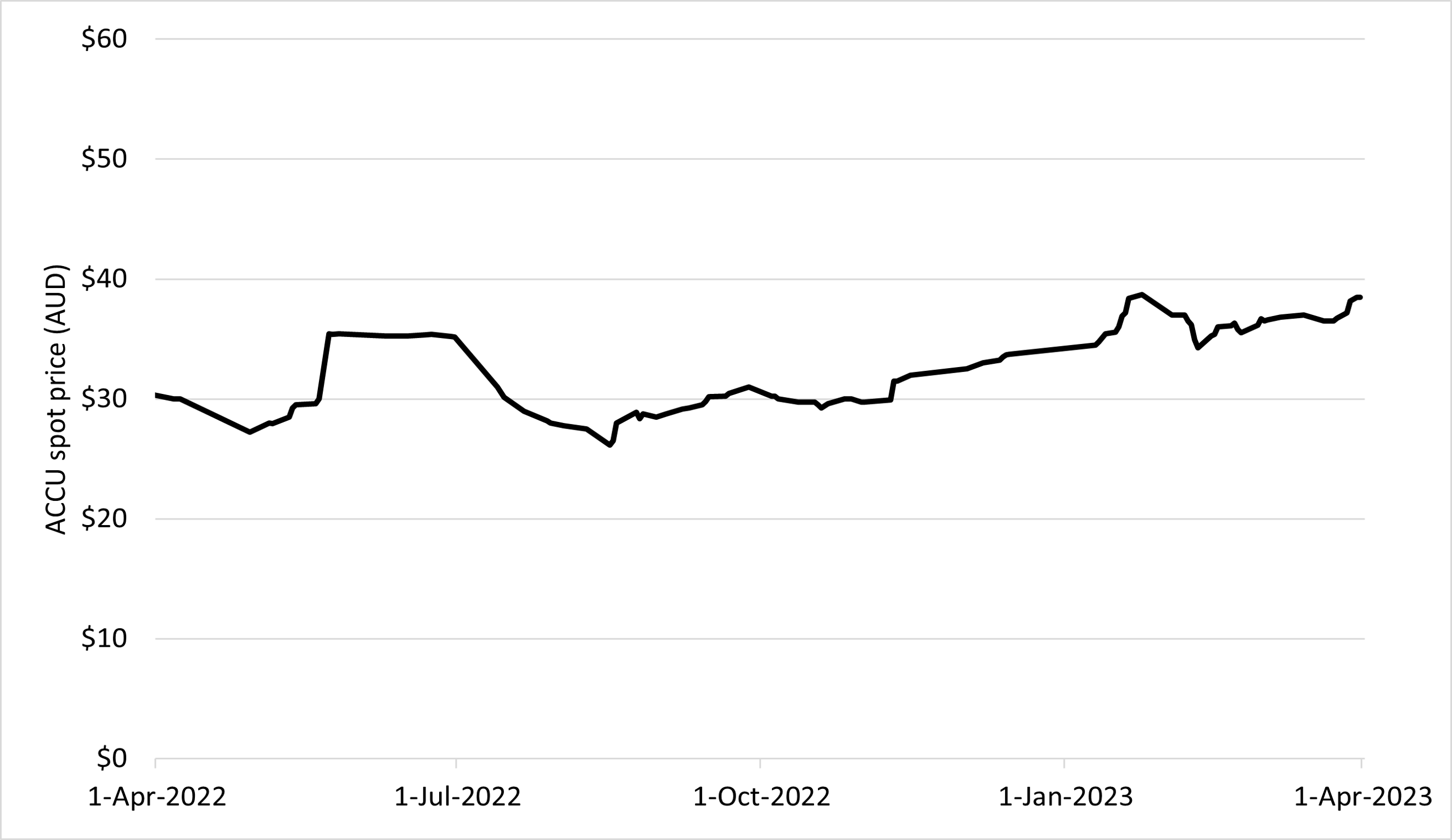

The market may have already priced in some of the expected impact of the Safeguard reforms during record trading of 5.3 million ACCUs during Q1 2023 in reported spot market sales. In the two weeks following passage of the Safeguard Mechanism (Crediting) Amendment Bill 2023, the generic ACCU spot price declined by $0.60 to $37.90 with 480,000 units traded.

