Key messages

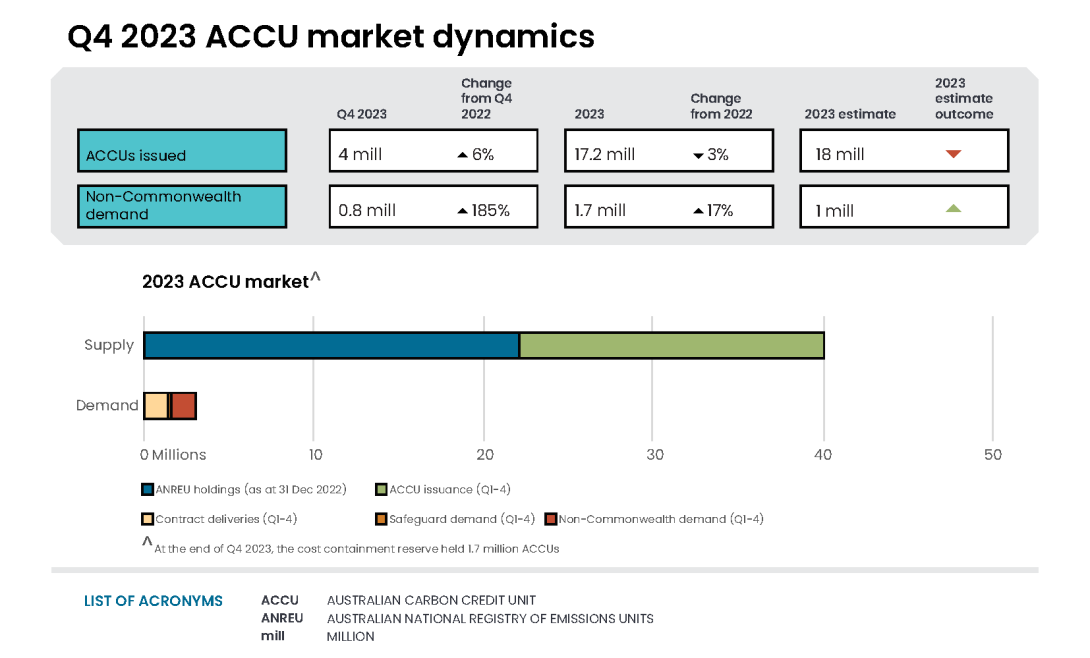

- In 2023, 17.2 million ACCUs were issued, slightly lower than the 17.7 million ACCUs issued in 2022. In Q4 2023, 4.0 million ACCUs were issued.

- We expect to issue at least 20 million ACCUs in 2024.

- We expect to issue at least 20 million ACCUs in 2024.

- At the end of 2023, the cost containment reserve held 1.7 million ACCUs.

- In the second half of 2023, Australian National Registry of Emissions Units (ANREU) holdings for Safeguard accounts increased by 4.1 million to 7.4 million ACCUs.

- In Q4 2023, 0.8 million ACCUs were cancelled for non-Commonwealth demand, a quarterly record.

- 1.7 million ACCUs were cancelled for non-Commonwealth demand in 2023. 1.1 million of these were cancelled for voluntary demand, an annual record.

- For financial year (FY)23, 1.0 million ACCUs were surrendered against Safeguard liability. This is an increase from the 0.2 million ACCUs surrendered for FY22.

Insights

- 2023 in review

- Anticipated record ACCU supply in 2024

- Intermediaries are playing a larger role in the ACCU market

- Safeguard entities continue to accumulate ACCUs to meet compliance obligations

- Modest deliveries against Commonwealth contracts

- Record voluntary cancellations in 2023 expected to be beaten in 2024

- Modest increases in ACCU prices

2023 in review

The ACCU market experienced many changes in 2023, including an increased source of long-term demand from the legislated Safeguard Mechanism reforms. There was also a strong focus on transparency and integrity of the ACCU market. This stemmed from the announced outcomes of the Independent Review of ACCUs in January 2023.

2023 price and supply:

- 17.2 million ACCUs were issued. This is the second highest annual supply after 2022, when 17.7 million ACCUs were issued.

- 361 projects were registered taking total registered projects to 1,767.

- ANREU holdings grew by 13.5 million to 36.2 million at the end of 2023.

- The generic ACCU spot price fluctuated between $24.00 and $39.25. During the second half of 2023, the human induced regeneration (HIR) ACCU spot price had an average premium of $3.70 over the generic ACCU spot price.

