Key messages

- Renewable energy met a record average 35% of demand in the National Electricity Market (NEM) in 2022, with more than 40% in Q4.

- Total new investment in wind and solar hit a record 7.1 gigawatts (GW)

- 4.3 GW of large-scale wind and solar energy projects reached a final investment decision (FID) in 2022 – a 50% increase over 2021.

- 2.8 GW of small-scale solar PV capacity was installed in 2022, third highest annual capacity installed on record. The H2 trend suggests a bigger year in 2023.

- A total of 5.3 GW of new renewable energy capacity was added to the grid in 2022 including 2.5 GW of large-scale wind and solar.

In 2022, the large-scale renewable energy sector responded to strong investment signals with 4.3 GW of large-scale wind and solar projects reaching final investment decision (FID), 2.1 GW of which was committed in Q4 alone. In comparison, an average 2.8 GW reached FID annually over the 2019 to 2021 period.

Key investment signals included:

- the legislated 2030 emissions reduction target

- the Australian Government goal of 82% renewable energy by 2030

- announced earlier closure of coal plants

- business demand for renewable energy

- proposed acceleration of large batteries and grid upgrades

- high wholesale electricity prices in some jurisdictions and strong LGC prices.

There are promising signs for the rooftop solar industry as well, which rebounded strongly across the second half of 2022. This resulted in 2.8 GW installed capacity for the year exceeding the CER's expectation set in early 2022 of 2.3 GW. Q4 was the second highest installed capacity quarter on record. A key factor driving these trends may have been increasing retail energy prices. Despite the temporary cap on coal and gas prices introduced in December 2022, retail energy prices appear set for another increase in 2023.1 This may see increased uptake of solar PV continue through 2023 unless increasing interest rates and tightening household budgets supress demand.

Ongoing state and Australian Government policy announcements on the installation of community batteries will be key watch points for this sector. Batteries will help ease some low voltage distribution network constraints and enable more solar PV to be installed than otherwise possible.

This increase in large-scale renewables and rooftop solar investment are promising developments that can be built on in Australia's journey to achieve 82% renewable generation, and 43% emissions reduction from 2005 level, by 2030.

Investment primed for growth?

