Insights

ACCU spot prices increased from $34.34 to $36.25 across the quarter and continued to run up post quarter to $42.50 on 19 November 2024.

Market intelligence indicates the cause was very high levels of activity from Safeguard entities as they prepare for the first compliance period under the reformed Safeguard Mechanism, and some accumulate for future years.

For the 2023-24 reporting year, all Safeguard facilities emissions data was reported by 31 October 2024 as required under National Greenhouse Emissions Reporting (NGER). Safeguard entities now know whether they have exceeded their baselines and need to either apply to flexibility measures such as a multiyear monitoring period or surrender ACCUs and/or Safeguard Mechanism Credit Units (SMCs).

Although Safeguard entities don’t need to hold and surrender the ACCUs and SMCs from their own accounts (they can have others to do so on their behalf) we believe there are still entities that need to and will secure supply to comply by 31 March 2025.

For the previous year’s Safeguard compliance period 2022-23, leading up to the surrender deadline in March 2023, prices rose 7.5 per cent in Q1 2024. A total of 0.9 million ACCUs were surrendered for Safeguard compliance in this period.

There were 45 million ACCUs in accounts at the end of Q3 and we expect more than 6 million will be issued in Q4. Much of this supply may be already secured for Safeguard, voluntary demand and contract deliveries - and not necessarily readily available on the spot market.

In Q3 2024, 0.94 million ACCUs were delivered to the Commonwealth, with the majority of the volume going to fulfil the minimum 20% fixed delivery exit requirement for fixed price carbon abatement contracts. On 19 November, the cost containment measure held 3.75 million ACCUs.

By the end of Q3, 1 million ACCUs had been voluntarily cancelled and we expect the total for the year will be in the order of 1.4 million.

Safeguard entities with emissions below their baselines are now eligible to apply to have SMCs issued and we provide further information on SMCs in the chapter.

The SMC issuance application form is now available. For applications received before 31 January, applicants are likely to be issued SMCs in the first week of February 2025. SMCs will be issued into the new Unit and Certificate Registry which will be in production by the end of November.

This creates a small window for trading and surrender of SMCs before the 31 March 2025 compliance date. We do not anticipate large trading volume and use of SMCs during this period. Safeguard entities receiving SMCs may trade them internally between facilities owned by a single corporate entity or choose to hold them for future year compliance.

ACCU supply could still get to our earlier estimate of about 20 million for 2024 if all current applications on hand are sound and all requests for further information are responded to promptly. As of 20 November, 15.5 million ACCUs had been issued, and applications for 4.6 million ACCUs were on hand, so the most probable total for the calendar year is in the order of 19 million.

Q3 saw the highest number of ACCU project registrations (182) on record. The sunsetting of the current Environmental Plantings method, bringing forward registrations, was one of the main reasons for the very high level of project registrations.

Following the first compliance period for the reformed Safeguard Mechanism on 31 March 2025, we will have a solid foundation for the necessary work to make forward estimates on likely Safeguard Mechanism demand for ACCUs and/or SMCs and SMC supply. We will update in a future QCMR on the likely timing for releasing those estimates.