2023 demand:

- There was an overall demand of 3.7 million ACCUs in 2023, down from 6.5 million ACCUs in 2022. This is mostly due to reduced deliveries against carbon abatement contracts.

- 1.7 million ACCUs were cancelled for non-Commonwealth demand. This is a 17% increase on the 1.5 million cancelled in 2022.

- 1.7 million ACCUs were delivered against Commonwealth carbon abatement contracts, including 0.2 million that were deemed surrenders. This is a 64% decrease from the 4.7 million delivered in 2022 due to contract holders using the pilot exit arrangements

- From 12 January 2023, delivered ACCUs are held in the cost containment reserve.

- 0.2 million ACCUs were cancelled to meet Safeguard obligations.

- Some Safeguard entities continue to acquire ACCUs to help meet their compliance obligations. At the end of 2023, there were 43 Safeguard accounts holding 7.4 million ACCUs.

Anticipated record ACCU supply in 2024

Following lower issuances in the first half of 2023, a record 11 million ACCUs were issued in the second half of 2023. This brought the total for 2023 to 17.2 million ACCUs, in line with our revised estimate of 17 million. This was slightly lower than the 17.7 million ACCUs issued in 2022.

The lower ACCU supply in 2023 was partly due to a lower issuance of HIR ACCUs. 5.4 million HIR ACCUs were issued in 2023 compared to 6.5 million HIR ACCUs in 2022. The crediting application processing times for HIR ACCUs were slowed in 2023 due to:

- implementing recommendation 8 of the Independent Review of ACCUs to ensure all HIR projects are conforming to the method’s intent as interpreted by the Independent Review of ACCUs

- the inclusion of HIR gateway audits as an additional check on compliance.

At the end of 2023, applications for 1.9 million HIR ACCUs were being processed. We expect more HIR ACCUs to be issued in 2024 with the continued implementation of the Independent Review of ACCUs recommendations and gateway audits.

On 15 December 2023, the gateway regeneration checks for HIR projects report was released, examining the outcomes of the first tranche of gateway audits. Associate Professor (Honorary) Cris Brack conducted the review. The report found HIR projects are demonstrating regeneration and project proponents are implementing the project activities.

Overall, we expect to issue at least 20 million ACCUs in 2024. This 2024 estimate considers several factors, including:

- 4.9 million ACCUs in crediting applications were being processed at the end of 2023

- an expected high number of claims greater than 50,000 ACCUs from existing projects that only claim every few years

- around 500 projects are anticipated to commence claiming for the first time.

Description

This figure shows ACCUs issued by method type over time. ACCU issuance follows a seasonal pattern for certain method types, including industrial fugitive methods and savanna fire management.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

In Q4 2023, 72 ACCU projects were registered bringing the 2023 total to 361 new projects registered under the ACCU Scheme. For 2023:

- 103 were HIR

- 94 were soil carbon

- 72 were reforestation by environmental plantings, an annual record.

- This record is partly due to the carbon and biodiversity pilot. 31 of the registered projects were participating in the pilot. The aim of the pilot is to test how landholders could create new income from plantings that deliver biodiversity improvements and carbon abatement. Learnings from the pilot will be incorporated into the design of the Nature Repair Market.

- 52 were plantation forestry.

- The remaining 40 projects were split among 12 other methods.

Description

This figure shows registered projects under the Australian Carbon Credit Unit (ACCU) Scheme by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of projects. Click/tap on the items in the legend to hide/show data in the figure.

Small print

The 'agriculture' method type has been segregated into 'agriculture - soil carbon' and 'agriculture- other' to highlight growth in the soil carbon sector.

The 'agriculture - soil carbon' method includes the ‘measurement of soil carbon sequestration in agricultural systems' method, the ‘sequestering carbon in soils in grazing systems’ method and the 'estimation of soil carbon sequestration using measurement and models' method.

Project registrations in 2023 were marginally down from the 382 projects registered in 2022. Notably, less than half as many soil carbon projects were registered in 2023 compared to 2022. This may have been due to the strong uptake of the 2021 soil carbon method, which came into effect in December 2021, subsiding. However, other methods increased compared to 2022:

- HIR projects increased to 103 from 43. As discussed in the Q3 2023 Quarterly Carbon Market Report (QCMR), the HIR method expired on 30 September 2023. This likely pulled forward projects that might have registered later.

- Plantation forestry projects increased to 52 from 14.