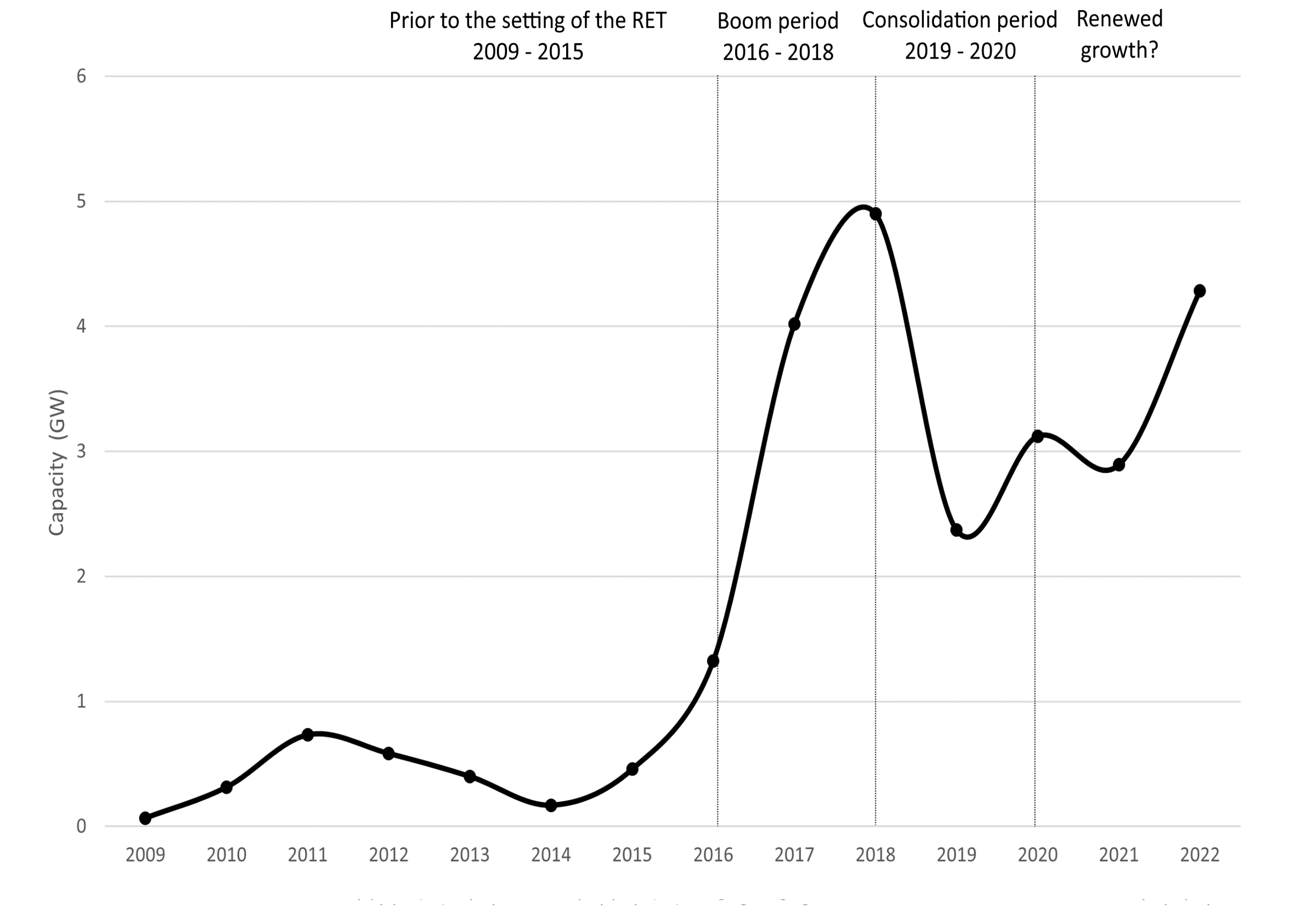

The 4.3 GW FID capacity for large-scale renewables in 2022 is the second highest annual capacity on record (see Figure 2.1). A new investment boom cycle may be forming, similar to that observed in 2016–2018 when the industry delivered a significant increase in investment to meet the 2020 Large-scale Renewable Energy Target. Future growth will depend on whether supply chains can rebound from constraints that arose from the pandemic and capitalise on the favourable investment environment for renewables.

Final investment decision for large-scale renewable generation

2009 to 2022 Note: This figure is not interactive.

Description

This graph shows final investment decision capacity of large-scale renewable energy power stations yearly.

Small print

The CER tracks public announcements and the above information may not be complete and may change retrospectively.

Data as at 31 December 2022.

Investment signals indicate a strong outlook for future renewable energy investment. The increase in FID capacity announcements is expected to continue in 2023. As highlighted in Figure 2.1, the renewables industry scaled up investment significantly from 2016 to 2018. Much of this investment was delivered between 2016 and 2020. Whether the industry can again scale up to enable an increased level of investment decision in 2023 and beyond, off the back of the big step up in H2 2022, remains to be seen.

For projects to reach FID, engineering, procurement and construction (EPC) contracts and contracts to procure key components are needed at commercial costs. Potential supply chain constraints for contractors and components represent the key risks to ongoing increases in investment. Some are arguing that incentives such as the Inflation Reduction Act in the United States of America will skew investment away from Australia. However, there are many large international renewables developers in Australia who have serious proven intent to invest here. Time will tell how these forces play out.

Factors contributing to a favourable investment environment for renewables

Favourable policy and regulatory landscape

- In line with Australia's emissions reduction target of 43% from 2005 level by 2030 and net zero emissions by 2050, the Minister for Climate Change and Energy set an ambition to get to 82% renewables share of electricity nationally by 2030. In progressing this agenda, the government is heavily investing in electricity network upgrades and storage, facilitating a faster transition to renewables through Powering Australia.

- State and territory governments have announced strengthened emissions reduction and renewable energy targets:

- The Victorian Government announced new renewable energy targets of 65% by 2030, and 95% by 2035. In progressing this, the second Victorian Renewable Energy Target Auction was held in October. This brought forward 623 MW of new renewable generation capacity and delivered up to 365 MW and 600 MWh of new battery energy storage.

- The Queensland Government announced new renewable energy targets of 70% by 2032, and 80% by 2035. As part of the Queensland Energy and Jobs plan, all publicly owned coal-fired power stations have been committed to be converted into clean energy hubs by 2035.