As reported in the December Quarter 2022 QCMR the generic ACCU spot price initially increased 12% to $38.50 following the release of the Independent Review of ACCUs and Safeguard Mechanism position paper on 9 and 10 January 2023. Subsequently, the generic ACCU spot price declined to $34.25 as the market awaited the outcomes of the Safeguard reforms. The generic ACCU spot price then increased following the passing of the Safeguard Mechanism (Crediting) Amendment Bill 2023 reaching $38.50 at the end of Q1 2023 (see Figure 1.1). The price then hovered around $38 – a similar price point to where it was in mid-January before softening slightly in May.

In Q1 2023 we also saw a spot price convergence between generic ACCUs and those from human induced regeneration (HIR) projects. HIR ACCUs had been attracting a $1 to $2 premium. This could be due to the market now seeing Safeguard reforms as the dominant source of demand where price is the most important factor. However, it is possible that specific HIR projects with strong evidence of environmental co-benefits may still attract a premium. Market preferences will become more evident as the number of ACCUs cancelled by Safeguard facilities and the method that they were created under, is published each year.

Market intelligence and spot ACCU trade volumes suggest there is currently sufficient available ACCU supply in the market at around $37 to meet short term demand. However, that may change as more Safeguard entities seek to secure the future supply they need.

Generic Australian Carbon Credit Unit (ACCU) spot price

April 2022 to March 2023 Note: This figure is not interactive.

Description

This graph shows the volume weighted average of ACCU generic spot price, where the generic spot price refers to the price of ACCU spot trades with an unspecified method.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

If the market anticipates likely scarcity of ACCUs in the lead up to 2030, the upward trend in Figure 1.1 may continue. Noting a cost containment measure has been introduced as part of the Safeguard reforms, which is discussed below.

The Minister for Climate Change and Energy amended the Safeguard Rules on 3 May 2023, which provide important details to assist Safeguard entities and market participants to form a view on future ACCU supply and demand dynamics.

Potential future market direction

While some Safeguard entities moved in advance of the legislative changes to secure a supply of ACCUs, we understand others may not have yet done so. A summary of ACCU holdings categorised by market participation type is shown in Figure 1.2. Actual holdings of entities and individuals are not public information under current laws.

Although there is currently ACCU inventory of about 24 million in ANREU, this is not all available to the open market. Some Safeguard entities and others hold units as a hedge for future Safeguard liability and voluntary net emissions reduction ambition. Other ACCU holdings may already be committed under forward contracts. Any future increases in ACCU prices may unlock some of this supply and encourage additional investment in new ACCU projects and emissions reductions at source at Safeguard facilities.

When we look at the actual holdings in each of the 3 categories in Figure 1.2, we see there has been a very large increase in holdings by Safeguard entities and intermediaries and a corresponding decrease in holdings by project proponents and reduced deliveries against Commonwealth contracts. These changes appear to be clearly driven by the Safeguard reforms.

Description

This graph shows ACCU holdings in ANREU accounts by three different holder categories.

Small print

| Category | Project proponent | Business and Government enterprise | Intermediary |

|---|---|---|---|

| Definition | An account holder is connected to one or multiple ERF projects. | Account holders that do not have a direct link to ERF projects.^ These include safeguard entities, voluntary participants and local government entities that are accumulating for voluntary or compliance purposes. | Account holder's primary operation is to facilitate trading of units between the supply and demand sides of the market. This also includes accounts who have accumulated ACCUs through the secondary market without known scheme obligations, offset use, or carbon trading/offset services. |

| Balance at end of quarter (millions of ACCUs) | 9.00 | 8.30 | 6.50 |

| Number of accounts* | 206 | 86 | 29 |

*Does not include accounts with nil volume at the end of the quarter.

^The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Predicting future market direction is always challenging. We have provided the following 3 elements to help the market better understand potential ACCU supply and demand dynamics, noting the impact will vary among market participants and Safeguard entities.

ACCU supply availability from the cost containment measure and interaction with the Commonwealth pilot contract milestone exit arrangements

The aggregate ACCU supply available to the market will be the same regardless of whether ACCUs are delivered against Commonwealth contracts or made available to private buyers via the pilot contract milestone exit arrangement.

The cost containment measure will make Australian Government-held ACCUs, delivered under carbon abatement contracts from 12 January 2023, available to Safeguard entities under specific circumstances (see more information in point 2).