- Reforestation projects increased to 72 from 52.

In 2023, 9 project’s crediting periods ended, 5 of which were energy efficiency projects.

Project proponents can withdraw from participating in the ACCU Scheme and voluntarily revoke their projects at any time. In 2023, 28 projects were revoked. More information on these projects is available in the project register.

In January 2024, the Australian Government announced $17.5 million in grants under the Carbon Farming Outreach Program to support continued growth in new ACCU projects. The program selected both state specific and Australia wide projects that will:

- provide training and advice to support farmers and land managers, including First Nations people

- reduce emissions

- store carbon.

Intermediaries are playing a larger role in the ACCU market

Intermediaries have taken a more active role on both the demand and supply side of the ACCU market. In 2023, accounts of intermediaries doubled activity, acquiring 15.9 million ACCUs and transferring or cancelling 13.5 million ACCUs. This is compared to 8.8 million ACCUs acquired and 4.2 million ACCUs transferred or cancelled in 2022. This excludes transfers between accounts of intermediaries.

Sellers (project proponents) and buyers (Safeguard entities and business and government enterprises) are both using intermediaries more often to exchange ACCUs. Intermediaries serve an important role in linking buyers and sellers, reducing the overall transaction costs and de-risking purchasing decisions.

At the end of 2023, total ACCU holdings in the ANREU, excluding the 1.7 million in the cost containment reserve, sat at 36.2 million, growing by 2.7 million over Q4 2023. Compared to Q3 2023, holdings changed as follows:

- Accounts of intermediaries increased by 0.2 million. 3.9 million ACCUs were acquired from project proponent accounts. ACCUs were also transferred 1.3 million to business and government enterprise accounts and 1.8 million to Safeguard accounts. Intermediaries cancelled 0.6 million ACCUs for voluntary purposes.

- Project proponent accounts decreased by 0.9 million, primarily sending to accounts of intermediaries.

- Safeguard accounts increased by 1.9 million, mostly acquired from accounts of intermediaries.

- Business and government enterprise accounts increased by 1.5 million, with 1.3 million acquired from the intermediaries and 0.3 million from project proponents.

Description

This figure shows ACCU holdings in Australian National Registry of Emissions Units (ANREU) accounts by different account holder categories over time.

This figure is interactive. Hover over/tap each data point to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Category | Project proponent | Business and government enterprise | Intermediary | Safeguard |

|---|---|---|---|---|

| Definition | An account holder is connected to one or more ACCU Scheme projects. The connection to projects has been determined based on the available project information. Entities may have linkages to projects that have not been disclosed to the Clean Energy Regulator. | Account holders that do not have a direct link to ACCU Scheme projects. These include voluntary participants and local, state and territory government entities that are accumulating for voluntary or compliance purposes. | Account holder’s primary operation is to facilitate trading of units between the supply and demand sides of the market. This also includes accounts who have accumulated ACCUs through the secondary market without known scheme obligations, offset use, or carbon trading/offset services. | Account holders are Safeguard entities that control a single account, or in cases where Safeguard entities control multiple accounts, only those that have surrendered ACCUs for Safeguard compliance purposes or specify a facility are included. Some Safeguard accounts also engage in trading activity that may result in holdings fluctuations within this category. |

| Balance at the end of the quarter (millions of ACCUs) | 10.3 | 7.6 | 10.9 | 7.4 |

| Number of accounts | 209 | 65 | 58 | 42 |

Accounts with nil volume at the end of the quarter are excluded.

Totals may not sum due to rounding.

Safeguard entities continue to accumulate ACCUs to meet compliance obligations

In Q4 2023, 2 additional Safeguard accounts were opened in the ANREU. At the end of 2023, there were 43 Safeguard accounts holding 7.4 million ACCUs. Since the Safeguard reforms commenced on 1 July 2023, Safeguard holdings have increased. In the second half of 2023, Safeguard holdings increased by 4.1 million ACCUs compared to 0.6 million ACCUs in the first half of 2023.

Safeguard entities have several key dates to meet their compliance obligations. This includes the end of February surrender deadline. Entities that exceed their baseline must surrender ACCUs to avoid being in an excess emission situation for the previous financial year compliance period. For the reporting year:

- 2022-23, 1.2 million ACCUs were surrendered

- of which 0.96 million were surrendered and 0.25 million were deemed surrenders.

- 2021-22, 0.7 million ACCUs were surrendered

- of which 0.2 million were surrendered and 0.5 million were deemed surrenders.