- The New South Wales Government announced new commitments to reduce emissions by 70% below 2005 levels by 2035, paving the way for a quicker transition to renewable energy.

- The Western Australian Government has committed to reducing emissions from all government agencies by 80% below 2020 levels by 2030. Legislation will also be introduced to formalise their goal of net zero by 2050.

- The reforms to the Safeguard Mechanism and baseline decay should progressively encourage facilities to consider fuel switching and electrification to reduce on-site scope 1 emissions.

- The Australian Government is facilitating growth of an Australian green hydrogen industry with a $525 million investment in developing hydrogen hubs. This is likely to attract complementary investment in renewables.

- The consultation on the proposed Guarantee of Origin (GO) scheme, including for renewable electricity certification ran from 12 December 2022 to 8 February 2023. This scheme will offer a mechanism to track and verify emissions associated with hydrogen and other low emissions commodities produced in Australia, signalling increased demand for renewables as a means for clean energy production.

- The Australian Energy Market Operator (AEMO) has been working closely with industry to make grid connection processes easier and faster. To replace the retiring coal fleet, AEMO has noted the need to connect at least 5 GW of large-scale renewable generation and storage capacity each year from 2022 to 2030. Recognising the faster pace of renewables integration and coal exit, AEMO adopted the Step Change Integrated System Plan scenario for the first time in 2022.

Price signals for investment

- LGC spot prices averaged $54 in 2022, 46% above 2021 prices. Prices grew strongly across future vintages as well. In early 2023, prices across most vintages have fallen (see 2.1: Large-scale Generation Certificates (LGCs) for further information).

- While wholesale electricity prices have decreased from the extremes observed in mid-2022, prices are still relatively high, with Q4 2022 prices averaging 55% higher than Q4 2021. The combined wholesale electricity and LGC prices send a clear signal that more generation capacity is required.