The Q1 2022 QCMR highlighted that the pilot milestone exit arrangements for fixed delivery contracts are an administratively simpler equivalent of the Buyers Market Damages (BMD) provisions of Commonwealth contracts. Under a fixed delivery contract, the maximum damages for failure to deliver against a milestone is paying the contract price to the Commonwealth and forgoing revenue at that contract price for the milestone. Participants may choose to not make a contract delivery to the Commonwealth if a seller can get a premium that more than covers double the Commonwealth contract price plus the higher transaction costs. These units will be available to the secondary market including for Safeguard facilities to purchase, and at a price that is currently much lower than the cost containment price.

The Australian Government has agreed to open a third pilot window for the fixed delivery exit arrangement. Exit applications can now be made for ACCU milestone deliveries scheduled from 1 January 2023 to 30 June 2023. While there is a range of contract prices, the average fixed delivery contract price during the second pilot window was $11.70. With a current ACCU spot price of about $37, there could be an incentive to use the exit arrangements (or take BMD) and sell to others.

Between 12 January and 15 May 2023, 430,000 ACCUs were delivered against Commonwealth contracts into a designated Commonwealth account for the cost containment measure. It is not possible to predict how many ACCUs will be delivered against Commonwealth contracts going forward but we will continue to report on volumes delivered.

At current spot ACCU prices we expect Safeguard entities are more likely to accumulate ACCUs from secondary market purchases, or longer-term offtake agreements, than rely on the cost containment measure.

The $75 cost containment measure is only for Safeguard compliance

The cost containment measure is intended to prevent excessive prices and to provide some certainty to facilities on the maximum compliance costs they may face under the Safeguard reforms. This measure will only be available for Safeguard facilities and only where they have exceeded their baseline.

The ACCUs available for use in this measure will be sourced from ACCUs delivered to the Commonwealth from 12 January 2023 onwards under carbon abatement contracts. So, total supply will be limited and the volume available will be determined by commercial decisions on delivery against Commonwealth contracts. Entities acquiring ACCUs under the cost containment mechanism will pay $75 per ACCU in 2023-24 increasing with the Consumer Price Index plus 2 per cent each year from 2024-25.

Future supply of ACCUs from HIR projects

The Independent Review of Australian Carbon Credit Units (the ACCU review) found that the HIR method is sound and is underpinned by a robust regulatory framework. We are implementing recommendation 8 for the HIR method. Recommendation 8 requires evidence of a causal relationship between suppression mechanisms in the baseline period and the HIR activities undertaken to remove the suppressors so that the land can regenerate to forest. We have developed guidance for HIR projects that outlines the implementation of recommendation 8.

The CER is expanding its Section 215 (s215) audit program to cover 5-yearly regeneration gateway checks for HIR projects. Section 215 audits are initiated and paid for by the CER. The purpose of regeneration gateway checks is for project proponents to confirm that carbon estimation areas still have forest potential and are regenerating. For further information on regeneration gateway checks please refer to the guidelines on stratification evidence and records for HIRs. The regeneration gateway audits will be undertaken by a registered greenhouse and energy auditor. When appointing an auditor, the CER must be satisfied that the auditor has, or the auditor will, select an audit team member with skills and experience in relation to ecological assessment.2

Compared to the same period in recent years, implementing recommendation 8 has slowed the rate of ACCU issuance for a short period. However, the crediting rate is expected to accelerate over time.

Auction 15 results

The results of Auction 15, held on 29 and 30 March 2023, were similar to Auction 14. The volume contracted in this auction at 7.9 million tonnes of CO2-e was 4% higher than in Auction 14 and averaged a slightly lower price. New optional delivery contracts were awarded to 24 projects with a total value of $134.6 million and an average price of $17.12. The three method types contracted in this auction are landfill and waste, vegetation and energy efficiency.

Successful bids at Auction 15 included 3 projects under the Industrial and Commercial Emissions Reduction (ICER) method that are at Safeguard facilities. As a result of National Greenhouse and Energy Reporting (Safeguard Mechanism) Amendment (Reforms) Rules 2023 being implemented on 3 May 2023, these projects will not be able to deliver ACCUs and the affected contracts are being terminated.

The continued strong participation in auctions suggests that optional delivery contracts are still valued in commercial processes to initiate new projects.

ACCU trading activity

There was a large step up in trading activity in Q1 2023 with 13 million ACCUs transacted in the secondary market (see Figure 1.3). The average transaction parcel size also increased in Q1 2023, up 56% on Q1 2022 from 16,642 to 26,000 ACCUs per trade. Accumulation by intermediaries has contributed to the increase in transactions as companies build their books in preparation for increased demand from Safeguard entities, interest from other existing clients and trading opportunities.

Description

This graph shows the volume of ACCUs transacted on the secondary market.

