Key messages

- LGC spot prices passed $70 in mid-September, first time since November 2015.

- Price has since softened, trading at around $65 in mid-October.

- Voluntary cancellation reached a record 4.7 million LGCs in Q3. This takes total cancellation for the year at the end of Q3 to 6.2 million LGCs, a

- 46% increase on the same period in 2021.

- 1.2 GW of new capacity was approved for LGC creation in first 3 quarters of 2022.

- Based on applications currently being processed, 2.7 GW of capacity is expected to be approved in total for 2022.

Q3 2022 saw investment signals for renewables strengthen further with LGC prices significantly increasing. While the large-scale renewable capacity added to the grid appears to be stabilising at around 3 GW per year, the rising price of LGCs highlights the need for more investment.

LGC price momentum continues

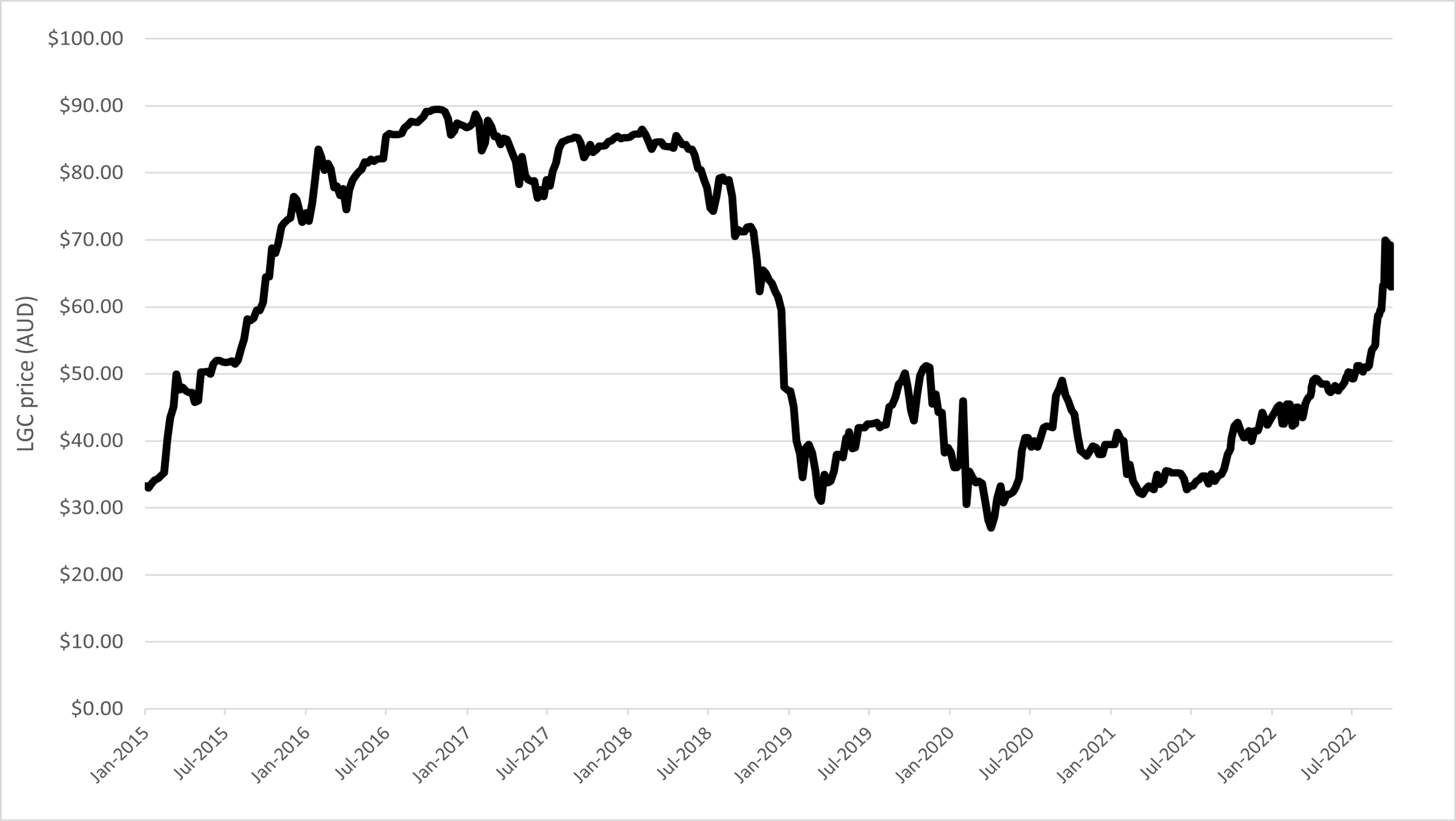

The LGC spot price reached $70 in mid-September before falling to $64.25 at the end of the quarter. Over the quarter, the spot price increased by 30% with much of this gain seen in August and September (increase of $7.75 and $5.50 respectively). In comparison, the spot price increased by an average $1.40/month over the January to July period.

A similar uptrend in November 2015 saw the spot price crossing the $70 mark and remaining at that high level for the following three years (see Figure 2.1). Price increases in 2015 were driven by an expectation of LGC scarcity as 6.3 GW of capacity had to be both committed and built in a period of 4.5 years to meet the 2020 Renewable Energy Target (RET) with sufficient LGC liquidity. To put this in context, an average of only 0.4 GW per year had been built before that time.

Spot LGC prices did not decline until enough renewable capacity was built or committed to meet the target of 33,000 gigawatt hours (GWh) in 2020 when the market considered LGC supply would be adequate. Further explanation of price dynamics in the lead up to the RET being met is available in the March Quarter 2021 report.

LGC spot price

January 2015 to September 2022 Note: This figure is not interactive.

Description

This graph shows the LGC spot price over time.

While the expected generation eligible for LGCs of 44,000 GWh in 2022 (leading to new supply of 44 million LGCs) is materially above the annual target1, the LGC market is still in an effective deficit. This is essentially the product of the LGC shortfall provision which has resulted in $954 million in consolidated revenue (as at end of Q3 2022) that can be redeemed under the 3-year rule. The market is using shortfall and refund as an effective inter-year liquidity mechanism.