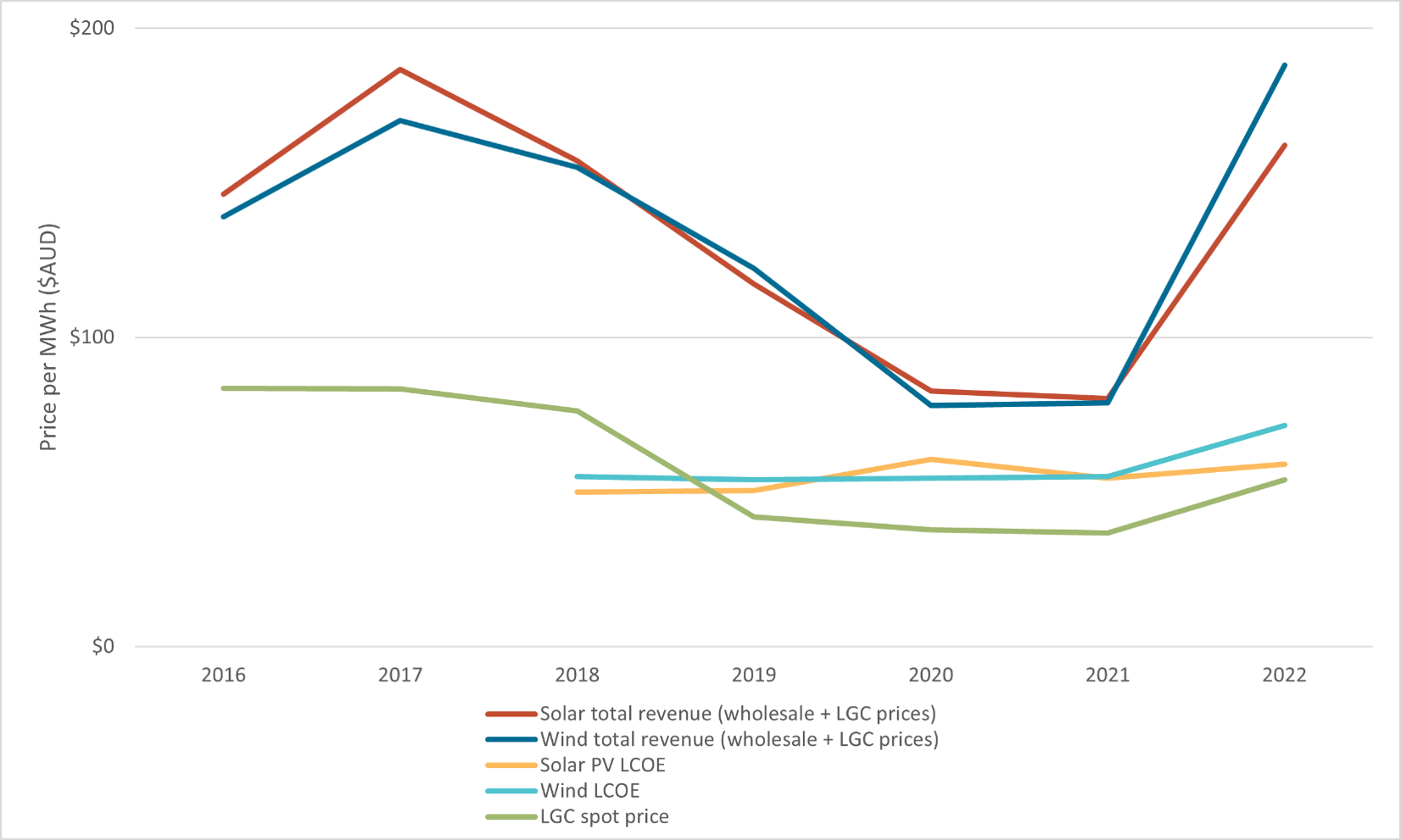

- CSIRO's 2022-23 GenCost consultation draft report suggests the levelized cost of energy (LCOE) of solar is $59 per MWh and wind is $71 per MWh. This reaffirms that solar and wind are some of the cheapest forms of new energy and provides attractive investment opportunities for project developers (see Figure 2.2).

- Coal-fired power stations continue to bring forward their closure dates in response to developments in the energy market. The most recent is the AGL Loy Yang A power station targeted closure in 2035, which is 10 years earlier than previously scheduled. This sends a strong investment signal to the market to build wind and solar power stations in time to replace the retiring coal fleet.

LGC spot price, NEM wholesale price and LCOE for wind and solar PV

2016 to 2022 Note: This figure is not interactive.

Description

This graph shows the LGC spot price, NEM whole prices and levelised cost of electricity estimates for large-scale wind and solar PV generation.

Small print

Spot trade data is compiled from trades reported by TFS Green and may not be comprehensive. NEM wholesale price is compiled from OpenNEM on 3 January 2023. Levelised cost of electricity (LCOE) compiled from CSIRO Gencost reports.

Continuing improvement of grid infrastructure and storage

- Major grid upgrades progressed in 2022, and significant investments were made in infrastructure and battery storage, opening opportunities to connect new power stations to the grid and providing firming for variable renewables generation. Major developments include:

- The Australian Renewable Energy Agency (ARENA) $176 million funding announcement for eight grid-scale battery projects across Australia. These batteries will be equipped with grid-forming inverter technology that provide essential system stability services.

- Australian Government and New South Wales Government joint investment of $7.8 billion to help finance the development of eight critical projects across the state. This includes connecting New South Wales Renewable Energy Zones and plugging Snowy 2.0 into the grid.

- New South Wales Eastern-section of Project EnergyConnect has received Australian Government and New South Wales governments approval. Construction of this 900 km long interconnector allows energy sharing between New South Wales and South Australia for the first time. This will enable the connection of further renewable generation. This project is on-track to be delivered by 2025.

Experienced and evolving industry

- On the supply side, project developers have access to a more diverse range of financing options, with many international companies having access to significant equity.

- On the demand side, developments such as Rio Tinto setting high ambition for additional renewables in Western Australia and Queensland could start to flow through to FID in the next few years. Furthermore, recent merger and acquisition activities, such as Squadron Energy acquiring CWP Renewables, could lead to surprises on the upside for investment.

Commercial processes to get projects to FID take significant time and do not follow a standard pattern. Announcements can vary considerably from quarter to quarter, even in a market that is rising. It is difficult to estimate future FID capacity given the factors previously discussed. However, with all the right investment signals in place, FID may increase again in 2023. Industry analyst Rystad suggests over 12 GW of large-scale wind and solar projects currently hold development approval with another 15 GW at concept or various stages in the approval process.2 Given the investment environment, many of these projects could progress to FID over coming years.