Small print

Note: ACCU market transactions refer to the transfer of ACCUs between accounts belonging to separate entities or corporate groups and does not include issuances, delivery to the Commonwealth for ERF contracts, and surrenders or cancellations of ACCUs. Transactions involving the transfer of ACCUs between project proponents, between project proponents and project developers, and between accounts belonging to the same company and/or subsidiaries are excluded.

The CER publishes quarterly estimates of transfer activity in the Australian National Registry of Emissions Units (ANREU) associated with the secondary market to provide transparency on liquidity and activity to participants. This estimate is based on known connections between participants, and may not be comprehensive.

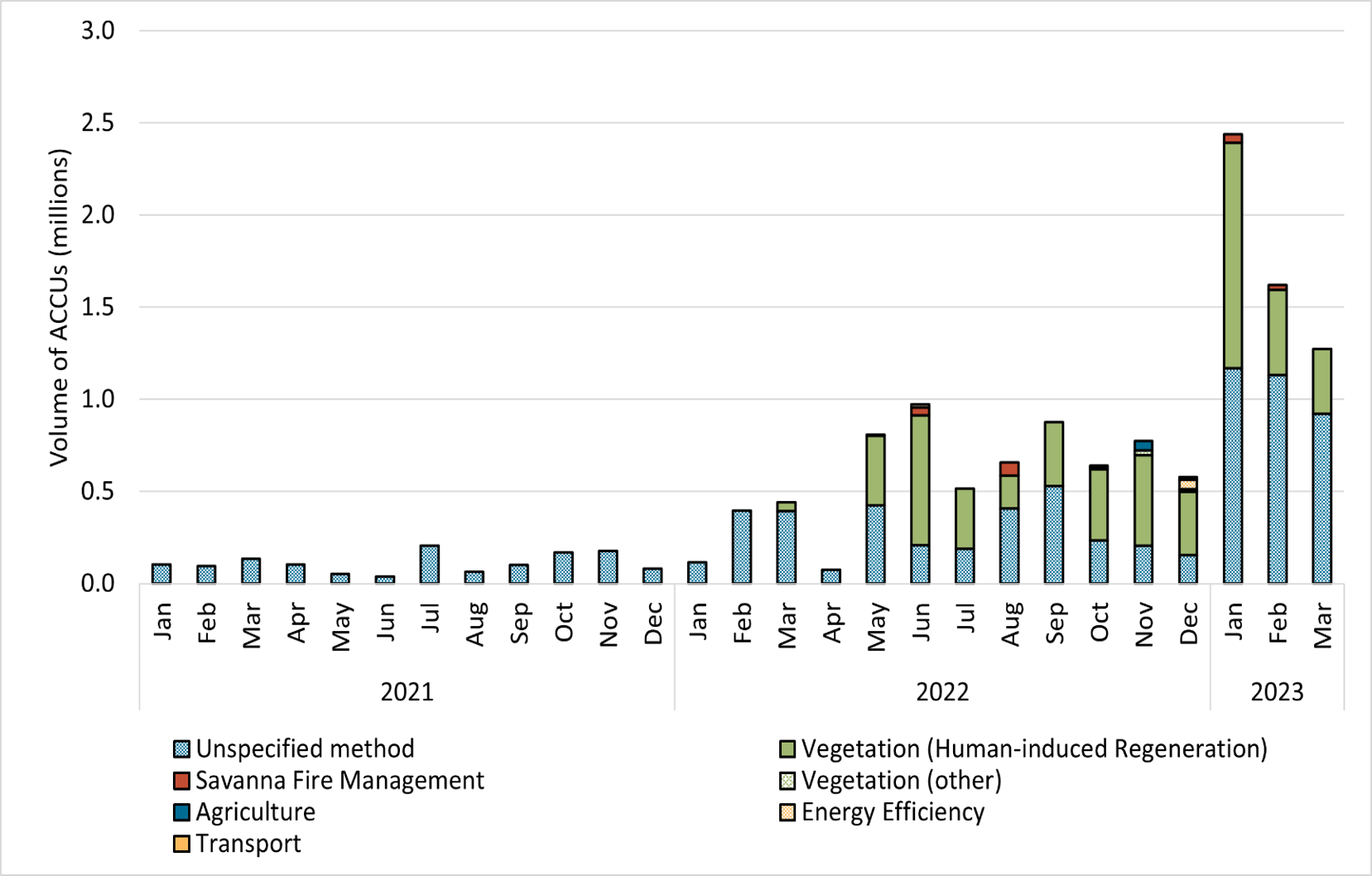

The increase in transaction numbers in Q1 2023 is reflected in record reported trading volumes by environmental brokers (see Figure 1.4), although trading activity continues to be sporadic at times. In Q1 2023 over 5.3 million ACCUs were reported in spot trades with most of the activity taking place in January. This is more than 2.5 times the volume reported in any previous quarter.