On this page

- Market dynamics

- SMCs to be issued for the first time in early 2025

- Safeguard entities continue to increase their ACCU holdings

- Project registrations

- Supplementary figures

Market dynamics

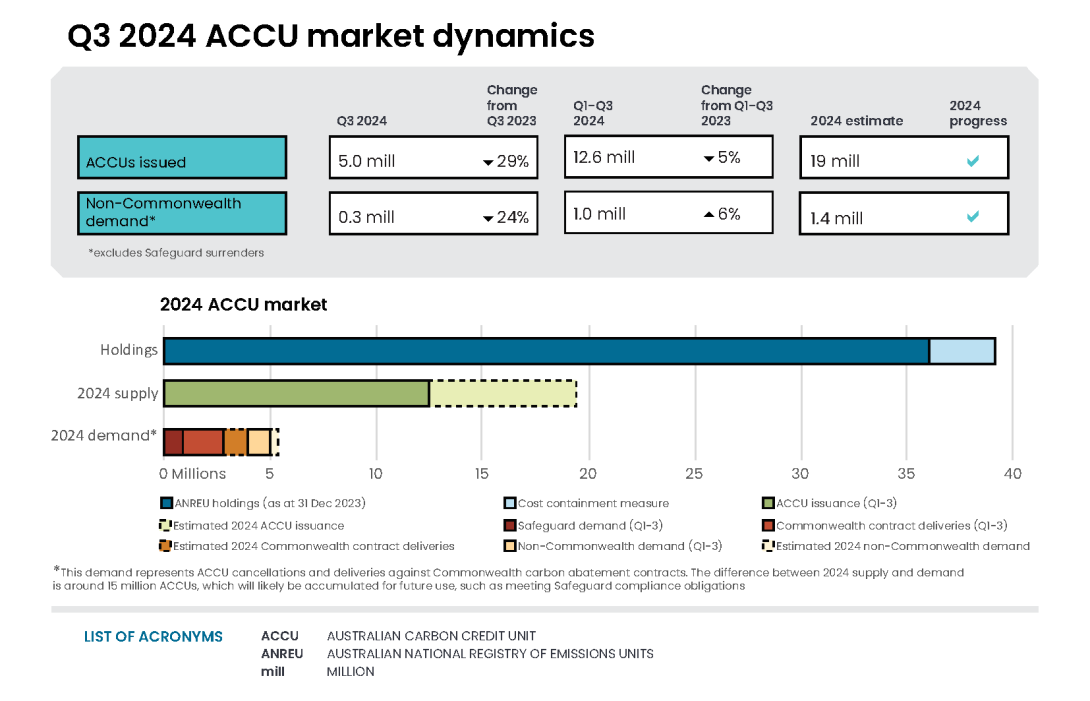

Table 1: ACCU supply and demand summary for Q3 2024

| Supply | Demand | |

|---|---|---|

| Balance carried forward from Q2 2024 | 41.3m | |

| ACCU supply | +5.0m | |

| ACCU Scheme contract deliveries* | -0.94m | |

| Non-Commonwealth cancellations | -0.30m | |

| Safeguard surrenders | <0.01m | |

| Net balance at the end of Q3 2024 | 45.0m | |

| Cost containment measure | 3.6m | |

*ACCUs delivered under Commonwealth carbon abatement contracts are held in the cost containment measure. These ACCUs are available to eligible Safeguard entities for purchase at a fixed price of $79.20 for 2024-25. ACCUs cancelled from non-commonwealth demand are removed from the market.

Estimating ACCU supply is inherently difficult. The quality of crediting applications can impact the time it takes from when a crediting application is submitted to the CER to when ACCUs are issued to the project proponent. Additionally, analysis of historical claiming behaviour and ACCU volumes, method-based claiming averages and canvassing project proponents and developers on likely timing of first-time project claims are all used in our annual estimate.

At the end of Q3 2024 1.4 million ACCUs had been issued to projects claiming for the first time and an additional 0.42 million were under assessment for projects claiming for the first time. We have revised down our original estimate of 3 million issuance for this cohort to 1.7 to 1.9 million.

There are 187 projects registered under the ACCU scheme between 2018 and 2022 that could be at the point of submitting offsets reports and claiming ACCUs but are yet to do so.

Description

This figure shows the volume of ACCUs issued to and the number of projects claiming for the first time each year. This figure also shows the amount of ACCUs on hand being claimed for the first time in 2024.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Hover over/tap along the line to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

For 2024, ACCU issuance and the number of projects are as at 30 September.

ACCUs on hand are the number ACCUs applied for in crediting applications being processed by the CER at a point in time.