The dynamics of investment are much simpler in the Small-scale Renewable Energy Scheme (SRES). The decision to invest in rooftop solar is consumer driven. Rooftop solar is an attractive investment for consumers, with average payback periods being as low as 3 years because of rising energy costs. Some jurisdictions and large solar retailers offer no interest loans which may entice new purchases in an environment of increasing interest rates.

However, the lag between signing a contract and installation is dependent on supply side factors, including installers and components as well as approvals. Market intelligence suggests current wait times of 3 to 5 months in some regions as demand outpaces available resources. Consumers who had systems installed in Q4 2022 were likely to have inquired and made investment decisions in Q3 2022. Investment decisions made in late 2022 and early 2023 will not be reflected in the installation data until Q2 2023. These supply chain constraints may limit how much capacity is installed in 2023.

The rooftop solar industry has previously handled higher levels of demand, with more than 6 GW total installed during 2020 and 2021. This supports optimism that the industry can progressively scale up to meet increasing demand.

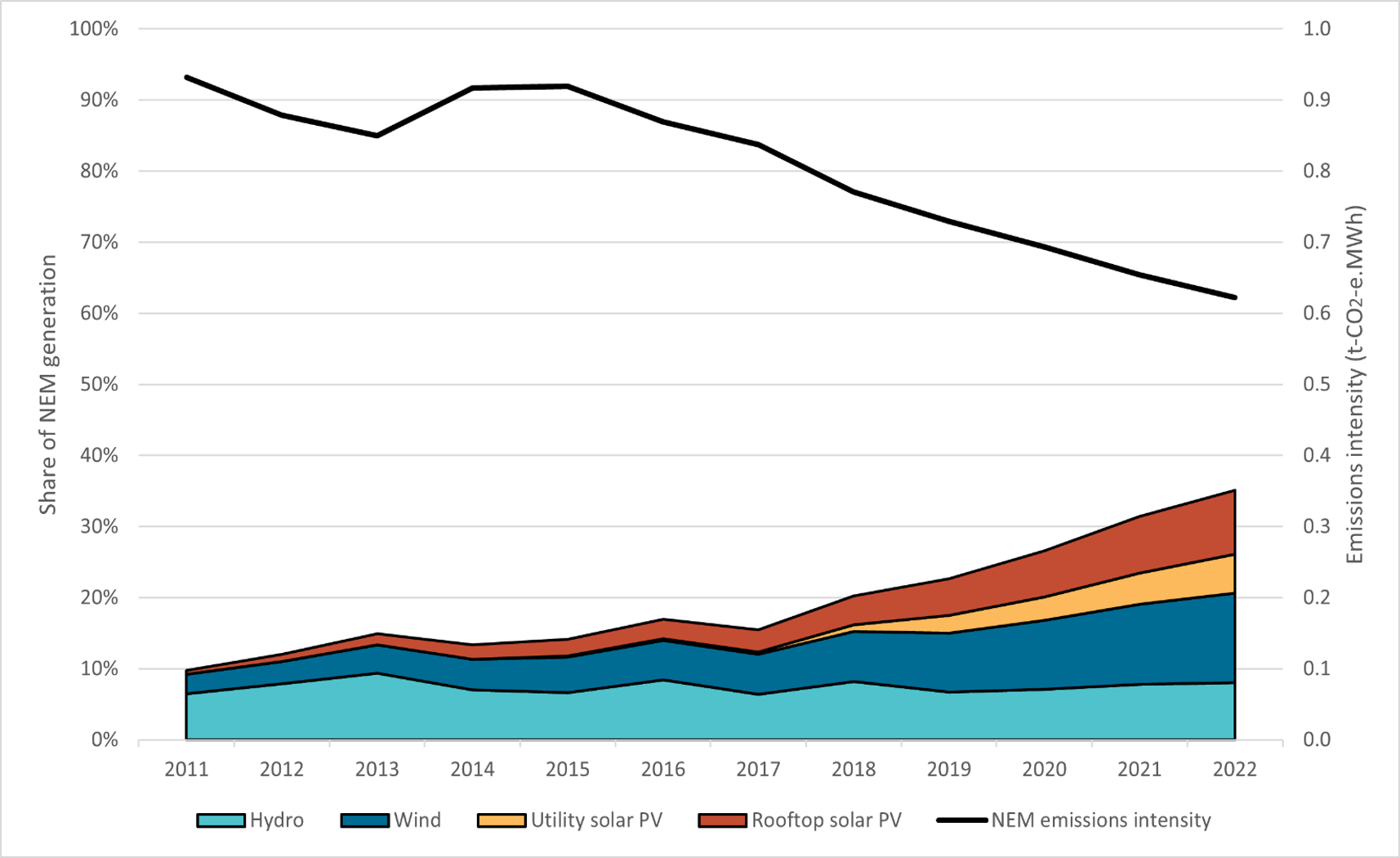

NEM renewable generation share grows

Renewables contributed 35% of total NEM generation in 2022, up 4 percentage points from 2021 (see Figure 2.3). The year finished strongly with both November and December recording 42% renewable generation in the NEM, compared to 36% over the same period in 2021. Solar performed at a record level in December with 23% of total generation. The CER expects renewables could reach an average of 40% of total NEM generation during 2023.

The rapid increase in renewable generation is bringing the emissions intensity of the grid down. Data from the AEMO Quarterly Energy Dynamics Q4 2022 report shows NEM emission intensity dropped to a record low of 0.62 tCO2-e/MWh by the end of 2022. This decline will continue as more renewable generators come online and coal generators reduce production and eventually exit. Increasing solar and wind generation continues to push down wholesale electricity prices. Solar PV and wind set the price in 17% of Q4 intervals, up from 11% in Q3, and average NEM wholesale electricity prices were down 57% quarter on quarter.

Renewables generation share in the National Electricity Market

2011 to 2022 Note: This figure is not interactive.

Description

This graph shows the share of NEM generation contributed by renewables.

Small print

A small portion of renewable generation including biomass is not shown.

Credit

Generation data sourced from OpenNEM on 3 January 2023. Emissions intensity data sourced from AEMO Q4 2022 QED.