In short, this situation arose primarily as it was not until Q4 2016 that material capacity started to reach FID even though the revised target was legislated in July 2015, giving market certainty to invest. The second factor at play has been the rapidly increasing rate of voluntary cancellations of LGCs to prove use of renewable energy, with the expected 8 million for this calendar year effectively adding 8,000 GWh to the annual target.

The recent spot and forward price increases likely reflect the market fully considering the scale of the effective deficit that has now remained quite stable for 3 years, as annual voluntary LGC cancellations increase at a similar level to new added generation. Hence, the market may now be considering it likely that the real LGC supply/demand balance may be tight for several years despite around 3 GW of additional capacity likely to be approved for LGC creation each year over the next few years (see Table 2.1).

| LGCs available from previous assessment years | +7.8 million |

|---|---|

| 2022 LGC supply (available for 2022 surrender) | +44 million |

| Legislated demand for 2022 | -32.6 million |

| Voluntary cancellations | -8 million |

| Total shortfall charge refund (at end of Q3 2022) | -14.7 million* |

| Effective balance (at the end of 2022 assessment year) | -3.5 million |

* This includes 4 million that is currently expected to be surrendered by February 2023 (or the right to claim refund forfeited).

Voluntary cancellation reaches record level

Q3 2022 recorded the single largest quarter of voluntary cancellations (see Figure 2.2). The 4.7 million LGCs cancelled is 36% higher than the previous record of 3.4 million in Q3 2020. Demand from GreenPower rose significantly with over 1 million LGCs cancelled in the program’s annual cancellation, typically done in Q3. This is the highest volume cancelled against GreenPower since 2017 and 59% more than the volume cancelled in 2021.

Description

This graph shows voluntary private and state and territory government demand for LGCs by reason for cancellation.

Small print

*formerly known as National Carbon Offset Scheme (NCOS).

'Other' is any cancellation which does not fit within the other three categories.

CER expects voluntary cancellations will be about 8 million LGCs in total for 2022, up from 5.8 million in 2021. As discussed in the June 2022 report, voluntary demand from Climate Active and Corporate Emissions Reduction Transparency (CERT) report participants may increase as new and tightening emissions reduction targets adopted by companies take effect.