0.30 million ACCUs were cancelled for non-Commonwealth purposes in Q3 2024, bringing the year-to-date total to 1 million. Around 1.4 million ACCUs are expected to be cancelled for non-Commonwealth demand in 2024, excluding Safeguard surrenders.

Description

This figure shows ACCU cancellations by demand source over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU cancellations exclude deliveries against Commonwealth carbon abatement contract milestones. This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations. Noting, Safeguard demand is included for ACCUs only.

Covered activities for each classification

Voluntary demand

Cancellations made against voluntary certification programs such as Climate Active and any sort of organisational emissions or energy targets.

Safeguard demand

Surrenders made by Safeguard entities to meet Safeguard Mechanism compliance.

Compliance demand

Cancellations made by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example to meet Environmental Protection Authority requirements.

Government demand

Cancellations by or on behalf of government entities. For example, to offset emissions from vehicle fleets or meet voluntary emissions reduction targets.

The generic ACCU spot price lifted from $34.34 to $36.25 over Q3 and has continued to move higher to $41.73 as of 15 November 2024.

Generic Australian carbon credit unit (ACCU) volume weighted average spot price

Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU spot price over time.

Small print

The generic spot price refers to the daily volume weighted average price of spot trades for ACCUs with an unspecified method. Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

Data as at 30 June 2024.

ANREU transfers were at an all-time high in Q3 2024. This is off the back of a record volume of ACCUs transacted in Q2.

Description

This figure shows the number of ACCU transactions and the volume of ACCUs transacted over time.

This figure is interactive. Hover over/tap along the line to see the number of ACCUs. Hover over/tap each segment to see the number of transactions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU transactions refer to the transfer of ACCUs between accounts. This does not include issuances, delivery to the Commonwealth for ERF contracts, and surrenders or cancellations of ACCUs. This data includes transactions involving the transfer of ACCUs between project proponents, between project proponents and project developers, and between accounts belonging to the same company and/or subsidiaries.

SMCs to be issued for the first time in early 2025

Safeguard Mechanism Certificates (SMCs) are a new carbon unit introduced as part of the Safeguard Mechanism reforms. A Safeguard facility is eligible to be issued with one SMC for each tonne of carbon dioxide equivalent (tCO2-e) emissions a facility is below its baseline, if the facility meets the eligibility criteria.

SMCs are a compliance unit that can be used for the purposes of meeting a Safeguard entity’s obligation under the Safeguard Mechanism and are therefore different to offsets like ACCUs.

SMCs are personal property and do not expire. Unlimited banking of SMCs is allowed under the Safeguard Mechanism, meaning that SMCs can be used for Safeguard compliance in any year. SMC eligibility for use in the Safeguard Mechanism after 2030 will be considered as part of the government’s 2026-27 review of the Safeguard Mechanism’s scheme settings.

SMCs are also financial products. People who provide financial services in relation to SMCs and related financial products and services in Australia may require an AFS licence which authorises them to provide those services.

For the purposes of meeting a Safeguard entity’s Safeguard obligations, ACCUs and SMCs are fungible – both can be used to reduce a facility’s ‘net emissions’ for a given monitoring period. While there is no restriction placed on the number of SMCs or ACCUs surrendered for Safeguard purposes, a Safeguard entity that surrenders ACCUs that equate to 30 per cent or more of a Safeguard facility’s baseline for the year, will be required to provide an explanation of why more carbon abatement was not undertaken at the facility during the period. This statement will be published on the Clean Energy Regulator’s (CER) website.

SMCs will be the first units to be available via the CER’s new Unit and Certificate Registry. In preparation for the issuance of SMCs, the first stage of the new registry is being released in November 2024. As part of this initial release, all existing ANREU accounts will be mirrored in the new registry. Once SMCs are issued, in early 2025, account holders will be able to view their SMC holdings in the new registry. Holdings of ACCUs will continue to be viewed and managed via the current ANREU, until ACCUs are also moved into the new registry (this won’t happen until after the 31 March 2025 Safeguard compliance deadline).