The increase from FY22 to FY23 was primarily related to the ending of various emissions management options, including multi-year monitoring periods. We anticipate demand for ACCUs will step up again for FY24 with declining baselines commencing under the reformed Safeguard Mechanism. Explore more Safeguard data, including the FY23 data released in March 2024.

Market intelligence suggests Safeguard entities are accelerating their accumulation of ACCUs to meet their compliance obligations. This includes developing their own ACCU projects and acquiring the land projects are developed on. Safeguard entities can also use intermediaries to acquire and cancel ACCUs on their behalf. We are unable to determine the volume of holdings held by intermediaries on behalf of Safeguard entities. Safeguard entities have likely secured more ACCUs than reported in ANREU holdings.

Modest deliveries against Commonwealth contracts

In Q4 2023, 0.5 million ACCUs were delivered against Commonwealth carbon abatement contracts. In 2023, a total of 1.7 million ACCUs were delivered against contract milestones, lower than the 4.7 million in 2022.

Through the third pilot window of the exit arrangement, 4.1 million of the eligible 9.3 million ACCUs exited from fixed delivery contracts. Of the remaining 5.2 million ACCUs, 0.8 million were delivered to the Clean Energy Regulator (CER) and the remainder were rescheduled as part of our normal carbon abatement contract management process.

Between August and October 2023, the Department of Climate Change, Energy, the Environment and Water (DCCEEW) consulted on the pilot exit arrangements, including whether:

- the pilot exit arrangements should be made permanent

- requiring a minimum percentage to be delivered to the Commonwealth in each window would help strengthen market confidence and reduce risk.

The outcome of the consultation and the policy detail of future contract delivery arrangements is yet to be announced.

In 2024, 18.6 million ACCUs are scheduled for delivery, including 2.9 million ACCUs from rescheduled milestones and 3.8 million ACCUs are under negotiation as part of our normal carbon abatement contract management process. Some contract holders may have rescheduled in anticipation of an announcement regarding future pilot exit arrangements. 14.4 million of the 18.6 million ACCUs are scheduled for delivery on or before 30 June 2024. Delivery of these ACCUs may be impacted by policy announcements and the ACCU spot price.

Of the 18.6 million ACCUs, 16.8 million are from fixed delivery and 1.9 million are from optional delivery contracts. Both optional and fixed delivery contracts include delivery milestones. However, fixed delivery contracts have an obligation to deliver while optional delivery contracts do not. In 2023, less than 0.1% of the 1.7 million ACCUs delivered to the Commonwealth were for optional delivery contract milestones.

At the end of 2023, of the 1.7 million ACCUs in the cost containment reserve:

- 1.3 million were from vegetation methods, including 1.1 million from avoided deforestation

- 0.3 million were from waste methods, primarily landfill gas

- 0.1 million were from energy efficiency methods.

Record voluntary cancellations in 2023 expected to be beaten in 2024

Past demand for ACCUs has primarily been Commonwealth demand, where ACCUs are delivered to the CER under Commonwealth carbon abatement contracts. In recent years, non-Commonwealth demand continues to grow. In 2023, a total of 1.7 million ACCUs were cancelled for non-Commonwealth demand, compared to 1.5 million in 2022.

In Q4 2023, 0.8 million ACCUs were cancelled for non-Commonwealth demand. This is a quarterly record, topping the previous record set in Q3 2022 by 0.3 million. Of the 0.8 million:

- 0.4 million ACCUs were cancelled by Chevron Australia for non-Commonwealth compliance purposes. This is a similar amount to 2022.

- 0.3 million ACCUs were cancelled for voluntary purposes.

Non-Commonwealth cancellations for voluntary purposes has steadily increased over recent years. In 2023, an annual record of 1.1 million ACCUs were cancelled for voluntary purposes. This was 30% higher than the 0.9 million ACCUs cancelled for voluntary purposes in 2022. This demand averaged 40% annual growth from 2019 to 2023.

Description

This figure shows non-Commonwealth ACCU cancellations by demand source over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

| Classification | Covered activities |

|---|---|

| Voluntary demand | Cancellations made against voluntary certification programs such as Climate Active, and any sort of organisational emissions or energy targets. |

| Local, state and territory government demand | Cancellations on behalf of local, state and territory governments, for example, to offset emissions from state fleets or meet emissions reduction targets. |

| Compliance demand | Cancellations by private organisations and corporations for compliance or obligations against municipal, local, state and territory government laws, approvals, or contracts. For example, to meet Environmental Protection Authority requirements. |

| Other demand | All activity not covered in the previous categories, primarily due to a lack of available information. |

This classification system is uniform across ACCU and large-scale generation certificate (LGC) cancellations.