Reported Australian Carbon Credit Unit (ACCU) spot trades by method type

January 2021 to March 2023 Note: This figure is not interactive.

Description

This graph shows reported ACCU spot trades broken out by method type.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

In addition to the reported spot trades, environmental brokers reported 1.3 million ACCUs agreed for future delivery in Q1 2023. Forward trade volume is not necessarily indicative of forward price predictions in the spot market. There may be several reasons why market participants engage in forward trades, such as for hedging purposes.

Non-Commonwealth demand for ACCUs

Cancellation of ACCUs to meet non-commonwealth demand fell in Q1 2023 compared to Q1 2022 as there were no cancellations of ACCUs for state/territory compliance reasons (see Figure 1.5). However, voluntary cancellations, the majority of which were for Climate Active purposes, were up by 31% compared to Q1 2022. Cancellations can be lumpy and there is also a strong seasonal demand with Q1 ACCU cancellations typically the lowest of any quarter in a calendar year. We will be in a better position after Q2 2023 to comment on trends. If we see the compliance cancellations come in strongly in Q2 then it is likely we will again see a year on year increasing trend.

Description

This graph shows ACCU cancellations broken out by demand source.

Small print

| Classification | Covered activities |

|---|---|

| Voluntary demand | Cancellations made against voluntary certification programs such as Climate Active, and any sort of organisational emissions or energy targets. |

| Local, state and territory government demand (LS&T) | Cancellations on behalf of local, state and territory governments, for example to offset emissions from state fleets or meet emissions reduction targets. |

| Compliance demand | Cancellations by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, to meet Environmental Protection Agency requirements. |

| Other demand | All activity not covered in the previous categories, primarily due to lack of information available. This grouping has declined substantially as part of these new classifications. |

This classification system is uniform across ACCU and LGC cancellations.

New ACCU supply

1.8 million ACCUs were issued in Q1 2023 (see Figure 1.6). Of which, 56% were from vegetation projects and 22% were from waste projects. We expect a total of just over 18 million ACCUs to be issued in the 2023 calendar year.

Description

This graph shows ACCUs issued per method type for each quarter.

The number of new projects registered in Q1 2023 declined from 122 projects in Q1 2022 to 71 in Q1 2023. However, this is not necessarily a trend and each project registered can significantly vary in its ACCU yield.

Contract milestone exit arrangements

The second pilot exit window ran from 1 July to 31 December 2022 with 3.2 million ACCUs eligible for release. 1.7 million ACCUs exited with the contract holders paying $19.4 million in exit fees. The average contracted price for ACCUs released was $11.70 per tonne of CO2-e.

At the opening of the third pilot window on 12 May 2023, 9.1 million ACCUs were scheduled for delivery. Note that some of this volume may not be released, as some sellers may choose to continue to deliver ACCUs to the Commonwealth instead of participating in the exit arrangement.

Supply/demand balance

Total ACCUs held in ANREU accounts increased by 1.2 million in Q1 2023 to 23.8 million – an increase of 5% on Q4 2022 (see Table 1.1).

| Balance carried forward from Q4 2022 | 22.7m |

|---|---|

| ACCUs supply | +1.8m |

| Actual Scheme contract deliveries | -0.2m |

| Safeguard demand3 | -0.2m |

| Non-Commonwealth demand | -0.2m |

| ACCU relinquishment4 | -0 |

| Net balance at the end of 2023 | 23.8m |

Within a specified period, supply of ACCUs refers to ACCUs issued. Demand of ACCUs incorporates Commonwealth ACCU Scheme contract deliveries, safeguard mechanism cancellations, relinquishments, and state and territory government and private sector voluntary cancellation.

Footnotes

2 https://www.legislation.gov.au/F2023L00530/latest/text

3 Safeguard mechanism cancellations do not include deemed cancellations. A 'deemed' cancellation occurs when ACCUs issued under an ACCU Scheme project at a safeguard facility, in a particular year, are delivered to the Commonwealth under an ACCU Scheme contract.

4 For more information see Australian Carbon Credit Units.