Owing to the uncertainty of the management options Safeguard entities will choose, and further applications for Trade Exposed Baseline Adjustments, it is difficult to provide an accurate estimate of the ACCU/SMC demand and SMC supply at this time.

Early Safeguard Mechanism data for 2023-24 will be included in the upcoming 2024 CCA annual progress report. Care is needed in interpreting this data as the relevant management options, including utilisation of flexibility measures, are still under consideration by participants. The CER is required to publish the Safeguard outcomes, including details of SMC issuance and SMC and ACCU surrenders, by 15 April 2025. Sign up to our subscription list to make sure you are notified when data is published.

Safeguard entities continue to increase their ACCU holdings

At the end of Q3 2024, the balance in ANREU accounts is 45 million ACCUs. It is expected that holdings will be around 50 million by the end of 2024. Safeguard and Safeguard related entities hold 61% of total ACCUs. This is up from 55% of total holdings at the end of Q2.

In Q3 2024, 0.94 million ACCUs were delivered to the Commonwealth, with the majority of the volume going to fulfil the minimum 20% delivery exit requirement for fixed price carbon abatement contracts. At the end of Q3 the cost containment measure held 3.6 million ACCUs.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts by market participation category over time.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs in millions. Click/tap on the items in the legend to hide/show data in the figure.

Small print

Totals may not sum due to rounding. ACCU holdings data has been revised to include all accounts. Previously, accounts with nil volume at the end of the quarter were excluded, impacting the historical data. The number of accounts still excludes accounts with nil volume at the end of Q3 2024.

Category definitions

Project proponent

An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator.

Safeguard

Account holders are Safeguard entities that control a single account, or in cases where Safeguard entities control multiple accounts, only those that have surrendered ACCUs for Safeguard compliance purposes or have specified a facility are included. Some Safeguard accounts also engage in trading activity, which may result in holding fluctuations in this category.

Safeguard related

Account holders are companies, such as subsidiaries, that are related to registered Safeguard entities. These accounts do not specify a facility or have not surrendered ACCUs for Safeguard compliance purposes. These ACCU holdings may be used for future Safeguard compliance purposes.

Intermediary

An account holder’s primary operation is to facilitate trading of ACCUs between the supply and demand sides of the market. This also includes accounts that have accumulated ACCUs through the secondary market without known compliance obligations, offset use, or carbon trading/offset services.

Government

Account holders are government entities that are accumulating for voluntary or compliance purposes.

Business

Account holders do not have a direct link to ACCU Scheme projects. Account holders include participants that are accumulating for voluntary purposes.

Cost containment measure

ACCUs that have been delivered under Commonwealth carbon abatement contract milestones after 12 January 2023. These ACCUs will be available to eligible Safeguard entities under the cost containment mechanism.

Project registrations

In Q3 2024, a record 182 new projects were registered under the ACCU scheme. This included:

- 95 agriculture projects, 94 of which were under the soil carbon methodology

- 77 vegetation projects

- 10 waste projects.

The high levels of new projects in vegetation registrations were driven by 57 Environmental Plantings projects. Project developers sought to register these projects before the current method sunset on 30 September 2024. A new method has been finalised to replace the existing method.

Description

This figure shows registered projects under the ACCU Scheme by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture - other' to highlight growth in the soil carbon sector. The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Supplementary figures

Description

This figure shows ACCUs issued by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive methods and savanna fire management.

Description

This figure shows ACCU cancellations by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

These ACCU cancellations in the Australian National Registry of Emissions Units (ANREU) are for purposes other than deliveries against Commonwealth carbon abatement contract milestones. These ACCU cancellations could be voluntary to show progress towards reducing net scope 1 emissions, to meet state or territory regulatory requirements or surrenders for Safeguard Mechanism compliance obligations.