Participants cancelled a total of 360,000 LGCs, including GreenPower purchases, to demonstrate renewable electricity use in the pilot phase of the CERT report. Moving forward, participants are expected to voluntarily cancel LGCs, to effectively reduce scope 2 emissions, in greater quantities than for the pilot. The Opt-in period for the 2023 CERT report opened on 1 November.

Stable year on year renewables capacity additions expected

CER approved 500 MW of capacity for LGC creation in Q3 2022, taking the total approved capacity for the year to 1.2 GW.

Nearly 1.8 GW of capacity remains under application (see Table 2.2), most of which is expected to be approved for LGC creation in 2022. This includes the New England Solar Farm which will, when approved, be Australia’s largest solar farm. Total capacity approved this year is expected to be about 2.7 GW, up from 2.3 GW approved in 2021. Solar is the dominant fuel source for power stations expected to be approved this year.

| Fuel source | ACT | NSW | NT | QLD | SA | TAS | VIC | WA | Total |

|---|---|---|---|---|---|---|---|---|---|

| Solar | 1 | 857 | 3 | 297 | 28 | 1 | 17 | 4 | 1207 |

| Wind | 0 | 0 | 0 | 157 | 317 | 0 | 109 | 3 | 585 |

| Total | 1 | 857 | 3 | 453 | 28 | 1 | 126 | 6 | 1,792 |

By the end of Q3, 2 GW capacity has reached FID in 2022. Based on industry intelligence and the projects being tracked by CER, total FID capacity for 2022 will likely be around 3 GW. This follows FID capacity of 2.9 GW in 2021 and 2.7 GW in 2020. These power stations are expected to get to first generation over the next 1-3 years. Power stations approved for 2021 LGC creation took, on average, 1.4 years to transition from FID to first eligible generation, with wind projects taking 21% longer than solar projects. However, larger projects typically take longer to build with construction usually done in stages. For example, the Macintyre Wind Farm in QLD, the largest wind farm in Australia currently under construction, reached FID in Q4 2021 and construction is not expected to be completed until 2024.

Based on FID capacity, large-scale renewables capacity added is estimated to average around 2.7 - 3 GW per year over the next few years. Variation to this on an annual basis can occur due to factors such as the fluctuation of construction times. High LGC spot prices indicate an increase of renewables is needed; however, it is difficult to predict when this may occur due to challenges such as the capacity of the grid to accept new connections. It is possible the next step up in annual capacity achieving FID may occur closer to the dates at which new transmission/interconnection is built and commissioned.

States and territories are playing a significant role in the energy transformation. Some recent developments include:

- New South Wales opened its inaugural renewable energy and long duration energy storage auction in early October, offering long-term electricity supply contracts and transmission access rights to prospective projects. As per the NSW Electricity Infrastructure Roadmap, 12 GW of renewable energy is expected by 2030, replacing retiring coal fired power stations with modern electricity infrastructure within the state.

- Victoria announced the result of its second Victorian Renewable Energy Target Auction. Six large-scale solar farms, four with big batteries included, have been successful. These projects account for a combined 623 MW of new generation capacity and 365 MW/600 MWh of new energy storage for the state.

- The Queensland Government has committed to install a dozen batteries in regional Queensland to boost distribution network storage capacity, particularly in areas with strong solar generation. This follows six 4 MW/8 MWh batteries that have already been installed and are expected to be commissioned soon.

In order to unlock potential for new large-scale renewable energy development, some major announcements have been made under the Australian Government’s ‘Rewiring the nation’ plan. This includes agreements with the Victorian Government to support new Renewable Energy Zones and offshore wind, and together with the Tasmanian Government to progress Marinus Link. Marinus Link is aiming to reach FID in late 2024 and then begin construction in 2025.

LRET data deep dive

The Q3 2022 Quarterly Carbon Market Workbook contains additional data on trends in LGC pricing and technology type. Updated information on the large-scale renewable final investment decision pipeline and approved capacity by location and fuel type is also available.

Footnotes

1 The target remains at 33,000 GWh until the scheme end at the end of 2030.