These ACCU cancellations in the Australian National Register of Emissions Units (ANREU) are for purposes other than deliveries against Commonwealth carbon abatement contract milestones or surrenders for Safeguard Mechanism obligations. They could be voluntary to show progress towards reducing net scope 1 emissions or to meet state or territory regulatory requirements.

In 2023, the majority of ACCUs cancelled for voluntary purposes were HIR (42%) and savanna fire management (46%). The majority of ACCUs cancelled for non-Commonwealth compliance purposes were landfill gas (63%).

In December 2023, the Australian Competition and Consumer Commission (ACCC) released making environmental claims: a guide for businesses. The guide includes 8 principles. Principle 5 is to avoid broad and unqualified claims. For emission related claims, the guidance includes being transparent about the use of purchased offsets. This includes providing information about the projects the offsets came from.

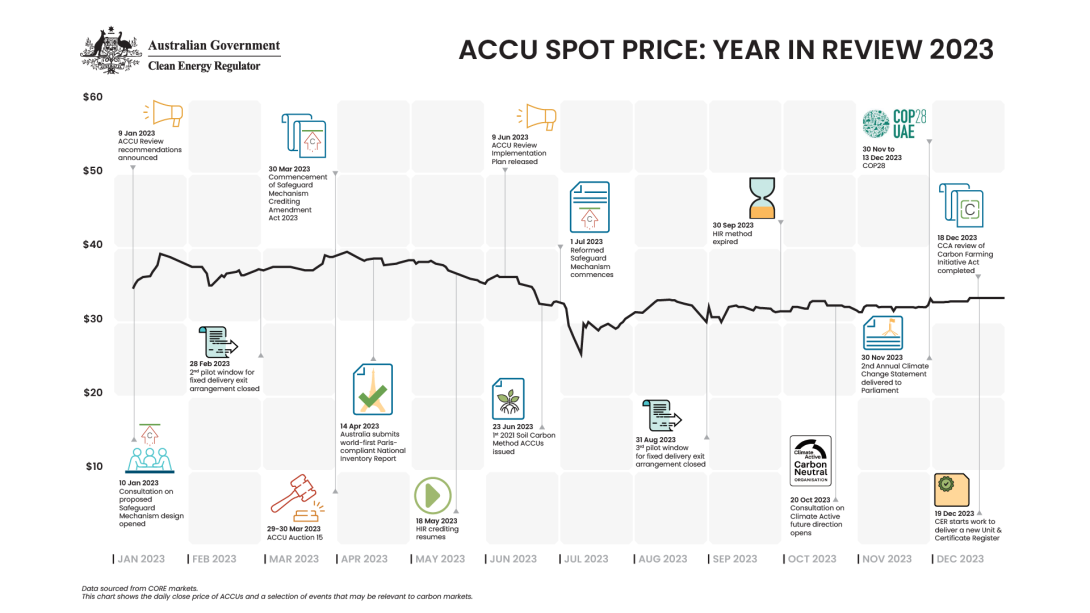

Modest increases in ACCU prices

ACCU prices are determined by the market. Numerous factors influence the price, including supply, demand, policy and fixed delivery Commonwealth carbon abatement contracts providing an effective floor price for ACCUs.

The below ‘ACCU spot price: year in review 2023’ infographic shows how the ACCU spot price has responded to events throughout 2023. In the first half of 2023, the generic ACCU price averaged $36.42. The new financial year seemed to trigger a small cohort of motivated sellers to dispose some of their ACCU inventory. The generic ACCU price dropped to a low of $24.00 on 10 July 2023 and then recovered. In the second half of 2023, the generic ACCU price briefly increased and averaged $30.67. As discussed in previous QCMRs, this price point is around a commercial premium to double the average Commonwealth contract price. In January 2024, the generic ACCU price stabilised around $35.

During the second half of 2023, HIR ACCUs had an average premium of $3.70 over generic ACCUs. In mid-January 2024, savanna fire management ACCUs without associated co-benefits traded at $35.25. At the time, this was below the HIR spot price of $37.50, but above the generic ACCU price. The last savanna fire management ACCUs with associated co-benefits traded at $53.05 in June 2023.