In a world first for a grid of its size, South Australia recorded more than 10 consecutive days when average production of wind and solar accounted for 100% of the state's demand. The state met an average 85% of its demand in December with renewables. This is a significant achievement that highlights the opportunity for South Australian generation to help meet demand in other parts of the grid when the NSW to SA interconnector is completed, and to support electrification of energy-intensive industries within the state. In recognition of this opportunity, the South Australian Government has committed $593 million to its Hydrogen Jobs Plan, which will see development of a hydrogen power station, electrolyser and storage facility within the Whyalla City Council by 2025.

Over the last 5 years, Australia has added an average of nearly 6 GW of new renewable energy capacity per annum and increased the share of renewable generation by 4 percentage points annually. To achieve 82% renewables by 2030, annual added capacity must increase beyond this level. If current electricity demand stayed the same to the end of the decade, renewable generation share must increase by 6 percentage points each year and annual added capacity must increase to at least 7 GW on a sustained basis.3 Investment of 7.1 GW (large-scale FID of 4.3 GW and 2.8 GW of small-scale installations) in 2022 is a good start.

AEMO's 2022 Integrated System Plan (ISP) suggests 2030 demand could increase by 8% under the step-change scenario, and 43% under the Hydrogen Superpower scenario. Electricity demand is predicted to increase due to:

- continuing electrification generally

- increased fuel switching across both residential and commercial sectors

- increased uptake of electric vehicles

- development of a renewables led hydrogen economy.

Electrification and any new sources of large demand, such as low emissions hydrogen and metals, will require further capacity growth beyond 7 GW per annum to match demand. Investment will need to continue to increase to achieve 82% renewables share of electricity by 2030 and to meet increasing low emissions electricity demand.

Footnotes

1 In the Budget October 2022–23 paper (Budget Paper No. 1, Budget Strategy and Outlook), Treasury has assumed retail electricity prices will increase by an average of 20 per cent nationally in late 2022, and stated that given forward wholesale contract prices for electricity remain elevated, retail electricity prices are expected to rise by a further 30 per cent in 2023–24.

2 Data as at 20 February, 2023. Data refers to projects that may come online by 2030.

3 Assuming no additional demand, 82% renewables in the NEM would require approximately 170 terra watt-hours (TWh) of annual renewables generation, almost 100 TWh more than the 72 TWh generated in 2022. Based on the 2022 split of wind and solar approved under the LRET and SRES, current capacity factors and assuming total demand remains stable, this would roughly require almost 57 GW of new renewables over 2023–2030, or just over 7 GW each year.