Supplementary figures

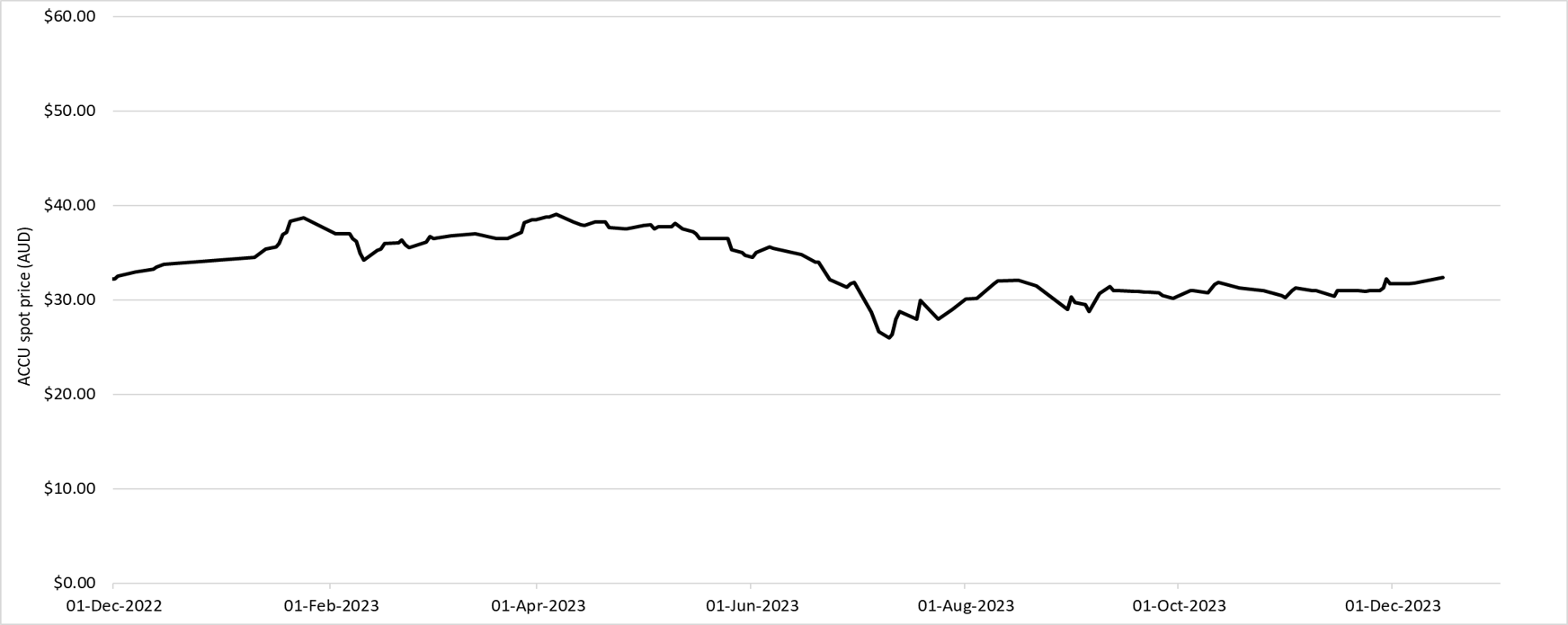

Generic Australian carbon credit unit (ACCU) reported spot price

Q1 2019 to Q4 2023 Note: This figure is not interactive.

Description

This figure shows the volume weighted average of the generic ACCU spot price. The generic spot price refers to the price of ACCU spot trades with an unspecified method.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.

Data as at 1 January 2024.

Description

This figure shows non-Commonwealth ACCU cancellations by method type over time.

This figure is interactive. Hover over/tap each segment to see the number of ACCUs. Click/tap on the items in the legend to hide/show data in the figure.

Small print

These ACCU cancellations in the Australian National Register of Emissions Units (ANREU) are for purposes other than deliveries to the Emissions Reduction Fund (ERF) or surrenders for Safeguard Mechanism obligations. They could be voluntary to show progress towards reducing net scope 1 emissions or to meet state/territory regulatory requirements.

Reported Australian carbon credit unit (ACCU) spot trades by method type

January 2021 to December 2023 Note: This figure is not interactive.

Description

This figure shows the volume of reported ACCU spot trades by method type over time.

Small print

Spot trade data is compiled from trades reported by Jarden and CORE markets, and may not be comprehensive.